Managing debt effectively is one of the most crucial financial skills you can develop. With the average American household carrying over $6,000 in credit card debt and total consumer debt reaching record highs, choosing the right debt repayment strategy can save thousands of dollars and years of payments. Two methods have emerged as the most popular and effective approaches: the debt snowball and debt avalanche methods.

Both strategies have passionate advocates, and each offers distinct advantages depending on your financial situation and psychological makeup. Understanding the nuances of each approach will help you make an informed decision that aligns with your goals and increases your chances of becoming debt-free.

Understanding Your Debt Landscape

Before exploring specific strategies, it’s essential to understand the current debt landscape. Consumer debt has reached unprecedented levels, with credit card interest rates averaging over 20% and personal loan rates ranging from 6% to 36%. The typical American household manages multiple debt sources, including credit cards, auto loans, student loans, and mortgages.

The psychological burden of debt extends beyond financial costs. Studies show that debt stress contributes to anxiety, depression, and relationship problems. This psychological component is crucial when selecting a repayment strategy, as the most mathematically optimal approach isn’t always the most sustainable for individual circumstances.

The Debt Snowball Method: Psychology Over Mathematics

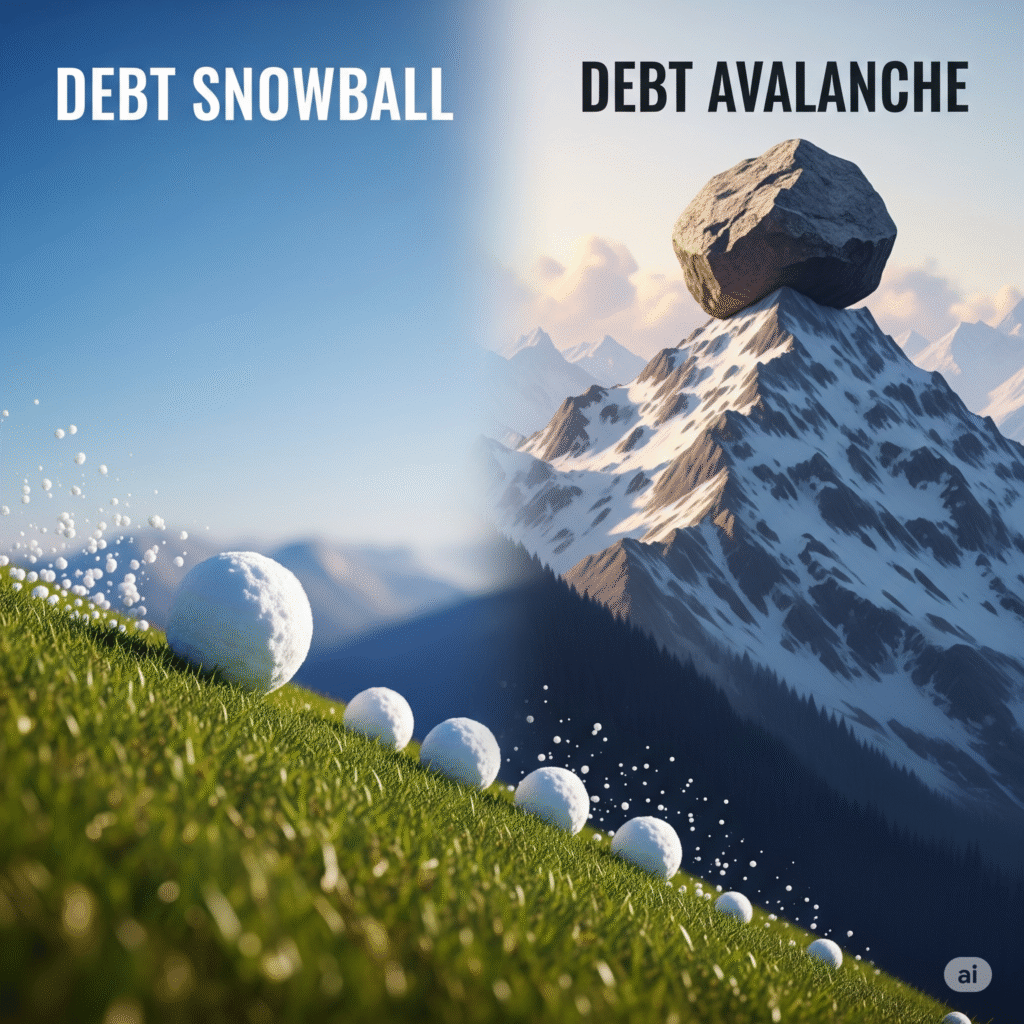

The debt snowball method, popularized by financial expert Dave Ramsey, focuses on psychological momentum rather than mathematical optimization. This approach involves paying minimum amounts on all debts while directing extra payments toward the smallest balance, regardless of interest rate.

How the Debt Snowball Works

Step one involves listing all debts from smallest to largest balance. Make minimum payments on all debts except the smallest, which receives every extra dollar available. Once the smallest debt is eliminated, take the total amount you were paying on that debt and apply it to the next smallest balance. This creates a “snowball effect” where payment amounts grow larger as debts are eliminated.

For example, if you have a $500 credit card, $2,000 personal loan, and $8,000 auto loan, you’d focus on eliminating the $500 credit card first, regardless of interest rates. The psychological victory of eliminating an entire debt quickly provides motivation to continue the process.

Advantages of the Debt Snowball

The primary advantage of the debt snowball method is psychological momentum. Each eliminated debt provides a sense of accomplishment and progress, which is crucial for maintaining long-term motivation. Research in behavioral psychology shows that early wins create positive reinforcement loops that make it easier to stick with difficult long-term goals.

The debt snowball also simplifies your financial life more quickly. Reducing the number of monthly payments and accounts to manage decreases complexity and reduces the chances of missed payments. This simplification can be particularly valuable for people who feel overwhelmed by multiple debt obligations.

Additionally, the debt snowball method works well for people who need external validation of progress. Seeing accounts closed and balances reach zero provides tangible evidence of success that can sustain motivation during challenging periods.

Disadvantages of the Debt Snowball

The most significant disadvantage of the debt snowball method is higher total interest costs. By focusing on balances rather than interest rates, you may end up paying more in total interest charges compared to the debt avalanche method. This difference can be substantial when high-interest debts have large balances.

The debt snowball may also take longer to eliminate all debts, particularly if your smallest debts have low interest rates while larger debts carry high rates. This extended timeline means more months of debt payments and potentially higher stress levels for some individuals.

The Debt Avalanche Method: Mathematical Optimization

The debt avalanche method prioritizes mathematical efficiency by focusing on interest rates rather than balances. This approach involves paying minimum amounts on all debts while directing extra payments toward the highest-interest debt first.

How the Debt Avalanche Works

List all debts from highest to lowest interest rate. Make minimum payments on all debts except the one with the highest interest rate, which receives all extra payments. Once the highest-interest debt is eliminated, redirect those payments to the debt with the next highest interest rate.

Using the previous example, if the $500 credit card has a 22% interest rate, the $2,000 personal loan has a 12% rate, and the $8,000 auto loan has a 6% rate, you’d focus on the credit card first, then the personal loan, and finally the auto loan.

Advantages of the Debt Avalanche

The debt avalanche method minimizes total interest paid over the life of your debts. This mathematical optimization can save hundreds or thousands of dollars compared to other approaches, particularly when high-interest debts have large balances. The savings increase dramatically as the difference between interest rates grows.

This method also typically results in faster debt elimination when measured by total time to become debt-free. By tackling the most expensive debt first, you reduce the overall cost burden more quickly, allowing you to allocate more money toward remaining debts.

The debt avalanche appeals to analytically-minded individuals who prefer logical, systematic approaches to financial problems. If you’re motivated by knowing you’re making the most mathematically sound choice, this method provides that satisfaction.

Disadvantages of the Debt Avalanche

The primary disadvantage of the debt avalanche method is potential psychological challenges. If your highest-interest debt has a large balance, it may take many months to see the first debt eliminated. This extended timeline can be discouraging and may lead to abandoning the debt repayment plan entirely.

The debt avalanche also doesn’t simplify your financial life as quickly as the snowball method. You’ll continue managing multiple payments and accounts for longer periods, which can feel overwhelming for some people.

Real-World Comparison: Running the Numbers

To illustrate the practical differences between these methods, let’s examine a realistic scenario. Assume you have $1,000 monthly for debt payments and the following debts:

- Credit Card A: $3,000 balance, 18% interest rate, $60 minimum payment

- Credit Card B: $8,000 balance, 22% interest rate, $160 minimum payment

- Personal Loan: $12,000 balance, 8% interest rate, $200 minimum payment

- Auto Loan: $15,000 balance, 5% interest rate, $300 minimum payment

Debt Snowball Results: Following the snowball method, you’d pay off Credit Card A first (smallest balance), then Credit Card B, then the personal loan, and finally the auto loan. This approach would result in approximately $8,200 in total interest paid over 28 months.

Debt Avalanche Results: Using the avalanche method, you’d tackle Credit Card B first (highest interest rate), then Credit Card A, then the personal loan, and finally the auto loan. This approach would result in approximately $6,800 in total interest paid over 26 months.

In this scenario, the debt avalanche saves about $1,400 in interest and eliminates all debt two months sooner. However, the first debt wouldn’t be eliminated until month 8, compared to month 4 with the snowball method.

Psychological Factors: The Hidden Variable

While mathematical calculations provide clear comparisons, psychological factors often determine real-world success. Behavioral economics research reveals that people frequently make decisions based on emotions rather than pure logic, especially regarding money.

The debt snowball method aligns with psychological principles of goal setting and achievement. Breaking large, overwhelming goals into smaller, manageable milestones increases the likelihood of success. The regular positive reinforcement from eliminating debts helps maintain motivation during difficult periods.

However, some individuals find motivation in maximizing efficiency. If you’re naturally analytical and derive satisfaction from optimizing systems, the debt avalanche method may provide sufficient psychological reward through its mathematical superiority.

Hybrid Approaches: Finding Middle Ground

Some financial advisors recommend hybrid approaches that combine elements of both methods. One popular variation involves using the debt snowball method for smaller debts (typically under $1,000) to build momentum, then switching to the debt avalanche method for larger balances.

Another hybrid approach involves targeting the highest-interest debt among your smallest balances. This method provides some psychological benefit while maintaining mathematical optimization among similarly-sized debts.

Which Method is Right for You?

Choosing between the debt snowball and debt avalanche methods depends on several personal factors:

Choose the Debt Snowball if:

- You need psychological motivation and frequent victories

- You feel overwhelmed by multiple debt payments

- You’ve previously failed to stick with debt repayment plans

- The interest rate differences between your debts are relatively small

- You prefer simplicity over optimization

Choose the Debt Avalanche if:

- You’re motivated by mathematical optimization

- You have strong self-discipline and don’t need frequent victories

- You have significant high-interest debt balances

- The interest rate differences between your debts are substantial

- You’re comfortable with delayed gratification

Implementation Strategies for Success

Regardless of which method you choose, several strategies can improve your chances of success:

Create a Detailed Budget: Understanding your income and expenses ensures you can maintain consistent extra payments toward debt elimination. Track every dollar to identify opportunities for increased debt payments.

Automate Payments: Set up automatic payments to ensure minimum payments are never missed. Consider automating extra payments to remove the temptation to spend that money elsewhere.

Build a Small Emergency Fund: Having $1,000 in emergency savings prevents new debt accumulation when unexpected expenses arise. This buffer is crucial for maintaining progress toward debt elimination.

Track Progress Visually: Create charts or use apps to visualize your debt reduction progress. Seeing balances decrease or accounts eliminated provides motivation to continue.

Celebrate Milestones: Acknowledge progress with modest celebrations that don’t derail your financial goals. These positive reinforcements help maintain long-term motivation.

Common Mistakes to Avoid

Both methods can fail if common mistakes derail your progress:

Continuing to Accumulate Debt: The most critical factor for success is stopping new debt accumulation. Cut up credit cards if necessary, and avoid taking on new loans during your debt elimination period.

Inconsistent Extra Payments: Sporadic additional payments reduce the effectiveness of both methods. Consistency is more important than the amount of extra payment.

Ignoring Minimum Payments: Never skip minimum payments on any debt to make larger payments on your target debt. This practice results in late fees and credit score damage.

Unrealistic Timelines: Both methods require sustained effort over months or years. Setting unrealistic expectations leads to discouragement and abandonment of the plan.

Advanced Considerations

Several advanced factors may influence your method choice:

Tax Implications: Some debt interest is tax-deductible, effectively reducing the real interest rate. Student loan interest and mortgage interest may qualify for deductions, potentially changing the mathematical optimization of the debt avalanche.

Credit Score Impact: Both methods can improve your credit score, but the timing differs. The debt snowball may improve your score faster by reducing the number of accounts with balances, while the debt avalanche may provide greater long-term benefits through lower overall utilization.

Variable Interest Rates: If your debts have variable interest rates, the debt avalanche method becomes more complex as you may need to reorder your focus as rates change.

Opportunity Cost: Consider whether extra debt payments provide better returns than investing. If you have access to employer 401(k) matching, that guaranteed return typically exceeds debt interest rates.

The Role of Technology

Modern financial apps and tools can enhance both debt elimination methods. Debt tracking apps provide visual progress indicators and automatic calculations. Some apps even simulate both methods to show projected timelines and total interest costs.

Budgeting apps help identify funds for extra debt payments by tracking expenses and suggesting areas for spending reduction. Automatic payment systems reduce the administrative burden of managing multiple debts.

Long-Term Financial Health

Both the debt snowball and debt avalanche methods are means to an end: achieving financial freedom. Once you eliminate consumer debt, the discipline and budgeting skills developed during debt elimination become valuable tools for building wealth.

The psychological benefits of debt elimination extend beyond the financial realm. Reduced stress, improved relationships, and increased confidence are common outcomes regardless of which method you choose.

Making Your Decision

The “better” method is the one you’ll actually complete. While the debt avalanche method offers mathematical advantages, the debt snowball method provides psychological benefits that may be more valuable for your specific situation.

Consider your personality, past experiences with financial goals, and current stress levels when making this decision. The most sophisticated strategy is worthless if you abandon it halfway through.

Conclusion: Your Path to Financial Freedom

Both the debt snowball and debt avalanche methods are proven strategies for debt elimination. The debt avalanche method optimizes for mathematical efficiency, potentially saving money and time. The debt snowball method optimizes for psychological success, providing regular victories that maintain motivation.

The key to success with either method is consistency, discipline, and a clear understanding of your financial situation. Whichever approach you choose, commit fully to the process and resist the temptation to switch methods mid-stream.

Remember that becoming debt-free is a significant achievement that requires sustained effort over time. The method that keeps you motivated and on track is the right choice for you. Whether you save money through mathematical optimization or achieve success through psychological momentum, the end result is the same: financial freedom and the peace of mind that comes with being debt-free.

Start today by listing your debts, choosing your method, and taking the first step toward a debt-free future. Your future self will thank you for making this important decision and following through with consistent action.