Setting financial goals is one of the most important steps toward achieving financial freedom and security. However, many people struggle with creating goals that are both realistic and achievable. The key lies in understanding how to set SMART financial goals – objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. This comprehensive guide will walk you through the process of creating effective financial goals and provide you with practical strategies to actually achieve them.

Understanding SMART Financial Goals

What Are SMART Goals?

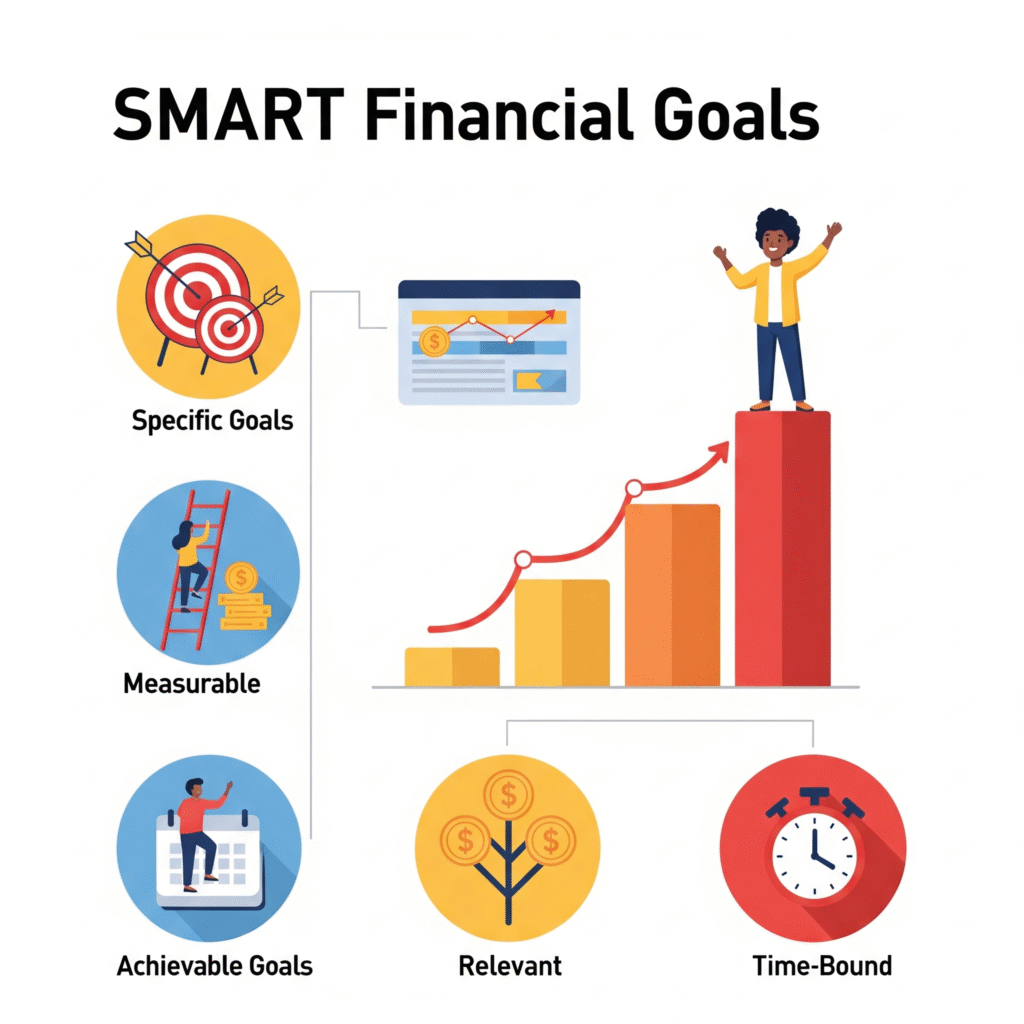

SMART is an acronym that stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework was originally developed for business management but has proven incredibly effective for personal financial planning. When applied to financial goals, the SMART criteria help transform vague aspirations like “I want to save money” into concrete, actionable objectives.

Why Traditional Goal Setting Often Fails

Most people set financial goals that are too broad or unrealistic. Common mistakes include setting goals that are too vague (“save more money”), too ambitious (“become a millionaire in one year”), or lacking a clear timeline. Without the structure that SMART goals provide, it’s easy to lose motivation or direction along the way.

The Five Components of SMART Financial Goals

1. Specific (S)

Your financial goals must be crystal clear and well-defined. Instead of saying “I want to save money,” specify exactly what you want to achieve. A specific goal answers the questions: What exactly do I want to accomplish? Why is this goal important? What resources or limitations are involved?

Example of a vague goal: “I want to save for retirement.” Example of a specific goal: “I want to save $500,000 for retirement to maintain my current lifestyle and have financial security in my golden years.”

2. Measurable (M)

Measurable goals include concrete numbers that allow you to track your progress. This component helps you stay motivated by showing how far you’ve come and how much further you need to go. Measurable goals answer questions like: How much money do I need to save? How will I know when I’ve achieved my goal?

Example: “I will save $10,000 for an emergency fund by contributing $833 per month.”

3. Achievable (A)

Your goals should be realistic and attainable based on your current financial situation, income, and expenses. Setting unrealistic goals often leads to frustration and abandonment of the goal altogether. An achievable goal stretches your capabilities while remaining possible to accomplish.

Consider these factors when setting achievable goals:

- Your current income and expenses

- Your existing financial obligations

- Your timeline for achieving the goal

- Potential obstacles or challenges

4. Relevant (R)

Relevant goals align with your broader life objectives and values. They should matter to you personally and fit within your overall financial plan. A relevant goal answers the question: Does this goal align with my other objectives and priorities?

Example: If you’re planning to start a family, saving for a larger home might be more relevant than saving for a luxury vacation.

5. Time-bound (T)

Every financial goal needs a specific deadline or timeframe. Time-bound goals create urgency and help you prioritize your efforts. Without a timeline, goals tend to be postponed indefinitely.

Example: “I will pay off my $15,000 credit card debt within 18 months by making monthly payments of $900.”

Step-by-Step Guide to Setting SMART Financial Goals

Step 1: Assess Your Current Financial Situation

Before setting any goals, you need a clear understanding of where you stand financially. This involves:

Creating a comprehensive financial inventory:

- List all your assets (savings accounts, investments, property, etc.)

- Document all your liabilities (credit cards, loans, mortgages, etc.)

- Calculate your net worth (assets minus liabilities)

- Track your monthly income and expenses

Analyzing your cash flow:

- Identify your fixed expenses (rent, insurance, loan payments)

- Calculate your variable expenses (groceries, entertainment, utilities)

- Determine your disposable income available for goal achievement

Step 2: Identify Your Financial Priorities

Different life stages and circumstances require different financial priorities. Common financial goals include:

Short-term goals (1-2 years):

- Building an emergency fund

- Paying off high-interest debt

- Saving for a vacation or major purchase

Medium-term goals (3-10 years):

- Saving for a home down payment

- Funding children’s education

- Building investment portfolio

Long-term goals (10+ years):

- Retirement planning

- Paying off mortgage

- Legacy planning

Step 3: Apply the SMART Framework

Transform each priority into a SMART goal using this template:

“I will [specific action] by [specific date] by [method/strategy] to [reason/benefit].”

Example: “I will save $20,000 for a home down payment by December 2026 by automatically transferring $600 monthly to a high-yield savings account to achieve homeownership and build equity.”

Step 4: Break Down Large Goals

Large financial goals can feel overwhelming. Break them into smaller, manageable milestones:

Example for a $60,000 retirement goal:

- Year 1: Save $15,000

- Year 2: Save $15,000

- Year 3: Save $15,000

- Year 4: Save $15,000

Step 5: Create Action Plans

For each SMART goal, develop a detailed action plan that includes:

- Specific steps you’ll take

- Resources you’ll need

- Potential obstacles and solutions

- Regular review and adjustment periods

Common Types of SMART Financial Goals

Emergency Fund Goals

SMART Example: “I will build a $12,000 emergency fund (covering 6 months of expenses) by December 2025 by saving $500 monthly in a high-yield savings account to protect against unexpected financial emergencies.”

Strategies for success:

- Automate transfers to emergency fund

- Keep funds in easily accessible but separate account

- Only use for true emergencies

Debt Elimination Goals

SMART Example: “I will pay off my $8,000 credit card debt by June 2025 by making monthly payments of $700 (minimum payment plus extra $450) to reduce financial stress and save on interest charges.”

Effective approaches:

- Use debt avalanche method (pay minimums on all debts, extra payment on highest interest rate)

- Consider debt snowball method (pay minimums on all debts, extra payment on smallest balance)

- Avoid taking on new debt while paying off existing obligations

Investment Goals

SMART Example: “I will invest $12,000 in a diversified index fund portfolio by December 2025 by contributing $1,000 monthly to build long-term wealth and achieve financial independence.”

Key considerations:

- Understand risk tolerance

- Diversify investments

- Consider tax-advantaged accounts (401k, IRA)

- Review and rebalance regularly

Homeownership Goals

SMART Example: “I will save $40,000 for a home down payment by September 2026 by saving $1,500 monthly and reducing discretionary spending by $300 monthly to achieve homeownership in my desired neighborhood.”

Important factors:

- Research local housing market

- Factor in closing costs and moving expenses

- Consider pre-approval process timing

Strategies for Achieving Your SMART Financial Goals

Automation and Technology

Modern technology makes goal achievement easier than ever:

Automatic transfers: Set up automatic transfers from checking to savings accounts to ensure consistent progress toward your goals.

Budgeting apps: Use apps like GramSave to track expenses and monitor progress toward financial goals.

Investment platforms: Utilize robo-advisors and investment apps for automated investing.

The Pay-Yourself-First Principle

Treat your financial goals as non-negotiable expenses. When you receive income, immediately allocate money toward your goals before spending on discretionary items.

Income Optimization

Consider strategies to increase your income:

- Seek promotions or raises at work

- Develop side hustles or freelance work

- Invest in skills development for career advancement

- Optimize tax strategies to keep more of your income

Expense Reduction

Identify areas where you can cut expenses without significantly impacting your quality of life:

- Review and negotiate recurring subscriptions

- Implement energy-saving measures

- Plan meals and reduce food waste

- Shop strategically for better deals

Monitoring and Adjusting Your Goals

Regular Review Schedule

Schedule monthly and quarterly reviews of your financial goals:

Monthly reviews should include:

- Progress toward each goal

- Budget performance

- Necessary adjustments for the following month

Quarterly reviews should include:

- Overall goal assessment

- Major adjustments if needed

- Celebration of achievements

Handling Setbacks

Financial setbacks are normal and expected. When they occur:

- Don’t abandon your goals entirely

- Adjust timelines or amounts if necessary

- Focus on getting back on track quickly

- Learn from the experience to prevent future setbacks

Celebrating Milestones

Acknowledge and celebrate progress toward your goals:

- Set milestone rewards for achieving 25%, 50%, 75% of your goal

- Share achievements with supportive friends or family

- Use celebrations as motivation for continued progress

Tools and Resources for Success

Financial Planning Apps

Modern financial apps can significantly simplify goal tracking and achievement. Look for apps that offer:

- Goal setting and tracking features

- Budget monitoring capabilities

- Investment tracking

- Progress visualization

Professional Support

Consider working with financial professionals when appropriate:

- Financial advisors for comprehensive planning

- Tax professionals for optimization strategies

- Debt counselors for debt management plans

Educational Resources

Continuously educate yourself about personal finance:

- Read reputable financial books and blogs

- Take online courses on investing and financial planning

- Join financial communities for support and advice

Common Pitfalls to Avoid

Setting Too Many Goals Simultaneously

Focus on 2-3 major financial goals at a time to avoid spreading your resources too thin.

Ignoring Inflation

Factor inflation into long-term goals, especially retirement planning.

Failing to Adjust for Life Changes

Life circumstances change, and your goals should adapt accordingly.

Perfectionism

Don’t let small setbacks derail your entire financial plan.

Conclusion

Setting and achieving SMART financial goals is a powerful strategy for building wealth and achieving financial security. By making your goals Specific, Measurable, Achievable, Relevant, and Time-bound, you create a clear roadmap for financial success.

Remember that financial goal achievement is a marathon, not a sprint. Consistency, patience, and regular review are key to long-term success. Start with one or two goals that matter most to you, apply the SMART framework, and take the first step today.

Your financial future depends on the decisions you make today. By implementing the strategies outlined in this guide, you’ll be well on your way to achieving your financial dreams and building the secure future you deserve.

Whether you’re just starting your financial journey or looking to optimize your existing plans, the principles of SMART goal setting will serve you well. Take action today, stay committed to your goals, and watch as your financial situation transforms over time.