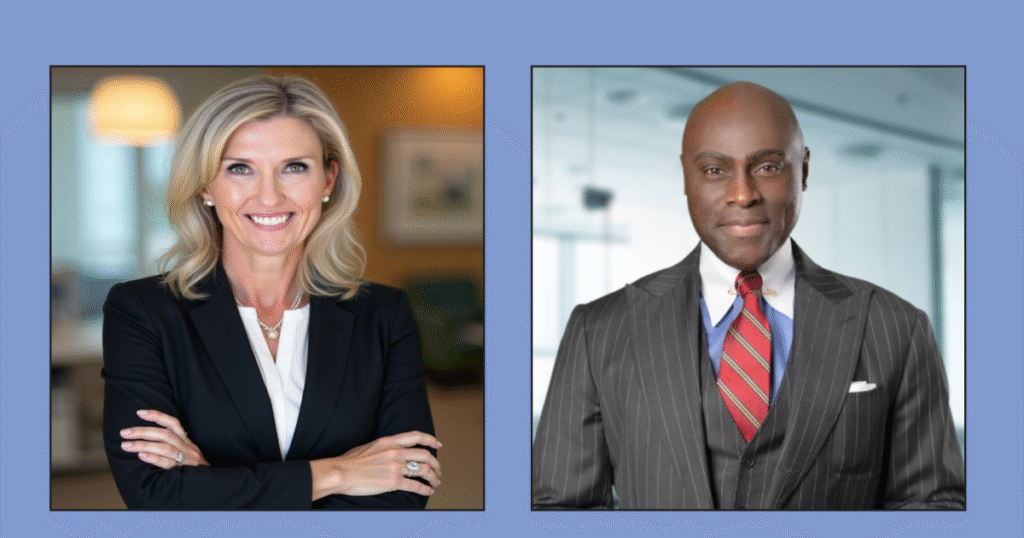

Two well-known industry executives have stepped away from Raymond James’ independent channel following the firm’s bumper year for recruiting.

Shannon Reid, formerly president of Raymond James Independent Contractor Division, left this week to take on the title of president at the firm’s independent broker-dealer rival Osaic. And former division director

Besides serving as president of Osaic, Reid will also hold the title of head of advisor growth and engagement. She had been at Raymond James for nearly 20 years. Before becoming president of Raymond James Independent Contractor Division, Reid had been director of the firm’s northeast division.

Her promotion from that position came around the time

“I was drawn to Osaic by the strength of its leadership team and a culture defined by clarity, accountability and execution — combined with the agility and flexibility of a nimble organization built to drive results,” Reid said in a statement provided by Osaic.

Raymond James declined to comment on either departure.

Reid is scheduled to step into her new roles on Jan. 12, taking over the president’s title from CEO Jamie Price. As part of her responsibilities at Osaic, she will be involved in recruiting and retaining advisors. She’ll work to build the firm’s “empowered independence” affiliation option, which allows advisors to join Osaic as direct employees rather than independent contractors.

Osaic said Reid was hired in part as a result of an internal reorganization the firm embarked on in July that included shifting former president Greg Cornick over to the position of executive vice president, wealth management solutions. The firm also this year completed a process it deemed

Reid is leaving Raymond James at the tail end of a year that saw the firm pull unusually large numbers of advisors from its rival firms. Raymond James has had particular success

But the disruption stemming from that Commonwealth deal, which drove many advisors to consider their options rather than join LPL, won’t be repeated in 2026. That means next year will be a test to see if Raymond James can keep up its recruiting momentum, said Phil Waxelbaum, the founder of the recruiting firm Masada Consulting.

And now the firm will have to do it without Reid driving those efforts on its independent side, Waxelbaum said.

“There’s no one else in their C-suite now that has as deep a background in the indie channel,” he said. “She was it. She was driving the bus. Yeah. So this is a huge, critical loss for them.”

Waxelbaum also deemed David a big loss for Raymond James. David was brought over in early 2024 from Stifel, where he had been head of that firm’s independent channel. (That channel, which had numbered less than 5% of Stifel’s financial advisors, is being

Before Stifel, David had been a managing director at Wells Fargo Advisors. His outside responsibilities include

“This was a missed opportunity for Raymond James, especially given Alex’s unique influence in the burgeoning minority community in the financial services industry,” Waxelbaum said. “But it’s a great opportunity for Alex. It puts him back in the CEO role of a broker-dealer that has an urgent desire to grow, and I have every confidence that he’ll make that happen.”