Introduction: Why Mindset Matters More Than Money

Have you ever wondered why some people seem to attract wealth effortlessly, while others struggle to make ends meet no matter how hard they work? The answer lies not just in luck, education, or opportunity—it’s in mindset.

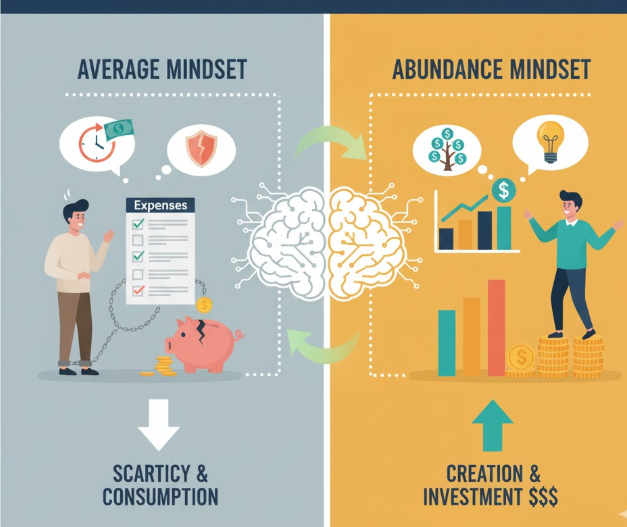

The difference between the rich and the average isn’t just about how much money they make. It’s about how they think about money. The wealthy operate from a mindset of growth, abundance, and long-term vision. The average person, on the other hand, often gets stuck in habits of fear, scarcity, and short-term thinking.

If you truly want to change your financial future, you must first transform the way you think about money. Let’s dive deep into the mindset shifts that make the biggest difference between the rich and everyone else.

🧠 Shift #1: From “Earning” to “Building Wealth”

Most people are taught to work for money. They trade their time for a paycheck and repeat this cycle their entire lives. The rich, however, make money work for them.

The Average Mindset:

-

“If I work more hours, I’ll make more money.”

-

“I need a raise to improve my lifestyle.”

-

“Money comes from my job.”

The Wealthy Mindset:

-

“How can I create systems or assets that generate income even when I’m not working?”

-

“Money is a tool to create more opportunities.”

-

“I focus on building wealth, not just earning it.”

| Key Difference | Average Thinker | Wealthy Thinker |

|---|---|---|

| Income Source | Salary | Investments, businesses, multiple income streams |

| Time vs. Money | Trades time for money | Buys time with money |

| Financial Goal | Comfort | Freedom and legacy |

💡 Lesson: Don’t just focus on earning. Focus on building assets—things like stocks, real estate, or businesses that keep paying you over time.

💡 Shift #2: From “Spending” to “Investing”

The average person sees money as something to spend. The rich see it as something to grow.

Common Habits of the Average Person:

-

Upgrading phones every year

-

Buying luxury items for status

-

Spending first and saving later

Habits of the Wealthy:

-

Investing in things that appreciate in value

-

Spending less than they earn

-

Letting compounding work in their favor

Example:

Imagine two people each earning $5,000 a month.

-

Person A spends $4,500 and saves $500.

-

Person B spends $3,000 and invests $2,000 in mutual funds.

After 10 years, Person B could have tens of thousands more—not because they earned more, but because they shifted from spending to investing.

📊 Quick Fact: According to financial studies, the average millionaire invests at least 20% of their income regularly.

💎 Takeaway: Every dollar you earn has two choices—either disappear or multiply. Choose multiplication.

⚙️ Shift #3: From “Scarcity” to “Abundance”

Many people grow up hearing phrases like:

-

“Money doesn’t grow on trees.”

-

“We can’t afford that.”

-

“Rich people are greedy.”

These beliefs plant scarcity thinking, which creates fear around money. The rich think differently—they believe there’s always enough opportunity for everyone.

How Scarcity Thinking Holds You Back:

-

You hesitate to take risks.

-

You underprice your skills.

-

You avoid investing because you fear losing money.

How Abundance Thinking Frees You:

-

You look for opportunities instead of limitations.

-

You collaborate rather than compete.

-

You’re not afraid to reinvest in yourself.

🧭 Mindset Exercise:

Write down three limiting beliefs about money you were taught growing up. Then, reframe them positively.

Example:

❌ “I can’t afford it.”

✅ “How can I afford it?”

💼 Shift #4: From “Short-Term” to “Long-Term” Thinking

The average person wants instant results. The rich think in decades.

Average Thinking:

“How can I make quick money?”

Wealthy Thinking:

“What actions today will create wealth 5–10 years from now?”

This difference is why the rich invest in things like real estate, stocks, or businesses that compound over time, while the average person spends impulsively for short-term pleasure.

📈 Example:

A $10,000 investment growing at 10% yearly becomes:

-

$25,937 in 10 years

-

$67,275 in 20 years

-

$174,494 in 30 years

That’s the power of patience and compound growth.

⏳ Key Lesson: Wealth is built slowly, quietly, and consistently.

🧩 Shift #5: From “Comfort Zone” to “Growth Zone”

The rich continuously challenge themselves to learn more, take risks, and adapt. The average person often seeks stability and comfort—even if it limits their potential.

The Growth Mindset of the Wealthy:

-

They invest in personal development.

-

They read, attend seminars, and learn from mentors.

-

They embrace failure as part of growth.

📚 Common Habits of Millionaires:

-

Read daily (especially about finance or leadership)

-

Set clear goals

-

Network with other successful people

-

Continuously learn new skills

Simple Rule:

“If you’re the smartest person in the room, you’re in the wrong room.”

🌱 Action Step: Start investing in your mind before your wallet. Knowledge compounds faster than money.

💬 Shift #6: From “Money as an End” to “Money as a Tool”

The average person often sees money as the final goal:

“If I have more money, I’ll be happy.”

The wealthy know that money is just a tool—a means to create freedom, impact, and choices.

The Real Purpose of Money for the Rich:

-

Freedom to live life on their terms

-

Ability to help others and create opportunities

-

Power to invest in ideas that matter

💬 Quote to Remember:

“Money is a terrible master but an excellent servant.”

When you see money as a servant, you stop chasing it—and it starts working for you.

🔁 Shift #7: From “Single Income” to “Multiple Streams”

Depending on one job or income source is financially risky. The rich know this well. They create diversified income streams—some active, some passive.

Common Types of Income:

| Type | Description | Example |

|---|---|---|

| Active | You trade time for money | Job, freelancing |

| Passive | Money works for you | Investments, real estate |

| Portfolio | Income from assets | Dividends, stock gains |

| Business | Income from systems | E-commerce, franchises |

Typical Wealthy Portfolio:

-

1 main business or job

-

1–2 passive investment sources

-

1 long-term real estate or asset growth plan

🪙 Takeaway: Never rely on one source of income. Build multiple streams—start small but stay consistent.

🧱 Shift #8: From “Saving What’s Left” to “Saving First”

The average person saves whatever remains after spending. The rich save before they spend.

Traditional Habit:

Income → Spend → Save what’s left

Wealthy Habit:

Income → Save/Invest → Spend what’s left

This single change can transform your financial future.

It’s not about how much you earn—it’s about how you manage what you earn.

📊 Savings Formula Used by the Rich:

| Purpose | Percentage of Income |

|---|---|

| Investments | 20–30% |

| Emergency Fund | 10% |

| Living Expenses | 50–60% |

| Charity / Growth | 5–10% |

📌 Tip: Automate your savings so you never “forget” to invest in your future.

💬 Shift #9: From “Fear of Debt” to “Leveraging Debt Wisely”

Most people fear debt. The rich understand that not all debt is bad.

Two Types of Debt:

| Type | Description | Example |

|---|---|---|

| Bad Debt | Used to buy depreciating items | Credit cards, consumer loans |

| Good Debt | Used to acquire appreciating assets | Real estate, business investment |

💡 Example:

Borrowing $20,000 for a car that loses value is bad debt.

Borrowing $20,000 to buy a property that earns rent and appreciates is good debt.

The wealthy don’t fear debt—they use it strategically to grow their wealth.

🔍 Shift #10: From “Blame” to “Responsibility”

Many people blame the economy, the government, or their upbringing for their financial situation. The rich take full responsibility for their money decisions.

Average Mindset:

-

“The system is unfair.”

-

“I can’t get ahead because of my background.”

-

“It’s not my fault.”

Wealthy Mindset:

-

“I control how I respond to challenges.”

-

“I can create my own opportunities.”

-

“No one will save me but me.”

⚙️ Reality Check:

The moment you stop blaming others, you start gaining power. Financial growth begins with ownership—not excuses.

💎 Shift #11: From “Income Goals” to “Impact Goals”

Rich people don’t chase numbers—they chase purpose.

They understand that wealth grows faster when you create value for others.

Example:

Instead of asking, “How can I make $10,000 a month?” ask,

“How can I help 1,000 people solve a $10 problem?”

When you shift focus from income to impact, money follows naturally.

🌍 Truth: Every millionaire or billionaire creates massive value—through products, services, or ideas.

🧭 Shift #12: From “Avoiding Risk” to “Managing Risk”

The average person avoids risk at all costs. The rich analyze and manage it.

They know that zero risk equals zero reward. Instead of avoiding failure, they prepare for it, learn from it, and move forward smarter.

The Wealthy Approach:

-

Research before investing

-

Diversify assets

-

Take calculated risks

📊 Risk-Reward Chart:

| Risk Level | Average Thinker Reaction | Wealthy Thinker Strategy |

|---|---|---|

| Low Risk | Feels safe, but limited growth | Starts here, learns basics |

| Medium Risk | Avoids due to fear | Studies and manages exposure |

| High Risk | Avoids completely | Invests small, gains big returns |

🔥 Quote:

“The biggest risk is not taking any risk.” — Mark Zuckerberg

📈 Shift #13: From “Working Hard” to “Working Smart”

Effort matters—but direction matters more.

The rich don’t necessarily work harder than others; they work smarter. They delegate, automate, and prioritize high-value tasks.

Smart Work Habits:

-

Automate routine financial tasks

-

Focus on high-income skills

-

Use technology to scale results

💼 Example:

A freelancer who learns to outsource design work and focus on client strategy earns more—with less effort.

🎯 Rule:

Work on your money, not just for your money.

🪞 Shift #14: From “Consumer” to “Creator”

The rich are creators—they create businesses, products, or ideas that others consume.

The average person is a consumer—they spend on things others created.

Simple Difference:

-

Consumers buy products.

-

Creators build and sell them.

📦 Examples of Creation:

-

Writing an eBook

-

Building a YouTube channel

-

Selling digital courses

-

Starting a brand

When you create, you build assets that continue to pay you long after the work is done.

🏁 Conclusion: Rewiring Your Money Mindset for Good

Wealth isn’t about luck or secret formulas. It’s about how you think, act, and decide every single day.

Here’s a quick summary of the key mindset shifts that separate the rich from the average:

| Shift | From | To |

|---|---|---|

| 1 | Earning | Building Wealth |

| 2 | Spending | Investing |

| 3 | Scarcity | Abundance |

| 4 | Short-Term | Long-Term |

| 5 | Comfort | Growth |

| 6 | Money as End | Money as Tool |

| 7 | Single Income | Multiple Streams |

| 8 | Save Last | Save First |

| 9 | Fear of Debt | Leveraging Debt |

| 10 | Blame | Responsibility |

| 11 | Income Goal | Impact Goal |

| 12 | Avoid Risk | Manage Risk |

| 13 | Work Hard | Work Smart |

| 14 | Consumer | Creator |

🌟 Final Thoughts

Shifting your money mindset isn’t a one-time event—it’s a lifelong process. Start small. Pick one mindset from this list and practice it daily.

The rich don’t become rich overnight. They think differently, act consistently, and stay patient.

If you truly want to join their ranks, don’t just ask, “How can I make more money?”

Instead, ask,

“How can I think like the rich—and make choices that build wealth for life?”