In an era dominated by sophisticated financial apps and digital tools, spreadsheets remain one of the most powerful and flexible options for personal finance management. Whether you’re using Microsoft Excel, Google Sheets, or another spreadsheet application, these tools offer unparalleled customization, complete control over your data, and the ability to create complex financial models tailored to your specific needs.

Start maintaining your finances with an Excel budget planning template. Customize an Excel template to suit your financial management needs, from small-business books to household budgets. The beauty of spreadsheets lies in their versatility – you can start with a simple budget tracker and gradually build a comprehensive financial management system that grows with your needs.

Why Choose Spreadsheets for Personal Finance?

Complete Control and Customization

Unlike pre-built financial apps, spreadsheets give you complete control over your data structure, calculations, and presentation. You can customize every aspect of your financial tracking system to match your unique situation, whether you’re managing multiple income streams, tracking complex investment portfolios, or planning for specific financial goals.

Cost-Effective Solution

Most people already have access to spreadsheet software through their workplace, school, or free alternatives like Google Sheets. This makes spreadsheets one of the most cost-effective solutions for personal finance management, especially compared to premium budgeting apps that charge monthly subscription fees.

No Privacy Concerns

When you use spreadsheets, your financial data remains entirely under your control. You don’t need to worry about third-party access, data breaches, or changes to privacy policies that might affect how your sensitive financial information is handled.

Flexibility and Scalability

Spreadsheets can grow with your financial complexity. Start with a basic budget and gradually add features like investment tracking, debt payoff calculators, retirement planning, or tax preparation worksheets as your needs evolve.

Essential Spreadsheet Features for Personal Finance

Built-in Functions and Formulas

Modern spreadsheet applications offer powerful built-in functions that are perfect for financial calculations:

- SUM(): Calculate totals for income, expenses, and balances

- AVERAGE(): Find average spending across categories or time periods

- IF(): Create conditional formatting and calculations

- VLOOKUP(): Match transactions to categories or budgets

- PMT(): Calculate loan payments and mortgage costs

- FV(): Determine future values of investments

- PV(): Calculate present values for financial planning

Data Validation and Protection

Spreadsheets allow you to set up data validation rules that prevent errors and ensure consistency in your financial data entry. You can also protect certain cells or worksheets to prevent accidental changes to formulas or historical data.

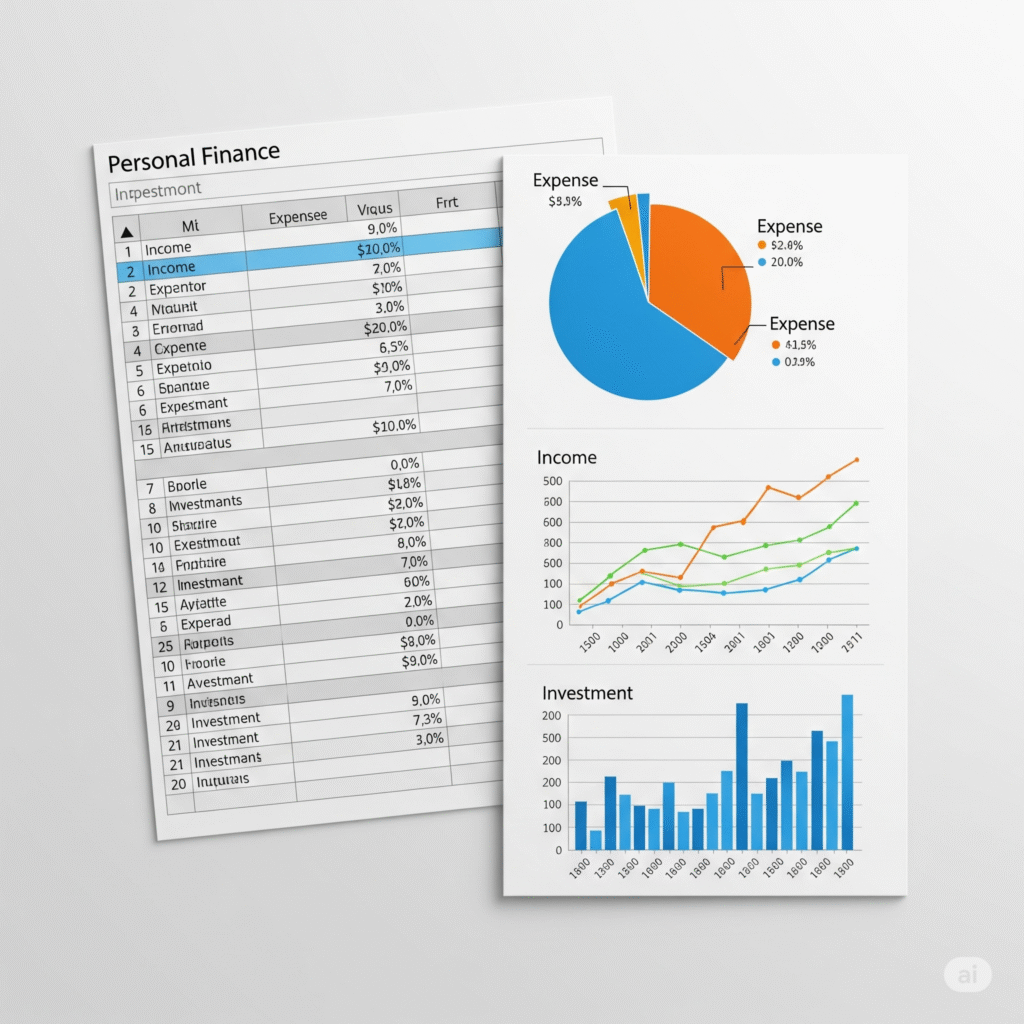

Charts and Visualization

Visual representations of your financial data help identify trends, patterns, and areas for improvement. Spreadsheets offer various chart types including pie charts for expense categories, line graphs for tracking progress over time, and bar charts for comparing different time periods.

Setting Up Your Personal Finance Spreadsheet System

Step 1: Choose Your Platform

Microsoft Excel: Offers the most advanced features and best performance for complex financial models. Ideal for users who need sophisticated calculations and extensive data analysis capabilities.

Google Sheets: Perfect for users who want cloud-based access and collaboration features. It follows the popular 50/30/20 rule for budgeting – allocating 50% to needs, 30% to wants, and 20% to savings. It’s a simple yet effective way to manage your finances.

LibreOffice Calc: A free, open-source alternative that offers most of the features found in Excel without the subscription cost.

Apple Numbers: Excellent for Mac users who want seamless integration with other Apple devices and services.

Step 2: Design Your Budget Structure

The NerdWallet budget spreadsheet lets you input your monthly income and expenses and shows how your finances compare with the 50/30/20 budget breakdown: 50% of your income goes toward needs, 30% toward wants and 20% toward savings and debt repayment.

Create separate worksheets for different aspects of your finances:

Income Tracking: List all sources of income including salary, freelance work, investments, and side hustles. Include columns for gross income, taxes, and net income.

Monthly Budget: Create categories for fixed expenses (rent, utilities, insurance), variable expenses (groceries, entertainment, transportation), and savings goals.

Expense Tracking: Design a system to record daily expenses with categories, dates, amounts, and payment methods.

Debt Management: Track all debts including balances, interest rates, minimum payments, and payoff strategies.

Savings and Investments: Monitor emergency funds, retirement accounts, and investment portfolios.

Step 3: Implement the 50/30/20 Rule

This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

The 50/30/20 budgeting rule provides a simple framework for organizing your finances:

- 50% for Needs: Essential expenses like housing, utilities, minimum debt payments, and groceries

- 30% for Wants: Entertainment, dining out, hobbies, and non-essential purchases

- 20% for Savings and Debt Repayment: Emergency fund, retirement contributions, and extra debt payments

Step 4: Create Dynamic Formulas

Set up formulas that automatically calculate totals, percentages, and variances:

=SUM(B2:B50) // Total monthly expenses

=B2/C2*100 // Percentage of budget used

=IF(D2>E2,"Over Budget","Within Budget") // Budget status

=SUMIF(A:A,"Groceries",B:B) // Category totals

Step 5: Add Conditional Formatting

Use conditional formatting to highlight important information:

- Red cells for over-budget categories

- Green cells for under-budget categories

- Yellow cells for approaching budget limits

- Color-coded payment due dates

Advanced Spreadsheet Techniques for Finance

Debt Snowball and Avalanche Calculators

Create calculators that help you determine the most effective debt repayment strategy. The debt snowball method focuses on paying off smallest balances first, while the debt avalanche method prioritizes highest interest rates.

Investment Portfolio Tracking

Build a comprehensive investment tracker that includes:

- Current holdings and values

- Purchase dates and prices

- Dividend and interest income

- Performance metrics and returns

- Asset allocation analysis

Retirement Planning Models

Develop sophisticated retirement planning spreadsheets that account for:

- Current savings and contribution rates

- Expected returns and inflation

- Social Security benefits

- Healthcare costs

- Withdrawal strategies

Tax Planning Worksheets

Create annual tax planning tools that help you:

- Estimate quarterly tax payments

- Track deductible expenses

- Plan tax-advantaged contributions

- Optimize tax withholdings

Best Practices for Spreadsheet Finance Management

Regular Data Entry and Review

Consistency is key to effective financial management. Set aside time weekly to:

- Update expense records

- Review budget performance

- Reconcile bank statements

- Adjust categories as needed

Backup and Version Control

Protect your financial data by:

- Creating regular backups

- Using cloud storage for automatic syncing

- Maintaining version history

- Keeping copies of important calculations

Data Security

Ensure your financial information remains secure:

- Use strong passwords

- Enable two-factor authentication

- Consider encryption for sensitive files

- Limit access to shared documents

Documentation and Notes

Maintain clear documentation of:

- Formula explanations

- Data sources

- Calculation methods

- Assumptions and estimates

Common Spreadsheet Templates for Personal Finance

Monthly Budget Template

A budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending

Create a comprehensive monthly budget that includes:

- Income sources and amounts

- Fixed and variable expenses

- Savings goals and contributions

- Budget vs. actual comparisons

- Variance analysis

Expense Tracking Template

The Sheetgo Expense tracker template is ideal for anyone looking for a simple way to monitor expenses and automate financial management. You could use it for your business or implement it in your team. You could even use it at home with your family, to track how much each person is spending.

Design an expense tracker with:

- Date, amount, category, and description fields

- Payment method tracking

- Automatic categorization using formulas

- Monthly and yearly summaries

Debt Payoff Calculator

Build a tool that helps you visualize debt repayment:

- Current balances and interest rates

- Minimum payment requirements

- Extra payment scenarios

- Payoff timelines and interest savings

Net Worth Tracker

Monitor your overall financial health:

- Assets (cash, investments, property)

- Liabilities (debts, loans, credit cards)

- Net worth calculations

- Monthly and yearly trends

Troubleshooting Common Spreadsheet Issues

Formula Errors

Common problems and solutions:

- #DIV/0!: Division by zero errors – use IF statements to check for zero values

- #REF!: Reference errors – update cell references when moving data

- #VALUE!: Value errors – ensure data types match formula requirements

- Circular references: Check for formulas that reference themselves

Data Integrity

Maintain accurate financial records:

- Use data validation to prevent entry errors

- Create backup copies before making major changes

- Regularly reconcile with bank statements

- Document unusual transactions or adjustments

Performance Optimization

Keep your spreadsheets running smoothly:

- Limit unnecessary calculations

- Use efficient formulas and functions

- Avoid excessive formatting

- Break large files into smaller, linked workbooks

Integrating Spreadsheets with Other Tools

Bank and Credit Card Downloads

Most financial institutions allow you to download transaction data in CSV or Excel format. This can be imported into your spreadsheet system for easier expense tracking and categorization.

Cloud Storage Integration

Use cloud storage services to:

- Access your financial data from multiple devices

- Share information with family members or financial advisors

- Maintain automatic backups

- Collaborate on family budgets

Mobile Applications

While spreadsheets are primarily desktop tools, many mobile apps can complement your spreadsheet system:

- Expense tracking apps that export to spreadsheets

- Receipt scanning tools

- Voice-to-text expense entry applications

Tips for Spreadsheet Success

Start Simple

Begin with a basic budget template and gradually add complexity as you become more comfortable with spreadsheet functions and your financial tracking needs.

Regular Maintenance

Schedule weekly or monthly reviews to:

- Update financial data

- Review progress toward goals

- Adjust budgets based on actual spending

- Identify areas for improvement

Learn Key Functions

Master essential spreadsheet functions that are particularly useful for finance:

- Mathematical operations (SUM, AVERAGE, COUNT)

- Logical functions (IF, AND, OR)

- Lookup functions (VLOOKUP, INDEX, MATCH)

- Financial functions (PMT, FV, PV, RATE)

Stay Organized

Maintain a clean, organized spreadsheet structure:

- Use consistent formatting

- Group related data together

- Add clear headers and labels

- Include explanatory notes where needed

Future-Proofing Your Spreadsheet System

Scalability Planning

Design your spreadsheet system to accommodate:

- Growing income and expense complexity

- Additional family members

- Investment portfolio expansion

- Business financial tracking

Technology Updates

Stay current with:

- New spreadsheet features and functions

- Cloud-based collaboration tools

- Mobile accessibility improvements

- Integration with financial services

Skill Development

Continuously improve your spreadsheet skills:

- Learn advanced formulas and functions

- Explore data analysis tools

- Practice with pivot tables and charts

- Study financial modeling techniques

Conclusion

Spreadsheets remain one of the most powerful and flexible tools for personal finance management. All the Vertex42™ budget templates can be downloaded for personal use and no charge. We hope that they will be helpful to you! The templates featured below also work with OpenOffice and Google Spreadsheets, so if you don’t own a version of Microsoft Excel®, the only thing stopping you from making a budget is the time to download and the determination to get your finances under control.

The key to success with spreadsheet-based financial management lies in starting with a simple system and gradually building complexity as your needs grow. Whether you’re tracking a basic monthly budget or managing a complex investment portfolio, spreadsheets offer the customization and control that many people find lacking in pre-built financial applications.

By following the guidelines and best practices outlined in this guide, you can create a robust, personalized financial management system that serves your unique needs and helps you achieve your financial goals. Remember that the most effective financial management tool is the one you’ll actually use consistently, and spreadsheets offer the perfect balance of power, flexibility, and accessibility for most people’s financial management needs.

However you choose to manage your money, the important thing is that you take a deep look at your spending and try to find a budgeting method that works for you. Budgeting spreadsheets are a great way to get organized toward your financial goals, track your spending and see how your money management skills improve over time. Start with the basics, be consistent with your data entry, and gradually expand your system as you become more comfortable with both spreadsheet functions and your personal financial management needs.