Derek Hagen, CFA, CFP®, FBS®, CFT™

“Man is the creature who does not know what to desire, and he turns to others in order to make up his mind.”

-René Girard

Good planning respects where someone is, not just where you think they should go.

Why Clients Struggle to Do What Matters Most

In your work with clients, you’ve likely encountered situations where people seem to act against their own self-interest.

Clients with variable income know they should save during good months, yet spend windfalls instead. Others have more than enough but still feel scarcity, deprivation, or guilt. Some reach financial “success” and discover they can’t enjoy it.

These struggles aren’t always about knowledge or discipline. Often, clients aren’t confused, they’re conflicted. They’re trying to do what they think they’re supposed to do, guided by stories, expectations, and unexamined assumptions about what a good life should look like.

Helping clients articulate what they truly want and then align their behavior with that vision is deeply meaningful work. But not every challenge lives at the same depth. Some problems can be resolved with simple awareness. Others require deeper exploration.

The mistake many advisors make is going too deep too fast.

A more effective approach is to start shallow and go deeper only when needed, matching the depth of your tools to the depth of the client’s challenge.

Level 1: Mimetic Desire and the Pull of Social Comparison

Humans are exceptionally good at survival.

Every one of your clients descends from a long line of survivors; people who stayed alive long enough to pass on their genes. As a result, we’re wired with a strong negativity bias. We’re more sensitive to threats than opportunities because, historically, missing a threat was far more costly than missing a gain.

This makes us excellent at survival mode. But most modern clients are no longer fighting for survival. Once basic needs are met, the challenge shifts from surviving to thriving, and this is where things get tricky.

When people don’t know what thriving looks like, they look around. They compare. They imitate.

This is what René Girard called mimetic desire: we want what others appear to want. We chase the same markers of success, often without realizing it. Everyone jokes about “keeping up with the Joneses,” but most people are deeply unaware of how much of their own behavior is shaped by social comparison.

Bronnie Ware famously observed that the most common regret of the dying was not living a life true to themselves, but living the life others expected of them.

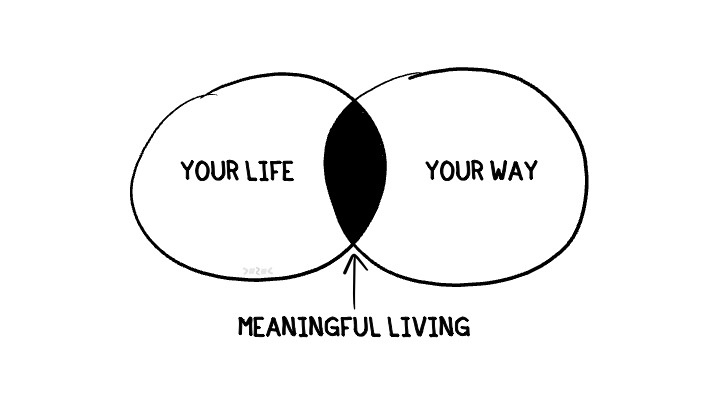

At this first level, helping clients live meaningful lives often means helping them step out of comparison. Sometimes, simply naming this dynamic and giving permission to question it is enough to create meaningful change.

Level 2: Clarifying Values and Defining True Wealth

For many clients, permission to choose their own path is enough to move forward. For others, it raises a new question: If I’m not following someone else’s definition of success, what actually matters to me?

Clients often respond with words like family, security, or freedom. These are important, but they’re broad. Without clarity, values remain abstract, and abstraction makes action difficult.

At this level, the challenge isn’t motivation; it’s direction. Once social comparison fades, clients can experience choice overload. The paradox of choice tells us that more options can actually reduce satisfaction.

This is where guided conversations and structured exercises become powerful. Advisors can help clients move from vague values to personally meaningful definitions of what True Wealth looks like for them.

Want to watch instead?

Get notified when the latest articles are published.

Level 3: Financial Psychology and Hidden Money Scripts

Some clients know what they want. They can articulate their values. They intend to live in alignment with them. And yet… they don’t.

This is where financial psychology enters.

At this level, the issue isn’t clarity; it’s ambivalence. Competing motivations pull clients in opposite directions. Beneath the surface are money scripts – deeply held beliefs and emotional conditioning formed through past experiences.

These scripts operate like invisible rules. By exploring a client’s history, advisors can help bring subconscious narratives into conscious awareness, moving them, as Jonathan Haidt might say, from the elephant to the rider.

Often, simply seeing the script is enough to loosen its grip.

Level 4: Financial Therapy and Healing

When money behaviors are rooted in trauma, deep emotional wounds, or long-standing patterns of shame or fear, financial therapy may be appropriate. This level isn’t for every client, and it isn’t the advisor’s role to provide therapy. But knowing when to refer is part of ethical, human-centered practice.

Different therapeutic approaches serve different needs, from solution-focused methods to cognitive behavioral work. The key is sequencing: this level comes only after the others have been explored.

Start Shallow and Go Deep Only When Needed

This framework isn’t about diagnosing clients or labeling them. It’s about discernment.

The art of good advice isn’t having every tool. It’s knowing which level you’re actually working on. When advisors match the depth of their approach to the depth of the client’s challenge, conversations become more effective, more respectful, and more meaningful.

This layered approach is embedded in Money Quotient’s True Wealth process, helping advisors move from surface-level awareness to deeper transformation… only when necessary.

Because meaningful lives aren’t built by applying the deepest tool first.

They’re built by meeting people where they are and going deeper together when the moment calls for it.

FAQ: Helping Clients Live Meaningful Lives

Why do clients struggle to do what matters most?

Many clients aren’t confused—they’re conflicted. Social comparison, unclear values, emotional ambivalence, or deep-seated money scripts can all interfere with aligned action.

What does it mean to “start shallow” with clients?

Starting shallow means addressing surface-level awareness—like social comparison or mimetic desire—before moving into deeper values or psychological work.

How do advisors know when to go deeper?

Advisors go deeper only when clarity isn’t enough. If clients understand what they want but still feel stuck, deeper financial psychology or therapeutic support may be appropriate.

What are money scripts?

Money scripts are unconscious beliefs about money formed through past experiences. They often drive behavior even when clients consciously want something different.

What role does financial therapy play?

Financial therapy may be appropriate when money behaviors are rooted in trauma or deep emotional wounds. Advisors don’t provide therapy—but knowing when to refer is part of ethical practice.

Want to Learn More?

Money Quotient trains financial professionals in the True Wealth process and helps them implement the concepts into their practices. The first step is to learn about the Fundamentals of True Wealth Planning.

References and Influences

Ariely, Dan: Predictably Irrational

Ariely, Dan & Jeff Kreisler: Dollars and Sense

Gilbert, Daniel: Stumbling on Happiness

Hagen, Derek: Your Money, Your Values, and Your Life

Haidt, Jonathan: The Happiness Hypothesis

Housel, Morgan: The Psychology of Money

Klontz, Brad, Rick Kahler & Ted Klontz: Facilitating Financial Health

Manson, Mark: The Subtle Art of Not Giving a Fuck

Reivich, Karen & Andrew Shatte: The Resilience Factor

Urban, Tim: What’s Our Problem?

Wagner, Richard: Financial Planning 3.0

Wallace, David Foster: This is Water

Ware, Bronnie: The Top Five Regrets of the Dying