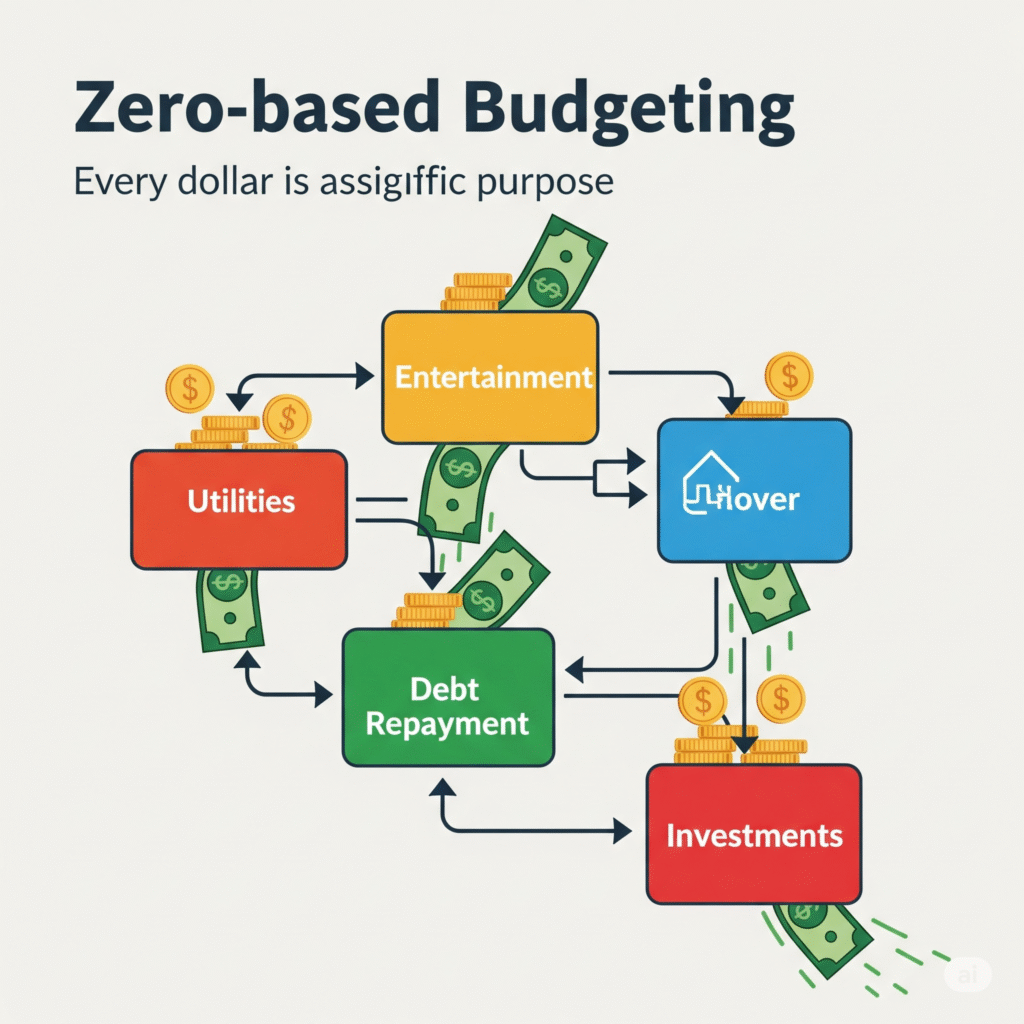

Zero-based budgeting is one of the most powerful and intentional approaches to personal finance management. Unlike traditional budgeting methods that focus on percentages or rough estimates, zero-based budgeting requires you to account for every single dollar you earn before you spend it. This method transforms your relationship with money from reactive to proactive, ensuring that every dollar serves a specific purpose in achieving your financial goals.

Originally developed for corporate finance by Texas Instruments manager Peter Pyhrr in the 1970s, zero-based budgeting has been successfully adapted for personal finance by millions of individuals seeking complete control over their financial lives. This comprehensive guide will teach you everything you need to know about implementing zero-based budgeting to maximize your financial potential.

What is Zero-Based Budgeting?

Zero-based budgeting is a method where your income minus all your planned expenses and savings equals zero. The fundamental equation is:

Income – Expenses – Savings = $0

This doesn’t mean you spend all your money or have zero dollars in your bank account. Instead, it means every dollar you earn has been assigned a specific job before you receive your paycheck. Whether that job is paying rent, buying groceries, building an emergency fund, or investing for retirement, each dollar has a predetermined purpose.

The Core Principle: Every Dollar Has a Job

The revolutionary aspect of zero-based budgeting is its intentionality. Traditional budgeting often leaves money unaccounted for, which typically gets spent on impulse purchases or forgotten entirely. Zero-based budgeting eliminates this problem by ensuring every dollar is working toward your financial objectives.

How It Differs from Other Budgeting Methods

Traditional Budgeting:

- Estimates spending based on past patterns

- Often leaves money unallocated

- Reactive approach to money management

Percentage-Based Budgeting (like 50/30/20):

- Uses broad categories with percentage allocations

- Provides general guidelines rather than specific assignments

- Less detailed tracking required

Zero-Based Budgeting:

- Requires specific allocation of every dollar

- Proactive approach to money management

- Detailed tracking and intentional spending decisions

The Benefits of Zero-Based Budgeting

Complete Financial Control

Zero-based budgeting gives you unprecedented control over your money. You decide exactly where every dollar goes based on your priorities and goals, not on impulse or habit.

Eliminates Mindless Spending

When every dollar has a job, there’s no room for mindless spending. You’ll think twice before making purchases because you’ll know exactly what financial goal you’re sacrificing.

Accelerates Goal Achievement

By intentionally allocating money toward your goals, you’ll reach them faster than with less structured approaches. Whether you’re paying off debt, saving for a house, or building wealth, zero-based budgeting ensures consistent progress.

Increases Financial Awareness

The process of assigning every dollar forces you to become intimately familiar with your income, expenses, and financial priorities. This awareness naturally leads to better financial decisions.

Reduces Financial Stress

Knowing exactly where your money is going and having a plan for every dollar significantly reduces financial anxiety. You’ll feel confident about your financial decisions and prepared for both expected and unexpected expenses.

Step-by-Step Guide to Zero-Based Budgeting

Step 1: Calculate Your Monthly Income

Start by determining your exact monthly income after taxes. Include all sources:

Regular Income:

- Salary or wages (after taxes and deductions)

- Freelance or contract work

- Side hustle income

- Investment dividends

- Rental income

Variable Income Tip: If your income varies, use the lowest amount you expect to earn in a month. Any extra income can be allocated to additional goals or savings.

Example:

- Primary job (after taxes): $3,200

- Side hustle: $400

- Total Monthly Income: $3,600

Step 2: List All Fixed Expenses

Fixed expenses are the same amount each month and are typically non-negotiable.

Housing:

- Rent or mortgage payment

- Property taxes

- Homeowners/renters insurance

- HOA fees

Transportation:

- Car payment

- Auto insurance

- Public transportation pass

Insurance:

- Health insurance premiums

- Life insurance

- Disability insurance

Debt Payments:

- Credit card minimum payments

- Student loan payments

- Personal loan payments

Utilities and Services:

- Phone service

- Internet service

- Streaming subscriptions

- Gym membership

Example Fixed Expenses:

- Rent: $1,200

- Car payment: $350

- Auto insurance: $120

- Phone: $80

- Internet: $60

- Streaming services: $25

- Total Fixed Expenses: $1,835

Step 3: Plan Variable Expenses

Variable expenses change from month to month but are still necessary.

Essential Variables:

- Groceries

- Utilities (electricity, gas, water)

- Gasoline

- Personal care items

- Clothing (basic needs)

- Medical expenses

Discretionary Variables:

- Dining out

- Entertainment

- Hobbies

- Shopping

- Travel

Planning Strategy: Use your historical spending data to estimate these categories, but be realistic about your actual needs versus wants.

Example Variable Expenses:

- Groceries: $400

- Utilities: $150

- Gas: $120

- Personal care: $50

- Dining out: $200

- Entertainment: $100

- Total Variable Expenses: $1,020

Step 4: Set Financial Goals and Allocate Funds

This is where zero-based budgeting really shines. Every remaining dollar gets assigned to specific financial goals.

Short-term Goals:

- Emergency fund

- Vacation savings

- Holiday gift fund

- Car maintenance fund

Medium-term Goals:

- House down payment

- Debt payoff

- Professional development

Long-term Goals:

- Retirement savings

- Investment portfolio

- Children’s education fund

Example Goal Allocation:

- Emergency fund: $200

- Retirement (401k): $300

- Vacation fund: $150

- Extra debt payment: $95

- Total Goal Allocation: $745

Step 5: Balance to Zero

Add up all your planned expenses and savings, then subtract from your income. The result should be zero.

Example Calculation:

- Income: $3,600

- Fixed expenses: $1,835

- Variable expenses: $1,020

- Goal allocation: $745

- Total: $3,600 – $3,600 = $0

If you have money left over, assign it to additional goals or create new budget categories. If you’re short, you’ll need to reduce expenses or increase income.

Advanced Zero-Based Budgeting Strategies

The Buffer Category

Create a small “miscellaneous” or “buffer” category for unexpected small expenses. This prevents you from derailing your entire budget over minor oversights.

Example: Allocate $50-100 monthly to a buffer category for small unexpected expenses.

Sinking Funds

Sinking funds are savings categories for predictable but irregular expenses. Instead of being surprised by these costs, you save for them monthly.

Common Sinking Funds:

- Car maintenance and repairs

- Home maintenance

- Annual insurance premiums

- Holiday and birthday gifts

- Clothing replacement

- Technology upgrades

Calculation Example: If you expect $600 in car maintenance annually, save $50 monthly ($600 ÷ 12 months).

The Paycheck Priority System

If you’re paid multiple times per month, assign specific expenses to specific paychecks.

Example for Bi-weekly Pay: First Paycheck ($1,800):

- Rent: $1,200

- Groceries: $200

- Utilities: $150

- Emergency fund: $200

- Miscellaneous: $50

Second Paycheck ($1,800):

- Car payment: $350

- Insurance: $200

- Gas: $120

- Dining out: $200

- Retirement: $300

- Debt payment: $400

- Entertainment: $100

- Vacation fund: $130

Zero-Based Budgeting for Variable Income

For freelancers, commissioned salespeople, or business owners with irregular income:

Strategy 1: Conservative Baseline

- Use your lowest monthly income from the past year

- Create a basic budget covering only essentials

- When you earn more, allocate excess to goals and wants

Strategy 2: Multiple Budget Scenarios

- Low-income month budget

- Average-income month budget

- High-income month budget

Strategy 3: Annual Planning

- Calculate total annual income

- Divide by 12 for monthly planning

- Build larger emergency fund to smooth income fluctuations

Common Challenges and Solutions

Challenge 1: Perfectionism Paralysis

Many people get overwhelmed trying to create the “perfect” budget on their first attempt.

Solution: Start with a rough zero-based budget and refine it over time. Your first budget will likely need adjustments, and that’s completely normal.

Challenge 2: Overspending in Categories

Even with careful planning, you might overspend in certain categories.

Solutions:

- Move money from other categories to cover overspending

- Use your buffer category for small overages

- Adjust next month’s budget based on actual spending patterns

Challenge 3: Forgetting Irregular Expenses

Annual or quarterly expenses can derail your budget if forgotten.

Solution: Create a comprehensive list of all irregular expenses and set up sinking funds for each one.

Challenge 4: Time-Intensive Planning

Zero-based budgeting requires more initial time investment than simpler methods.

Solution: Use budgeting apps or spreadsheets to automate calculations and tracking. The time investment decreases significantly after the first few months.

Tools and Technology for Zero-Based Budgeting

Budgeting Apps

YNAB (You Need A Budget):

- Specifically designed for zero-based budgeting

- Automatically syncs with bank accounts

- Excellent mobile app and web interface

- Monthly subscription fee

EveryDollar:

- Created by Dave Ramsey’s team

- Free version available

- Premium version includes bank syncing

- Simple, user-friendly interface

Mint:

- Free budgeting app

- Can be adapted for zero-based budgeting

- Automatic categorization

- Investment tracking included

GramSave:

- Designed for comprehensive financial tracking

- Customizable categories

- Goal tracking features

- Automated savings tools

Spreadsheet Templates

For those who prefer manual control:

Google Sheets Benefits:

- Free and accessible anywhere

- Customizable templates

- Real-time collaboration

- Automatic calculations

Excel Benefits:

- Advanced formulas and functions

- Offline access

- Professional formatting options

- Integration with other Microsoft tools

Manual Tracking Methods

Notebook Method:

- Write out your budget monthly

- Track expenses by hand

- Forces conscious spending decisions

- No technology required

Envelope Method:

- Cash-based zero-based budgeting

- Physical envelopes for each category

- Prevents overspending

- Tactile money management

Real-World Zero-Based Budgeting Examples

Example 1: Jessica – Single Professional ($4,200 Monthly Income)

Income: $4,200

Fixed Expenses:

- Rent: $1,400

- Car payment: $320

- Insurance (auto/renters): $150

- Phone: $75

- Internet: $60

- Streaming: $30

- Gym: $50

- Total Fixed: $2,085

Variable Expenses:

- Groceries: $350

- Utilities: $120

- Gas: $100

- Personal care: $75

- Dining out: $250

- Entertainment: $150

- Total Variable: $1,045

Financial Goals:

- Emergency fund: $300

- Retirement (401k): $400

- Vacation fund: $200

- Professional development: $100

- Extra debt payment: $70

- Total Goals: $1,070

Total Allocated: $2,085 + $1,045 + $1,070 = $4,200 ✓

Example 2: The Martinez Family ($6,800 Monthly Income)

Income: $6,800

Fixed Expenses:

- Mortgage: $2,200

- Car payments (2): $650

- Insurance (auto/home/life): $400

- Childcare: $800

- Phone: $120

- Internet: $80

- Various subscriptions: $50

- Total Fixed: $4,300

Variable Expenses:

- Groceries: $600

- Utilities: $200

- Gas: $180

- Personal care: $100

- Dining out: $300

- Entertainment/kids: $200

- Clothing: $150

- Total Variable: $1,730

Financial Goals:

- Emergency fund: $200

- Retirement (401k): $500

- Kids’ education (529): $300

- Vacation fund: $200

- Home maintenance: $150

- Extra mortgage payment: $220

- Total Goals: $1,570

Buffer: $200

Total Allocated: $4,300 + $1,730 + $1,570 + $200 = $6,800 ✓

Maximizing Success with Zero-Based Budgeting

Monthly Budget Meetings

Schedule regular budget meetings (with yourself or your partner) to:

- Review last month’s performance

- Plan next month’s budget

- Adjust categories based on changing needs

- Celebrate progress toward goals

Track Daily Expenses

Use apps, receipts, or a spending journal to track every expense. This ensures you stay within your allocated amounts and provides data for future budget improvements.

Use the 24-Hour Rule

For unplanned purchases over $50, wait 24 hours before buying. This prevents impulse spending that can derail your carefully planned budget.

Automate What You Can

Set up automatic transfers for:

- Fixed expenses (rent, insurance, loan payments)

- Savings goals (emergency fund, retirement)

- Investment contributions

Build in Flexibility

While zero-based budgeting requires planning every dollar, life happens. Build small buffer categories and be willing to move money between categories when needed.

Long-Term Benefits of Zero-Based Budgeting

Wealth Building Acceleration

By intentionally allocating money to investments and savings, zero-based budgeting accelerates wealth building. Consider the long-term impact of consistently investing $500 monthly:

- 5 years: $35,000 (assuming 7% annual return)

- 10 years: $87,000

- 20 years: $264,000

- 30 years: $614,000

Debt Elimination

Zero-based budgeting’s intentional approach to debt repayment can dramatically reduce payoff times. By allocating specific amounts to debt payments and finding extra money through careful budgeting, you can pay off debt years ahead of schedule.

Financial Independence

The discipline and intentionality required for zero-based budgeting naturally leads to habits that support financial independence. You’ll develop a mindset of conscious spending and purposeful saving that serves you throughout life.

Common Mistakes to Avoid

Mistake 1: Being Too Restrictive

Creating a budget that’s too tight leads to frustration and eventual abandonment. Include reasonable amounts for entertainment and personal spending.

Mistake 2: Not Adjusting for Reality

Your first zero-based budget is an educated guess. Adjust categories based on actual spending patterns rather than forcing unrealistic restrictions.

Mistake 3: Ignoring Small Expenses

Small expenses add up quickly. Include categories for coffee, apps, parking, and other minor but regular expenses.

Mistake 4: Not Planning for Fun

A budget without any fun money is unsustainable. Include entertainment and personal spending categories to maintain balance.

Mistake 5: Giving Up After Overspending

Overspending in a category doesn’t mean your budget has failed. Simply adjust by moving money from other categories or learning for next month.

Conclusion

Zero-based budgeting is a powerful tool for taking complete control of your finances and accelerating your progress toward financial goals. While it requires more initial effort than simpler budgeting methods, the benefits of intentional money management far outweigh the costs.

The key to success with zero-based budgeting is patience and persistence. Your first budget won’t be perfect, and you’ll likely need to make adjustments as you learn your actual spending patterns. However, the discipline of assigning every dollar a job will transform your relationship with money and set you up for long-term financial success.

Remember that zero-based budgeting is not about restriction—it’s about intention. You’re not limiting your spending; you’re directing it toward your most important priorities and goals. This shift in mindset from scarcity to abundance makes all the difference in maintaining a zero-based budget long-term.

Start your zero-based budgeting journey today by calculating your income, listing your expenses, and assigning every dollar a specific job. Your future self will thank you for the financial clarity and accelerated progress toward your dreams that comes from making every dollar count.