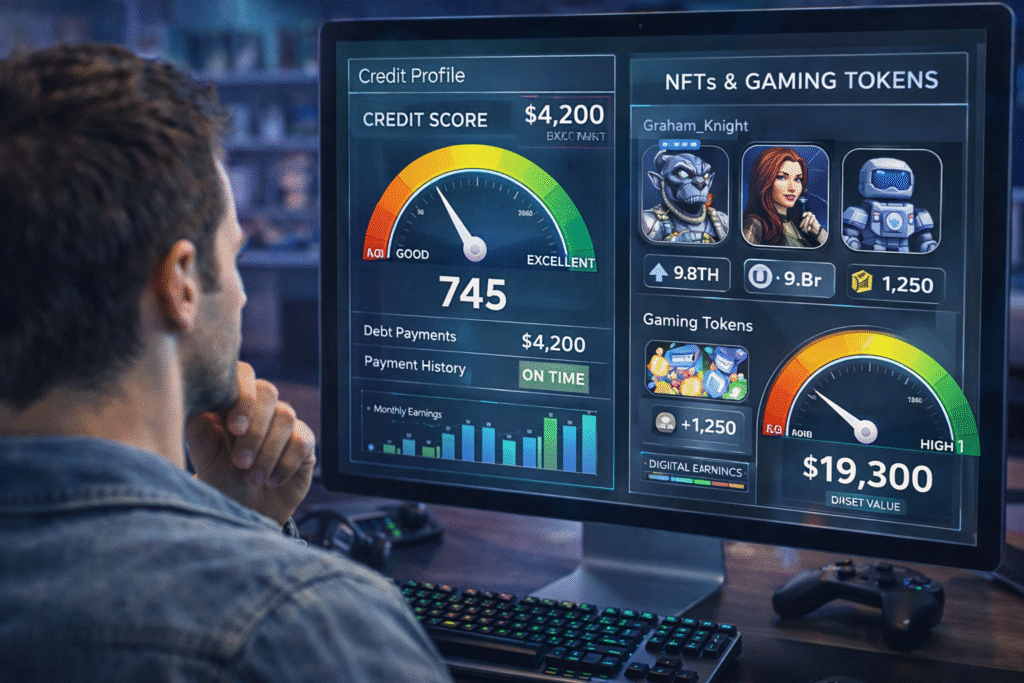

Your credit score might tell one story, but what if your digital wallet is writing another? While millions of Americans struggle with thin credit files or no credit history at all, they’re actively building substantial digital portfolios through NFT collections and gaming tokens—assets that could reshape digital assets credit evaluation in the near future. These blockchain-based holdings create permanent, verifiable records of financial behavior that traditional credit bureaus can’t yet access.

The question isn’t whether lenders will eventually tap into this data, but when. Every NFT purchase, gaming token transaction, and smart contract interaction leaves an immutable trail of financial habits, decision-making patterns, and risk tolerance. For consumers excluded from traditional lending, digital assets credit evaluation could unlock new pathways to better loan terms and alternative ways to demonstrate creditworthiness beyond payment history.

Beyond Traditional Credit Metrics: How Digital Asset Ownership Reveals Hidden Financial Behaviors

Traditional FICO scores capture only a narrow slice of financial behavior, focusing primarily on debt management and payment history while overlooking the broader spectrum of financial decision-making that defines true creditworthiness. For the 45 million Americans with thin or nonexistent credit files, this limitation creates major barriers to fair lending. Digital assets credit evaluation offers a powerful alternative by analyzing sophisticated financial behaviors embedded within NFT collections and gaming token portfolios.

The patterns of NFT acquisition reveal discipline and analytical skill central to digital assets credit evaluation. Collectors who research projects, assess market cycles, and make strategic purchases over time display financial judgment similar to that required for major borrowing decisions. Tracking floor prices, timing entries, and managing acquisition data mirrors the planning behaviors lenders seek but traditional credit bureaus cannot observe.

Gaming ecosystems further expand digital assets credit evaluation by showcasing financial responsibility inside virtual economies. Players who earn, save, and deploy gaming tokens strategically demonstrate budgeting discipline, long-term planning, and risk balancing. Managing multiple token streams and coordinating financial strategies with other participants reflects a level of financial complexity that exceeds traditional credit metrics.

The psychological traits associated with successful digital asset holders strongly support digital assets credit evaluation models. Extended holding periods demonstrate patience, due diligence reflects research capability, and diversified portfolios indicate sound risk management. These behavioral signals correlate closely with positive loan performance but remain invisible in legacy credit scoring.

Smart contract interactions provide some of the strongest signals for digital assets credit evaluation. Users navigating DeFi protocols, liquidity pools, or governance voting exhibit advanced financial literacy and decision-making under uncertainty—skills directly relevant to responsible borrowing.

As lenders explore alternative data sources, digital assets credit evaluation stands out as a framework capable of capturing real-world financial competence that traditional systems miss, especially for borrowers excluded by outdated credit models.

The Immutable Ledger Advantage: Blockchain Transparency in Credit Assessment

Blockchain technology eliminates a core weakness of traditional credit reporting: reliance on self-reported or manipulable financial data. Every blockchain transaction creates an immutable, time-stamped record, giving lenders unprecedented visibility into real financial behavior. This transparency forms the foundation of digital assets credit evaluation, replacing curated financial narratives with verifiable on-chain activity.

The real-time availability of blockchain data gives digital assets credit evaluation a major advantage over traditional credit systems that lag weeks or months behind real events. Lenders can assess current portfolio values, recent transaction patterns, and active financial commitments without waiting for reporting cycles, enabling faster and more accurate lending decisions through digital assets credit evaluation.

Gas fee payment patterns offer especially valuable signals within digital assets credit evaluation frameworks. Users who consistently maintain balances to cover transaction fees across multiple networks demonstrate cash-flow reliability and financial planning discipline. The timing and frequency of these payments reveal income consistency and prioritization behaviors invisible to traditional credit reports.

Multi-wallet management strategies further strengthen digital assets credit evaluation by highlighting financial organization and risk management skills. Maintaining separate wallets for long-term holdings, active trading, and DeFi activity mirrors the compartmentalization successful borrowers apply to traditional financial products, signaling lower default risk within digital assets credit evaluation models.

Blockchain verification capabilities also reduce fraud risks associated with credit applications. Income claims can be validated through transaction histories, asset ownership is instantly verifiable, and spending behavior cannot be artificially inflated—making digital assets credit evaluation far more resistant to manipulation than legacy systems.

Privacy remains a critical consideration as digital assets credit evaluation evolves. Zero-knowledge proofs and selective disclosure technologies allow borrowers to prove financial capability without exposing full transaction histories, enabling lenders to assess risk accurately while preserving user privacy.

Gaming Economies as Financial Responsibility Indicators

Virtual gaming economies operate as sophisticated financial ecosystems that mirror real-world economic principles while generating rich data for digital assets credit evaluation. Players who achieve sustained success in these environments demonstrate financial judgment, discipline, and adaptability—skills that translate directly to real-world creditworthiness but remain invisible to traditional credit scoring systems without digital assets credit evaluation frameworks.

Play-to-earn gaming models create verifiable income streams that strengthen digital assets credit evaluation by documenting consistent effort, skill-based earnings, and financial capability. Players who reliably generate gaming tokens, complete high-difficulty objectives, or manage valuable virtual assets show persistence and planning qualities strongly correlated with positive loan performance.

Guild participation within gaming communities adds a social dimension to digital assets credit evaluation. Players who contribute to shared treasuries, coordinate group financial strategies, or hold leadership roles demonstrate trustworthiness, accountability, and cooperative financial behavior—signals that traditional credit metrics cannot capture.

The complexity of modern gaming economies further reinforces the value of digital assets credit evaluation. Successful players must manage supply and demand, navigate virtual inflation, time asset trades, and balance short-term spending against long-term accumulation. These behaviors closely parallel the financial literacy and decision-making required for responsible borrowing and debt management in the real world.

Cross-game asset transfers and portfolio management reveal strategic financial thinking that extends beyond individual gaming platforms. Players who successfully move assets between different gaming ecosystems, arbitrage price differences across platforms, or maintain diversified virtual portfolios demonstrate financial sophistication that suggests strong credit risk management capabilities.

Virtual asset portfolio maintenance over extended periods indicates financial discipline and long-term thinking that traditional credit metrics often miss. Players who resist the temptation to liquidate valuable virtual assets during market downturns, maintain consistent investment strategies across multiple gaming seasons, or successfully navigate economic changes within game environments show the same patience and strategic thinking that characterizes responsible borrowers.

Key indicators of financial responsibility in gaming economies include:

- Consistent earning patterns across multiple gaming sessions and time periods

- Strategic resource allocation between immediate needs and long-term investments

- Successful navigation of virtual market volatility without panic selling

- Collaborative financial activities that demonstrate trustworthiness

- Maintenance of valuable assets through various game economic cycles

- Evidence of financial planning through pre-positioning for game updates or events

Regulatory Evolution and Implementation Challenges

The integration of digital assets into credit evaluation systems faces complex regulatory challenges that span financial privacy, consumer protection, and technological standardization. Current regulatory frameworks were designed for traditional financial data and struggle to accommodate the unique characteristics of blockchain-based financial information.

Financial privacy regulations must evolve to address the transparent nature of blockchain technology while protecting consumer rights. The permanent and public nature of blockchain transactions creates unprecedented challenges for privacy protection, requiring new regulatory approaches that balance transparency benefits with privacy concerns. Regulators must develop frameworks that enable credit-relevant data extraction while preventing unauthorized financial surveillance.

The development of standardized methodologies for evaluating digital asset data remains in early stages. Unlike traditional credit data with established scoring models and risk correlations, digital asset information requires new analytical frameworks to translate blockchain activity into credit-relevant insights. This standardization process must account for the volatility of digital asset values, the diversity of blockchain platforms, and the rapid evolution of digital financial products.

Cross-border regulatory coordination presents additional complexity as digital assets operate globally while credit evaluation remains largely jurisdiction-specific. A borrower’s digital asset portfolio may span multiple blockchain networks, international gaming platforms, and various regulatory environments, requiring coordinated approaches to data evaluation and privacy protection across different legal frameworks.

Consumer protection mechanisms must address the unique risks of digital asset-based credit evaluation. Borrowers need protection against discrimination based on their choice of digital platforms, gaming preferences, or blockchain network usage. Regulatory frameworks must ensure that digital asset evaluation enhances rather than restricts access to credit, particularly for underserved populations who may benefit most from alternative credit assessment methods.

The technical integration challenges between traditional credit bureaus and blockchain technology require significant infrastructure development. Existing credit reporting systems must be enhanced to process real-time blockchain data, validate digital asset ownership, and translate complex transaction patterns into standardized credit metrics. This technological evolution demands substantial investment and coordination across the financial services industry.

Strategic Digital Asset Management for Credit Building

Strategic digital asset management requires understanding how current blockchain activities may influence future credit assessments. Building credit with NFTs and gaming tokens demands intentional approaches that demonstrate financial responsibility while maintaining privacy and flexibility in digital asset choices.

Creating verifiable patterns of responsible digital asset management begins with consistent transaction practices across multiple platforms. Regular, strategic purchases that demonstrate research and planning create positive financial behavior patterns. Avoiding impulsive trading, maintaining diversified digital portfolios, and showing patience through market cycles all contribute to profiles that suggest creditworthy behavior.

Documentation and organization of digital financial activities become crucial as credit evaluation systems evolve to incorporate blockchain data. Maintaining detailed records of purchase rationales, tracking portfolio performance metrics, and organizing transaction histories across multiple wallets and platforms creates comprehensive financial profiles that lenders can evaluate effectively.

The timing and execution of digital asset transactions carry long-term credit implications that many users do not consider. Large, unexplained purchases followed by immediate sales may suggest financial instability or speculative behavior that could negatively impact credit assessments. Conversely, steady accumulation patterns, strategic market timing, and evidence of research-based decision-making create positive impressions of financial capability.

Privacy management becomes increasingly important as digital financial data gains relevance in credit evaluation. Users must balance the benefits of transparent financial behavior with the need to protect sensitive information. Understanding which blockchain activities to keep public and which to protect through privacy protocols enables strategic credit profile development without sacrificing personal financial security.

Building a diversified digital portfolio that showcases financial acumen requires understanding how different types of digital assets may be perceived by future credit evaluation systems. Balancing speculative investments with stable digital assets, demonstrating cross-platform financial management skills, and maintaining consistent activity levels across various digital financial products creates comprehensive profiles that suggest financial sophistication and responsibility.

Conclusion: The Future of Credit Assessment Is Already Being Written

The convergence of blockchain technology and credit evaluation represents more than just an incremental improvement to existing systems—it’s a fundamental reimagining of how financial responsibility should be measured. While traditional credit bureaus continue to rely on narrow payment histories that exclude millions of Americans, digital asset behaviors are already creating comprehensive portraits of financial sophistication, strategic thinking, and risk management skills. Your NFT collection and gaming token transactions aren’t just entertainment expenses; they’re building an immutable record of financial decision-making that demonstrates creditworthiness in ways that FICO scores simply can’t capture.

The regulatory frameworks and technical infrastructure needed to fully integrate digital assets into credit evaluation are rapidly developing, but the behavioral patterns that will define tomorrow’s credit assessments are being established today. As lenders recognize the predictive power of blockchain-based financial data, the question isn’t whether this transformation will happen, but whether you’ll be positioned to benefit from it. Every strategic digital asset purchase, every calculated gaming token investment, and every thoughtful blockchain interaction is quietly building your financial reputation for a credit system that doesn’t yet officially exist—but soon will.