When it comes to Social Security, professional guidance often boils down to just one word: delay.

Processing Content

The argument is simple. Delaying claiming Social Security until age 70 maximizes a retiree’s monthly payout by 80% compared to claiming at 62. A

The study’s author, Derek Tharp, a finance professor at the University of Southern Maine and the head of innovation at Income Lab, wanted to know if “early claiming reflects mistakes or rational responses to preferences overlooked in standard analyses,” he wrote.

Nearly 1 in 4 Americans claim benefits at the earliest possible age of 62, while fewer than 10% wait until age 70. While traditional economic models often

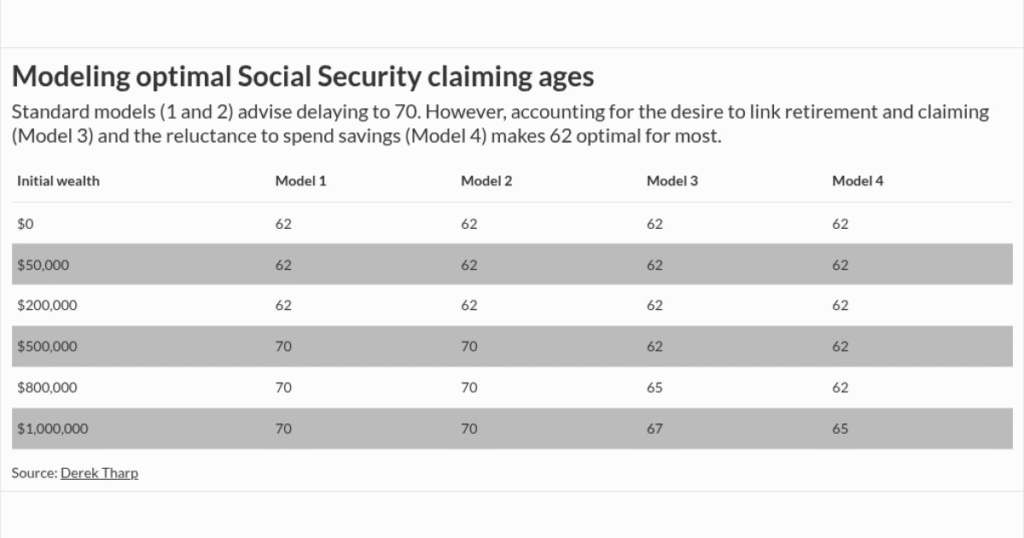

Tharp developed a series of economic models, each incorporating varying degrees of three specific behavioral factors often ignored in standard financial planning: a preference for spending more during the active early years of retirement (“front-loaded consumption”), a reluctance to spend down personal savings (“source-dependent utility”) and a desire to retire and claim benefits simultaneously.

When these factors are accounted for, the “optimal” claiming age drops significantly.

The $800,000 threshold

Under standard models, households with $500,000 or more in wealth are typically advised to delay claiming until age 70 to secure the roughly 8% annual increase in benefits.

However, when Tharp’s model accounts for behavioral preferences, claiming at age 62 becomes the optimal strategy for households with up to $800,000 in initial wealth. That wealth range encompasses the vast majority of Americans approaching retirement.

Even for households with $1 million in savings — a level generally considered to be “

Why the math shifts

Tharp found that while standard financial models are designed to maximize “lifetime wealth,” they often overlook the psychological realities of retirement.

One key driver behind this gap is the concept of “source-dependent utility.” Data shows that retirees are comfortable spending guaranteed income like Social Security but are reluctant to withdraw principal from their investment portfolios.

By claiming Social Security early, retirees maximize the income they feel comfortable spending, rather than depleting their savings to fund a delay.

The study also accounts for “front-loaded consumption,” a preference held by most retirees to spend more in their 60s when they are healthier and more active, rather than in their 70s and later.

Finally, the research incorporates what Tharp terms the “claim-retire linkage,” the strong tendency for workers to treat retiring and claiming benefits as a bundled decision. Roughly 90% of early male retirees claim Social Security within one year of leaving the workforce.

For these households, delaying benefits may be financially optimal but psychologically costly, requiring retirees to bridge the years from 62 to 70 entirely with their own assets.

Advisors like Mark Stancato, founder and lead advisor at VIP Wealth Advisors in Decatur, Georgia, see the effects of those psychological preferences firsthand.

“Convincing someone to retire at 62 and self-bridge to 70 is extremely difficult in practice,” Stancato said. “For most people, retirement and claiming are

Still, Tharp cautions that his own model is not intended to be universally prescriptive.

“The observation that claiming at 62 is optimal under Model 4 for wealth levels encompassing over 90% of American households does not imply that 90% of Americans ought to claim at 62,” he wrote. “The results presented here apply to a hypothetical individual whose preferences precisely match every parameter specified in this analysis — including the specific degree of front-loaded consumption preferences, the exact magnitude of source-dependent utility and the assumption of a claim-retire linkage. In practice, preferences vary substantially across individuals.”

Implications for financial advice

The findings suggest that the financial services industry may focus too heavily on the math of delaying, often ignoring the premium clients place on immediate cash flow. For advisors, striking a balance between client preferences and the mathematically optimal strategy is a continuous challenge.

“Clients are often comfortable spending Social Security checks, dividends or interest, but feel real emotional resistance to selling assets or drawing down principal, even when the math supports it,” Stancato said.

While the math often favors delay, especially as advisors plan around increased life expectancy, “optimization that ignores behavior often misses the correct answer for the client,” Stancato said.

Leslie Beck, owner of Compass Wealth Management in Rutherford, New Jersey, shared that sentiment.

“While the math indicates that waiting until age 70 to claim is the best decision, math is rarely the deciding factor where people and money are concerned,” Beck said.

Addressing some of those challenges, Thrap offered two major recommendations based on his findings.

“First, resist applying blanket delay prescriptions derived from models that omit these preference dimensions,” he wrote. “And second, engage clients in conversations that surface their actual preferences rather than assuming they conform to — or deviate from — any particular model’s assumptions.”