Creating your first budget can feel overwhelming, but it’s one of the most powerful tools for taking control of your financial future. Whether you’re drowning in debt, living paycheck to paycheck, or simply want to be more intentional with your money, a well-crafted budget serves as your financial roadmap.

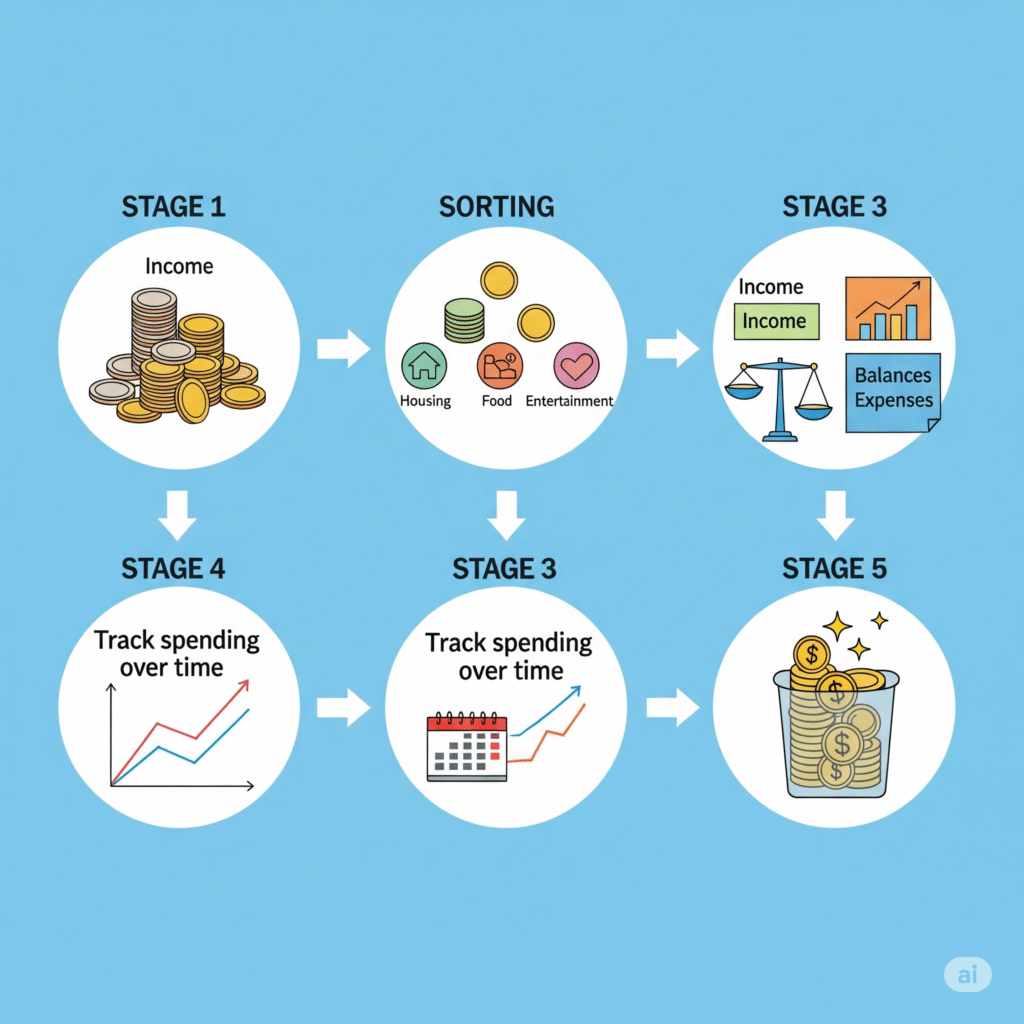

In this comprehensive guide, we’ll walk you through exactly how to create your first budget using five simple, actionable steps. By the end of this article, you’ll have all the knowledge and tools needed to build a budget that actually works for your lifestyle and financial goals.

Why Budgeting Matters More Than You Think

Before diving into the how-to, let’s address the why. Many people resist budgeting because they think it means restricting their lifestyle or constantly tracking every penny. In reality, budgeting is about gaining financial freedom and making informed decisions about your money.

Research shows that people who budget regularly are more likely to:

- Save for emergencies and long-term goals

- Pay off debt faster

- Experience less financial stress

- Build wealth over time

- Make confident financial decisions

The key is creating a budget that works with your lifestyle, not against it.

Step 1: Calculate Your Total Monthly Income

The foundation of any successful budget starts with knowing exactly how much money you have coming in each month. This might seem straightforward, but many people underestimate the importance of being precise with this number.

For Salaried Employees

If you receive a regular paycheck, calculate your monthly take-home pay by:

- Looking at your most recent pay stub

- Identifying your net pay (after taxes and deductions)

- Multiplying by the number of paychecks you receive per month

For example, if you’re paid bi-weekly and your net pay is $2,000, your monthly income would be approximately $4,333 ($2,000 × 26 pay periods ÷ 12 months).

For Variable Income Earners

If your income fluctuates (freelancers, commissioned salespeople, small business owners), use these strategies:

Conservative Approach: Use your lowest monthly income from the past 12 months as your baseline. This ensures you can always cover your expenses, and any extra income becomes a bonus for savings or debt payoff.

Average Approach: Add up your total income from the past 12 months and divide by 12. This gives you a more realistic picture but requires building a larger emergency fund to handle low-income months.

Don’t Forget Additional Income Sources

Include all sources of income:

- Side hustles or freelance work

- Rental income

- Investment dividends

- Child support or alimony

- Government benefits

- Regular gifts or financial support

Step 2: Track and Categorize Your Expenses

Understanding where your money goes is crucial for creating a realistic budget. Many people are shocked to discover how much they’re actually spending in certain categories.

The 30-Day Expense Tracking Method

For the most accurate picture, track every expense for 30 days. Use whatever method works best for you:

- Smartphone apps like Mint, YNAB, or even a simple notes app

- A small notebook you carry everywhere

- Saving all receipts in a designated envelope

- Reviewing bank and credit card statements

Essential Expense Categories

Organize your expenses into these main categories:

Fixed Expenses (Same amount each month):

- Rent or mortgage payments

- Insurance premiums

- Car payments

- Subscription services

- Phone and internet bills

- Student loan payments

Variable Expenses (Amount changes monthly):

- Groceries

- Utilities (electricity, gas, water)

- Transportation (gas, public transit, rideshares)

- Entertainment and dining out

- Clothing and personal care

- Medical expenses

Periodic Expenses (Don’t occur monthly):

- Car maintenance and repairs

- Annual insurance premiums

- Holiday and gift expenses

- Home maintenance

- Professional development or education

Pro tip: For periodic expenses, estimate the annual cost and divide by 12 to get a monthly amount to set aside.

Step 3: Choose Your Budgeting Method

There’s no one-size-fits-all budgeting method. The best budget is the one you’ll actually stick to. Here are three popular approaches:

The 50/30/20 Rule

This simple method divides your after-tax income into three categories:

- 50% for needs: Housing, utilities, groceries, transportation, insurance, minimum debt payments

- 30% for wants: Entertainment, dining out, hobbies, shopping, subscriptions

- 20% for savings and debt payoff: Emergency fund, retirement savings, extra debt payments

This method works well for beginners because it’s simple and flexible.

Zero-Based Budgeting

Every dollar of income is assigned a specific purpose until you reach zero. The formula is: Income – Expenses – Savings = $0

This method gives you complete control over your money and ensures every dollar has a job.

The Envelope Method

Traditionally done with cash and physical envelopes, this method involves allocating specific amounts to different spending categories. When the envelope is empty, you’re done spending in that category for the month.

Modern digital versions use apps or separate bank accounts instead of physical envelopes.

Step 4: Set Realistic Financial Goals

Your budget should align with your financial goals, both short-term and long-term. Without clear goals, it’s easy to lose motivation and abandon your budget.

Short-Term Goals (1-2 years)

- Build an emergency fund of $1,000-$2,000

- Pay off high-interest credit card debt

- Save for a vacation or major purchase

- Establish a consistent savings habit

Medium-Term Goals (2-5 years)

- Build a full emergency fund (3-6 months of expenses)

- Save for a house down payment

- Pay off student loans

- Start investing for retirement

Long-Term Goals (5+ years)

- Achieve financial independence

- Pay off your mortgage early

- Build substantial retirement savings

- Fund children’s education

Making Goals Specific and Achievable

Instead of vague goals like “save more money,” create specific, measurable objectives:

- “Save $100 per month for 10 months to build a $1,000 emergency fund”

- “Pay an extra $200 per month toward credit card debt to be debt-free in 18 months”

- “Save $500 per month for a house down payment”

Step 5: Create and Implement Your Budget

Now it’s time to put it all together. Using the information from steps 1-4, create your first budget.

Budget Creation Process

- Start with your monthly income (from Step 1)

- List all fixed expenses and subtract from income

- Estimate variable expenses based on your tracking (Step 2)

- Allocate money toward your goals (Step 4)

- Assign any remaining money to appropriate categories

Sample Budget Template

Here’s a simple budget template you can customize:

Monthly Income: $4,000

Fixed Expenses:

- Rent: $1,200

- Car payment: $300

- Insurance: $200

- Phone: $80

- Subscriptions: $40

- Total Fixed: $1,820

Variable Expenses:

- Groceries: $400

- Utilities: $150

- Gas: $120

- Entertainment: $200

- Dining out: $180

- Personal care: $50

- Total Variable: $1,100

Savings & Goals:

- Emergency fund: $300

- Retirement: $400

- Debt payoff: $200

- Total Savings: $900

Remaining for miscellaneous: $180

Implementation Tips

Use Technology: Apps like GramSave can help automate your budgeting process and provide insights into your spending patterns.

Start Small: Don’t try to change everything at once. Pick one or two categories to focus on initially.

Build in Flexibility: Life happens. Include a small miscellaneous category for unexpected expenses.

Review Weekly: Check your progress weekly to stay on track and make adjustments as needed.

Common Budgeting Mistakes to Avoid

Being Too Restrictive

Creating an unrealistic budget that doesn’t allow for any fun or flexibility is a recipe for failure. Include money for entertainment and personal expenses.

Not Tracking Actual Spending

A budget is only effective if you monitor your actual spending against your plan. Regular check-ins help you stay accountable.

Forgetting Irregular Expenses

Car repairs, medical bills, and other irregular expenses can derail your budget. Build a cushion for these items.

Not Adjusting for Life Changes

Your budget should evolve with your life. Review and adjust it when your income, expenses, or goals change.

Making Your Budget Work Long-Term

The First Month Reality Check

Your first month of budgeting is an experiment. Don’t expect perfection. Use this time to:

- Identify areas where your estimates were off

- Adjust categories that were too restrictive or too generous

- Find your natural spending patterns

Building Sustainable Habits

- Automate what you can: Set up automatic transfers to savings and automatic bill payments

- Use the 24-hour rule: Wait a day before making unplanned purchases over $50

- Celebrate small wins: Acknowledge when you meet your budget goals

- Find an accountability partner: Share your goals with someone who will support your journey

Regular Budget Reviews

Schedule monthly budget reviews to:

- Compare actual spending to planned spending

- Adjust categories based on real-world experience

- Update goals as you make progress

- Plan for upcoming expenses or income changes

Conclusion

Creating your first budget doesn’t have to be complicated or restrictive. By following these five simple steps – calculating your income, tracking expenses, choosing a method, setting goals, and implementing your plan – you’ll have a solid foundation for financial success.

Remember, budgeting is a skill that improves with practice. Your first budget won’t be perfect, and that’s okay. The important thing is to start. Every month you budget brings you closer to your financial goals and gives you greater control over your money.

The journey to financial wellness begins with a single step. Take that step today by creating your first budget. Your future self will thank you for the financial clarity and peace of mind that comes from knowing exactly where your money goes and having a plan for achieving your dreams.

Start small, be consistent, and watch as your financial confidence grows along with your savings account. With the right tools and mindset, budgeting can transform from a dreaded chore into an empowering habit that sets you up for long-term financial success.