Introduction: Why Financial Milestones Matter

Money isn’t everything—but it touches every part of life. Whether it’s paying bills, buying a home, raising kids, or planning retirement, your financial health determines how much freedom and peace you enjoy.

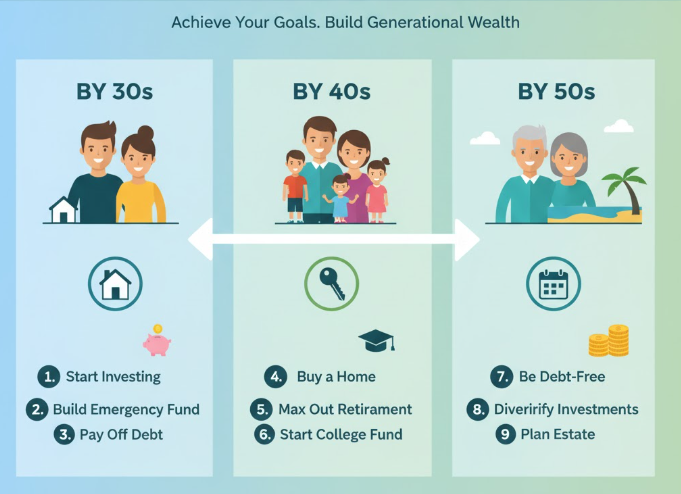

Reaching certain financial milestones by your 30s, 40s, and 50s gives you a roadmap to long-term stability. Think of these milestones as checkpoints that guide you toward financial independence. You don’t need to be a millionaire to hit them—you just need the right habits, mindset, and consistency.

In this article, we’ll explore key financial goals to achieve by age 30, 40, and 50, including savings, investments, debt management, and more. By the end, you’ll have a clear, realistic plan to follow—no matter where you are today.

Financial Milestones to Hit by Age 30

Your 20s are for learning, experimenting, and laying the foundation for your financial life. By the time you reach 30, your goal should be to move from surviving to building.

1. Build a Solid Emergency Fund

Life is unpredictable—a medical bill, car repair, or job loss can happen anytime. An emergency fund keeps you safe from going into debt when those moments strike.

Goal: Save at least 3–6 months’ worth of living expenses in a separate savings account.

Quick Tips:

-

Start small—save one month’s expenses first.

-

Automate your savings so a fixed amount transfers each month.

-

Keep the fund liquid (accessible but separate from your checking account).

2. Eliminate High-Interest Debt

Debt is like a financial anchor—it slows everything down. Focus on paying off credit card balances, payday loans, and other high-interest debts before age 30.

Action Plan:

-

List all your debts and their interest rates.

-

Use the “avalanche method” (pay off highest-interest debt first) or “snowball method” (start with smallest balance).

-

Avoid minimum payments—they only keep you stuck.

Why It Matters:

Debt-free living frees up your income for saving, investing, and experiences instead of paying interest.

3. Start Investing for the Future

Time is your biggest financial advantage in your 20s. Thanks to compound growth, even small investments can grow massively over decades.

Example:

| Starting Age | Monthly Investment | Average Annual Return | Value at 60 |

|---|---|---|---|

| 25 | $200 | 7% | $475,000+ |

| 35 | $200 | 7% | $230,000+ |

Action Steps:

-

Open a retirement account (401(k), IRA, or your local pension plan).

-

Invest in index funds or ETFs for diversification.

-

Contribute regularly—even small amounts count.

4. Build Credit Wisely

A strong credit score isn’t just about borrowing—it affects your ability to rent an apartment, buy a car, or even get a job.

Target Credit Score by 30: 700 or higher

How to Build It:

-

Pay all bills on time.

-

Keep credit card balances below 30% of your limit.

-

Avoid opening too many new accounts.

5. Set Financial Goals and Track Them

Financial success doesn’t happen by luck—it’s planned. Create short-term (1 year), medium-term (5 years), and long-term (10+ years) goals.

Example Goals by 30:

-

Save $10,000+ in emergency fund

-

Have no credit card debt

-

Invest at least 15% of income

-

Maintain good credit

Pro Tip: Use free budgeting tools like Mint, YNAB, or a simple spreadsheet to track progress.

6. Learn to Live Below Your Means

Lifestyle inflation (spending more as you earn more) can destroy savings potential. Your 20s are the best time to master contentment.

Tips to Stay on Track:

-

Follow the 50/30/20 rule:

-

50% needs

-

30% wants

-

20% savings/investments

-

-

Cook at home, use public transport, and delay luxury purchases.

-

Remember: Every dollar you don’t spend is a dollar you can grow.

Financial Milestones to Hit by Age 40

Your 30s are typically the decade of stability—career growth, family, and financial structure. By 40, your focus shifts from building a foundation to accelerating growth and protecting what you’ve earned.

1. Grow Your Retirement Savings

By 40, aim to have at least 2–3 times your annual salary saved for retirement.

If you make $60,000 per year, your retirement savings target should be around $120,000–$180,000.

Ways to Boost Retirement Growth:

-

Increase contributions as income rises.

-

Take advantage of employer matches.

-

Avoid early withdrawals or loans against your retirement account.

2. Own or Be Close to Owning a Home

While renting is fine, homeownership builds long-term equity and stability.

Milestone by 40: Either own your home or be halfway through your mortgage.

Checklist Before Buying:

-

Emergency fund in place

-

Stable income

-

Debt-to-income ratio below 35%

-

Down payment (ideally 20%) saved

3. Secure Life and Health Insurance

With growing responsibilities—spouse, kids, or dependents—insurance becomes crucial.

Essentials by 40:

-

Health insurance: Protects against medical costs.

-

Life insurance: Covers family in case of your death (term insurance preferred).

-

Disability insurance: Replaces income if you’re unable to work.

Pro Tip: Buy insurance early—it’s cheaper when you’re young and healthy.

4. Build Multiple Streams of Income

Relying solely on a job can be risky. One layoff can destroy your savings if you’re not prepared.

Smart Side Income Ideas:

-

Freelancing or consulting

-

Real estate rental income

-

Dividend-paying stocks

-

Online businesses or eBooks

Goal by 40: At least one additional income stream besides your main job.

5. Start College Savings (If You Have Kids)

If you’re a parent, planning for your children’s education can save you stress later.

Action Plan:

-

Open an education savings account or local equivalent.

-

Invest regularly instead of saving cash—education costs rise faster than inflation.

-

Teach kids basic money skills early.

6. Improve Your Investment Strategy

At this stage, you should diversify your portfolio. Don’t put all your money in one asset.

Balanced Portfolio Example (Age 40):

| Asset Type | Percentage |

|---|---|

| Stocks/Equity Funds | 60% |

| Bonds/Debt Funds | 25% |

| Real Estate | 10% |

| Cash/Other | 5% |

Tip: Revisit and rebalance your investments every year to maintain ideal risk levels.

7. Estate Planning and Will Preparation

It might feel too early, but planning your estate is an act of love and responsibility.

Documents You Need:

-

A will or trust

-

Beneficiary designations on all accounts

-

Power of attorney and healthcare proxy

Even if your assets are modest, this ensures they’re handled properly if something unexpected happens.

Financial Milestones to Hit by Age 50

By 50, your financial focus changes from growth to preservation. You’ve likely reached your career peak and are preparing for the next stage—retirement and financial independence.

1. Be on Track for Retirement Goals

By age 50, aim to have 5–6 times your annual income saved for retirement.

If you earn $80,000, that’s roughly $400,000–$480,000 in savings.

Checkpoints:

-

Use retirement calculators to project your needs.

-

Increase contributions (many plans allow “catch-up” payments after 50).

-

Shift investments toward safer, income-producing assets.

2. Pay Off Major Debts

Entering your 50s with minimal debt gives you freedom and peace of mind.

Milestone by 50:

-

Mortgage either paid off or close to it

-

No credit card or personal loan debt

-

Car loans fully paid

Strategy:

-

Make extra mortgage payments yearly.

-

Avoid financing new vehicles unless necessary.

-

Use any bonuses or raises to reduce principal debt.

3. Review and Adjust Investment Risk

As retirement approaches, protecting your savings becomes more important than chasing high returns.

Investment Shift Example (Age 50+):

| Asset Type | Percentage |

|---|---|

| Stocks/Equity Funds | 40% |

| Bonds/Debt Funds | 40% |

| Cash/Real Estate | 20% |

Goal: Balance stability with growth potential to keep up with inflation.

4. Reassess Insurance and Estate Plans

Your 50s are the right time to ensure all safety nets are strong.

Checklist:

-

Update your will and beneficiaries.

-

Review life insurance—consider reducing coverage if debts are gone.

-

Consider long-term care insurance for future medical needs.

5. Prepare for College and Parental Support

If your kids are in college, plan tuition funding carefully without sacrificing your retirement savings.

At the same time, aging parents may start needing support—emotionally and financially.

Tips:

-

Set clear financial boundaries with adult children.

-

Explore government programs or insurance for elder care.

-

Don’t drain your savings for others—secure your future first.

6. Plan for Lifestyle Goals

Your 50s can be the best years of your life—if you plan well. Whether it’s travel, hobbies, or early retirement, align your finances with your passions.

Ideas for Life Balance:

-

Create a “bucket list fund.”

-

Downsize your home to reduce costs.

-

Move to a low-cost area to stretch savings further.

7. Start a Retirement Income Plan

Now’s the time to plan how you’ll turn savings into income.

Key Questions:

-

When will you start taking social security or pension?

-

Which investments will you draw from first?

-

How will you handle taxes in retirement?

Consider consulting a financial planner to map out your withdrawal strategy efficiently.

Quick Financial Progress Chart

| Age Group | Core Goals | Target Savings | Key Milestones |

|---|---|---|---|

| By 30 | Build emergency fund, eliminate high-interest debt, start investing | 1x annual salary | Good credit, no bad debt |

| By 40 | Grow retirement fund, buy a home, diversify investments | 2–3x annual salary | Insurance, side income, will prepared |

| By 50 | Secure retirement readiness, minimize debt, shift investment risk | 5–6x annual salary | Debt-free, stable income, estate planning |

Infographic Idea (for Visual Engagement)

(You can use this layout when designing the infographic for your blog post)

Title: “Your Financial Roadmap: 30s → 40s → 50s”

Visual Flow:

-

30s: “Foundation Building” (Emergency Fund, Credit, Investing)

-

40s: “Growth and Protection” (Retirement, Home, Insurance)

-

50s: “Stability and Legacy” (Debt-Free, Estate, Retirement Income)

Bonus Tips for Financial Success at Any Age

-

Automate Everything: Savings, bill payments, and investments work best when automatic.

-

Avoid Lifestyle Creep: Keep living costs low as income rises.

-

Continue Learning: Read books, follow financial blogs, and update your money knowledge.

-

Track Your Net Worth: Review every six months to measure true progress.

-

Prioritize Health: Medical bills can destroy wealth—stay active and insured.

Conclusion: Building a Life of Financial Freedom

Money doesn’t buy happiness—but financial security gives you the freedom to live life on your terms. Whether you’re 25, 35, or 55, the key is to start where you are and keep moving forward.

You don’t have to be perfect or wealthy to hit these milestones—just consistent. Small, steady steps compound into financial confidence over time.

So take a look at where you are today, set your next milestone, and commit to reaching it.

Your future self will thank you for the choices you make right now.