Your virtual reality headset tracks more than just your gaming sessions. Every purchase you make for digital assets, every virtual property investment, and even the way you move through digital spaces is creating a data trail that could shape your VR metaverse financial reputation. What happens when your avatar’s spending habits start influencing your real-world credit score?

The lines between virtual and physical financial identities are blurring faster than most people realize. Credit reporting systems weren’t designed to manage multiple digital personas, virtual currency transactions, or the behavioral data VR platforms collect. This creates new opportunities for errors, misreporting, and algorithmic bias that may affect your VR metaverse financial reputation in unexpected ways—impacting loans, mortgages, and credit cards in the real world.

The Anatomy of Virtual Identity Cross-Contamination

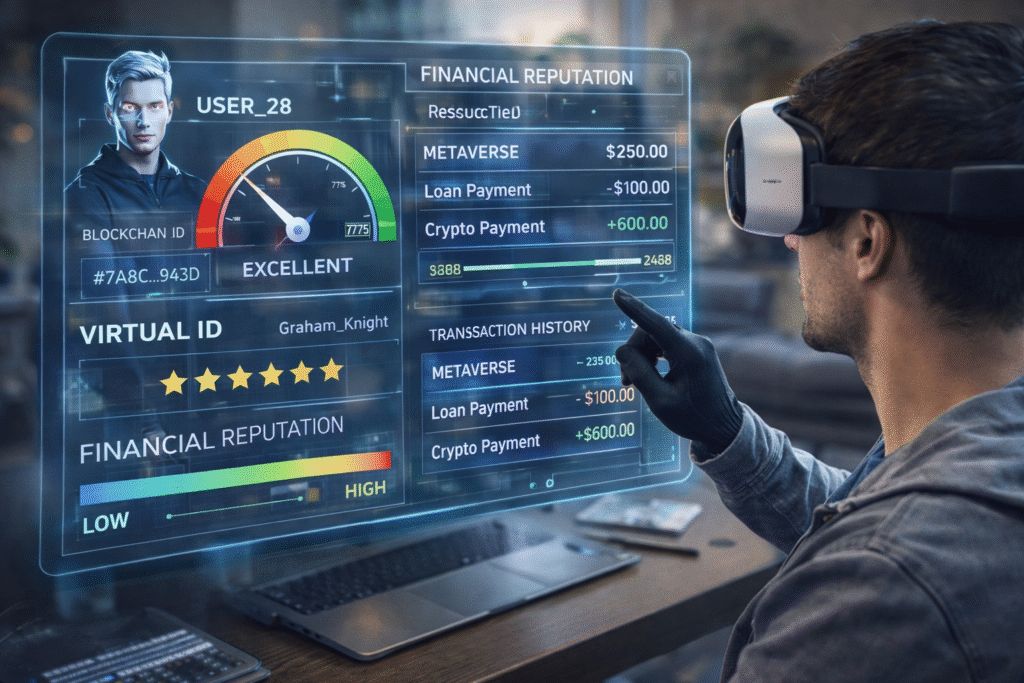

Virtual reality platforms create unprecedented pathways between your digital personas and real-world financial identity, directly shaping your VR metaverse financial reputation through advanced data collection systems that go far beyond traditional transaction monitoring. VR headsets capture biometric data such as eye movement, hand gestures, and even cardiovascular responses during immersive experiences, forming unique biological identifiers that financial institutions increasingly view as reliable signals. This biometric leakage forges a direct link between avatar activity and physical identity, making VR metaverse financial reputation difficult to separate from real-world credit profiles.

The mechanics of data aggregation across virtual and physical touchpoints rely on complex algorithms that correlate seemingly unrelated information streams. When you purchase virtual real estate using cryptocurrency, that activity generates multiple signals—from payment methods tied to bank accounts to behavioral timing patterns—that feed into systems shaping your VR metaverse financial reputation. Credit agencies increasingly access aggregated data spanning social platforms, gaming environments, metaverse activity, and traditional financial accounts.

Behavioral pattern mapping represents the most advanced form of virtual identity crossover, where AI systems analyze movements, interactions, and decision-making inside virtual environments to infer real-world financial behavior. An avatar’s impulsive spending, risk-taking in virtual investments, or consistent asset management can all influence VR metaverse financial reputation assessments. Multiple avatars tied to a single individual further complicate these models, especially when conflicting behaviors confuse credit algorithms.

Credit Report Contamination From Virtual World Activities

Credit report errors tied to virtual world activity create new forms of financial harm that traditional dispute systems struggle to resolve, directly threatening your VR metaverse financial reputation. Phantom debt attribution occurs when virtual subscriptions, in-game purchases, or metaverse property investments appear as unexplained debts on credit reports. These errors often stem from automated systems misclassifying virtual transactions under traditional merchant codes, causing activity meant for digital environments to spill into real-world credit reporting and damage VR metaverse financial reputation.

Avatar-to-person misalignment introduces another layer of risk to VR metaverse financial reputation, especially when multiple users share VR devices or payment methods. Credit reporting systems built for single account holders cannot accurately separate financial behavior across multiple avatars, leading to merged profiles that reflect combined spending patterns. This becomes particularly harmful when one user’s risky virtual spending negatively affects the credit standing of others connected to the same financial accounts.

Virtual currency conversion errors are an expanding source of contamination for VR metaverse financial reputation as algorithms attempt to translate crypto-based metaverse transactions into traditional credit metrics without understanding virtual economic context. Converting real currency into virtual tokens may be misinterpreted as cash advances, speculative investments, or elevated risk behavior. Combined with digital asset volatility, these misclassifications can distort credit assessments in ways disconnected from actual financial responsibility.

Identity Verification Challenges in Digital Spaces

Traditional identity verification methods fail catastrophically in virtual environments where the one-person-one-identity assumption breaks down, creating gaps that directly threaten VR metaverse financial reputation. The tension between metaverse anonymity and financial transparency forces users into impossible trade-offs, as maintaining separate virtual identities can trigger fraud systems that interpret multiple personas as identity theft. As institutions demand real-world verification for virtual activity, protecting VR metaverse financial reputation often comes at the cost of privacy.

Pseudonymous financial footprints introduce additional risk to VR metaverse financial reputation when users rely on anonymous payment methods, cryptocurrency transactions, or prepaid accounts. While intended to preserve privacy, these behaviors frequently activate credit monitoring systems built to flag suspicious activity, leading to fraud alerts, account freezes, and negative credit notations. Delays between virtual activity and credit system updates widen verification gaps, compounding identity confusion across platforms.

The multi-avatar single-person dilemma presents unprecedented challenges for credit assessment and long-term VR metaverse financial reputation management. Credit algorithms designed around single-identity models struggle to evaluate individuals operating multiple avatars with contrasting spending behaviors. This forces lenders to either reject metaverse-related activity outright or apply overly broad risk assumptions that fail to recognize legitimate separation between virtual identities.

Algorithmic Bias in Virtual Behavior Assessment

Artificial intelligence systems interpreting virtual world behavior as creditworthiness indicators introduce systemic bias that can quietly undermine VR metaverse financial reputation. These biases often reflect unconscious assumptions embedded in training data and development teams, creating discriminatory credit assessments that operate below traditional regulatory scrutiny. Avatar appearance bias emerges when credit models analyze virtual representations, potentially disadvantaging users whose avatars reflect racial, cultural, or socioeconomic traits historically associated with credit discrimination—without understanding the personal or creative intent behind those choices.

Virtual social credit mechanisms further complicate VR metaverse financial reputation by analyzing metaverse interactions, group affiliations, and community standing as indicators of financial risk. Participation in certain virtual communities, alternative lifestyles, or subcultures may negatively influence credit evaluations through algorithmic association rather than actual financial behavior. Gamified environments add another layer of risk, as virtual achievements and reward systems can be misinterpreted as real-world financial responsibility or recklessness.

The growing sophistication of behavioral profiling systems introduces subtle yet powerful discrimination vectors affecting VR metaverse financial reputation. AI models assess movement patterns, reaction timing, and decision-making behavior within virtual spaces to build psychological risk profiles. These systems may inadvertently disadvantage users with disabilities, neurodivergent traits, or culturally influenced interaction styles, extending credit evaluation into deeply personal behavioral territory that was never meant to inform financial trustworthiness.

Proactive Virtual Identity Protection Strategies

Digital identity compartmentalization requires sophisticated technical strategies that go beyond simple account separation to create genuine isolation between virtual personas and credit profiles through advanced privacy-preserving technologies and careful financial architecture design. Effective compartmentalization involves establishing separate payment systems for virtual world activities using prepaid cards, cryptocurrency wallets, or digital payment platforms that cannot be easily correlated with primary financial accounts. This separation must extend to device usage patterns, internet connections, and even biometric data isolation through the use of shared or public VR systems when engaging in activities that might negatively impact credit assessments.

Preemptive credit monitoring for virtual-world-related anomalies requires specialized approaches that monitor for specific types of errors and misclassifications unique to metaverse activities rather than relying on traditional credit monitoring services designed for conventional financial transactions. These monitoring strategies must include:

- Regular review of credit reports for unexplained virtual currency transactions or gaming-related charges

- Monitoring for phantom debt attribution from virtual world subscriptions or in-game purchases

- Tracking cross-platform identity synthesis issues that might merge multiple virtual personas

- Surveillance of behavioral profiling impacts through sudden changes in credit score algorithms

- Documentation of legitimate virtual world investments to prevent fraud misclassification

Virtual asset documentation creates essential paper trails for legitimate virtual world investments and purchases to prevent misclassification as fraudulent activity while establishing clear legal ownership of digital properties that may appreciate in value. This documentation process requires maintaining detailed records of virtual world transactions, including screenshots of purchase confirmations, blockchain transaction records for cryptocurrency payments, and correspondence with virtual world platforms regarding asset ownership transfers. The documentation must also include clear explanations of the legitimate business or investment purposes behind virtual world activities to help financial institutions understand the context when these transactions appear in credit assessments.

Advanced protection strategies must account for the evolving nature of virtual identity risks by establishing regular review processes for privacy settings across all metaverse platforms and maintaining awareness of new data sharing agreements that might expose virtual activities to credit reporting systems. Users must actively manage their digital footprints across virtual platforms while building positive credit history through transparent, well-documented virtual world financial activities that demonstrate responsible digital asset management and investment behavior.

Conclusion: Protecting Your Financial Future in Virtual Worlds

The convergence of virtual reality and credit reporting systems represents a fundamental shift in how financial reputation is assessed and maintained. Your avatar’s spending habits, social interactions, and behavioral patterns are already influencing credit algorithms in ways that traditional dispute processes can’t adequately address. The biometric data collection, cross-platform identity synthesis, and algorithmic bias embedded in these systems create unprecedented risks to your financial standing that extend far beyond your virtual world activities.

As virtual economies continue to integrate with traditional financial systems, the distinction between your digital persona and real-world credit profile will only blur further. The sophisticated behavioral profiling and identity verification challenges we’re seeing today are just the beginning of a larger transformation in financial assessment. Understanding these risks and implementing proactive protection strategies isn’t just about preserving your virtual assets—it’s about ensuring that your journey through digital worlds doesn’t derail your real-world financial opportunities. The question isn’t whether virtual identity will impact your credit score, but whether you’ll be prepared when it does.