Introduction: Why Saving Money Feels So Hard — and Why You Can Change That

Let’s be honest — saving money isn’t easy. Between rising living costs, impulsive online shopping, and social media showing you the “perfect lifestyle,” it’s no wonder many people struggle to stay consistent.

But here’s the truth: saving money isn’t just about income — it’s about discipline and consistency. You don’t need to be rich to save; you need the right mindset, habits, and systems that make saving automatic and sustainable.

This guide will show you, step-by-step, how to build financial discipline and consistency so you can stop living paycheck to paycheck and finally gain control over your money.

1. The Foundation: Changing How You Think About Saving

Before any strategy or app can help, you must start with the right mindset. Your thoughts about money influence every financial decision you make.

A. Stop Thinking of Saving as Sacrifice

Most people fail to save because they treat saving as losing something — less fun, fewer outings, fewer treats. But in reality, saving is buying freedom.

Think of every dollar saved as a vote for your future independence.

✅ Mindset shift:

Instead of saying “I can’t afford it,” try saying “This isn’t in my current plan.”

This simple change gives you control, not guilt.

B. Visualize the Reward

Set a clear, motivating goal for your savings. Whether it’s a new home, your dream trip, or early retirement, visualization helps your brain connect saving to something positive.

📘 Pro tip: Create a “vision board” (physical or digital) showing what your savings will help you achieve. When you see your goal daily, motivation stays strong.

2. Know Your Starting Point: Tracking Your Money

You can’t build discipline in saving without knowing where your money goes.

A. Track Every Expense

Start by listing everything you spend for 30 days. Yes, every cup of coffee and every ride fare.

| Category | Amount Spent (Monthly) | Goal (Next Month) |

|---|---|---|

| Food & Groceries | $450 | $400 |

| Transportation | $150 | $130 |

| Entertainment | $120 | $80 |

| Shopping | $200 | $150 |

| Savings | $0 | $100 |

When you see where your money actually goes, you’ll notice habits that can easily be adjusted.

B. Use Simple Budgeting Tools

You don’t need fancy finance software. Apps like Mint, YNAB (You Need a Budget), or even a Google Sheet can help track your expenses automatically.

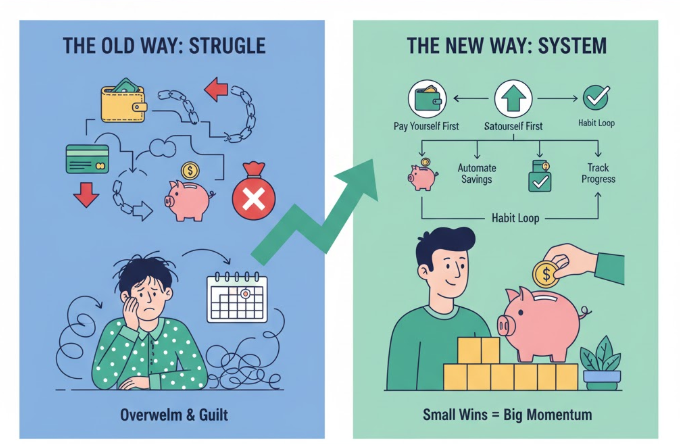

3. Build a System That Forces Consistency

Saving money shouldn’t depend on daily willpower. Instead, create automated systems that make saving effortless.

A. Automate Your Savings

Set your bank account to automatically transfer a portion of your paycheck to your savings account every month.

Start small — even $50 a week adds up to $2,600 a year.

💡 “Pay yourself first” — treat your savings like a bill that must be paid every month.

B. Use Separate Accounts

Have one account for spending and one for saving.

When the money isn’t easily accessible, you’ll be less tempted to touch it.

C. Create Mini Saving Goals

Instead of saving for “the future” (which feels vague), set short-term milestones:

-

Save $300 for an emergency fund

-

Save $500 for a short vacation

-

Save $1,000 for long-term security

Each milestone boosts your confidence and keeps you motivated.

4. The 50/30/20 Rule — A Simple System That Works

The 50/30/20 rule is one of the easiest budgeting frameworks for consistency.

| Category | Percentage | Example on $2,000 Income |

|---|---|---|

| Needs (rent, bills, groceries) | 50% | $1,000 |

| Wants (entertainment, shopping) | 30% | $600 |

| Savings & Debt Repayment | 20% | $400 |

Even if your income varies, keeping this ratio in mind helps you maintain a healthy balance.

🎯 Goal: Try to slowly increase your savings rate from 20% to 25% as your discipline grows.

5. Turn Saving into a Daily Habit

Discipline isn’t built in one day — it’s built through repetition and habit.

A. Use Habit Stacking

Connect saving with an existing routine.

For example:

-

Every payday → move 10% into savings.

-

Every Sunday → review your weekly spending.

B. Challenge Yourself

Gamify your saving habits:

-

No-spend challenges (avoid unnecessary purchases for 7 days)

-

Round-up savings (if something costs $4.30, round up to $5 and save the $0.70)

-

Cash envelope challenge (use cash for weekly expenses to prevent overspending)

C. Reward Yourself Smartly

It’s okay to celebrate small wins — just do it wisely.

After hitting a savings milestone, treat yourself within your budget. This reinforces positive behavior.

6. Mastering Self-Discipline: The Key to Long-Term Success

Consistency in saving isn’t about luck; it’s about self-control.

A. Learn to Delay Gratification

Impulse buying kills savings faster than anything else.

Ask yourself before every purchase:

“Will this still matter to me in a month?”

If not, skip it or add it to a 24-hour “cooling-off” list.

B. Set Clear Rules

Create personal “money rules” to avoid decision fatigue.

Examples:

-

No online shopping after 9 PM

-

Only buy if it’s on your pre-planned list

-

Always wait 48 hours before big purchases

These small boundaries create automatic discipline.

7. Use Psychology to Stay Consistent

Money management isn’t just math — it’s psychology.

Understanding how your mind works can make saving easier.

A. The Power of Small Wins

Our brains love progress. Start small, stay consistent, and celebrate every step.

Instead of saving $500 a month (which might feel hard), start with $100 and increase over time.

B. Automate Motivation

Set reminders on your phone:

-

“Did you save today?”

-

“You’re getting closer to your goal!”

These micro-reminders keep your financial goals fresh in your mind.

C. Environment Matters

Unsubscribe from promotional emails.

Avoid unnecessary “window shopping.”

Follow content that promotes financial growth, not consumerism.

Your environment either supports your savings goals — or destroys them.

8. Practical Ways to Boost Savings Without Feeling Restricted

You don’t have to give up your lifestyle completely. You just need to be smart about spending.

A. Cut Hidden Costs

-

Cancel unused subscriptions

-

Cook at home more often

-

Use cashback and discount apps

B. Plan Your Purchases

Buying things impulsively often leads to regret.

Plan your shopping — check deals, compare prices, and buy only what’s needed.

C. Increase Income (Not Just Reduce Spending)

Saving becomes easier when you earn more.

Try:

-

Freelancing

-

Selling unused items

-

Taking a side hustle

Even small extra income can go directly into your savings.

9. Build an Emergency Fund — Your Safety Net

Having an emergency fund is the foundation of financial peace. It protects you from using credit cards or loans during unexpected events.

A. How Much Should You Save?

Aim for 3–6 months of living expenses.

| Monthly Expense | Target Emergency Fund (3 Months) |

|---|---|

| $1,000 | $3,000 |

| $1,500 | $4,500 |

| $2,000 | $6,000 |

B. Keep It Separate

Use a high-yield savings account or a digital wallet for this fund.

Avoid mixing it with regular spending accounts.

10. Stay Accountable — Don’t Do It Alone

Accountability keeps discipline alive.

A. Share Your Goals

Tell a trusted friend or family member about your savings goals.

When someone checks in on you, it’s harder to give up.

B. Join a Community

Join online saving challenges or groups.

Seeing others succeed can motivate you to stay consistent.

C. Track Your Progress Monthly

At the end of each month:

-

Review how much you saved

-

Identify what worked

-

Adjust where needed

Even small improvements compound over time.

11. Build a Reward System That Fuels Motivation

Discipline doesn’t mean punishment. The goal is to enjoy the process while staying consistent.

A. Create Milestone Rewards

-

Save $500 → Buy yourself a small treat

-

Save $1,000 → Plan a weekend getaway

-

Save $5,000 → Invest in something long-term

B. Visualize Growth

Use a savings tracker chart or jar.

Seeing your progress visually strengthens your motivation.

📊 Example of Progress Tracker:

| Month | Goal | Saved | Progress |

|---|---|---|---|

| January | $300 | $320 | ✅ |

| February | $600 | $580 | ⚠️ |

| March | $900 | $950 | ✅ |

| April | $1,200 | $1,180 | ✅ |

12. Keep Learning — Financial Education Builds Confidence

Consistency thrives when you understand what you’re doing.

A. Read Personal Finance Books

Some great beginner-friendly reads:

-

“The Richest Man in Babylon” by George S. Clason

-

“Atomic Habits” by James Clear (for habit-building)

-

“Your Money or Your Life” by Vicki Robin

B. Watch Finance YouTubers or Podcasts

Learn from experts who share practical, relatable advice.

C. Learn to Invest

Once you’re saving consistently, start exploring low-risk investments like:

-

Index funds

-

Fixed deposits

-

Retirement accounts

Investing ensures your saved money grows instead of losing value to inflation.

13. Overcoming Common Setbacks

Even the most disciplined savers face challenges. The key is to recover quickly.

A. Unexpected Expenses

Don’t panic if you dip into your savings. That’s what it’s there for.

Just make a plan to rebuild it.

B. Losing Motivation

Look back at your “why.” Revisit your goals and remind yourself why saving matters.

C. Comparing Yourself to Others

Everyone’s financial journey is different.

Focus on your own progress, not someone else’s highlight reel.

14. The Power of Consistency Over Time

Discipline gives you the foundation, but consistency builds wealth.

Even small, regular savings grow significantly through compounding.

Example of Compounding Power:

| Monthly Saving | Years | Total Saved | Value with 5% Annual Growth |

|---|---|---|---|

| $100 | 10 | $12,000 | $15,528 |

| $200 | 10 | $24,000 | $31,056 |

| $300 | 10 | $36,000 | $46,584 |

Consistency beats intensity — saving $100 every month for years is better than saving $1,000 once and quitting.

Conclusion: Discipline Is Your Superpower

Building discipline and consistency in saving money isn’t about being perfect — it’s about being persistent.

When you control your spending, automate your savings, and reward your progress, you build habits that last a lifetime.

Start today, no matter how small the amount. Because every dollar saved today becomes a brick in the foundation of your financial freedom tomorrow.

💬 “Discipline is choosing between what you want now and what you want most.”

So choose wisely — your future self will thank you.

Quick Summary Table

| Step | Action | Outcome |

|---|---|---|

| 1 | Change your money mindset | Positive view toward saving |

| 2 | Track expenses | Identify wasteful spending |

| 3 | Automate savings | Build consistency |

| 4 | Follow 50/30/20 rule | Balanced budgeting |

| 5 | Form habits | Daily discipline |

| 6 | Use psychology | Stay motivated |

| 7 | Cut hidden costs | Save effortlessly |

| 8 | Build emergency fund | Financial security |

| 9 | Stay accountable | Consistent progress |

| 10 | Reward milestones | Sustainable motivation |