The private market wave is growing, and it appears workplace plan sponsors are increasingly eager to test the waters.

Processing Content

According to a

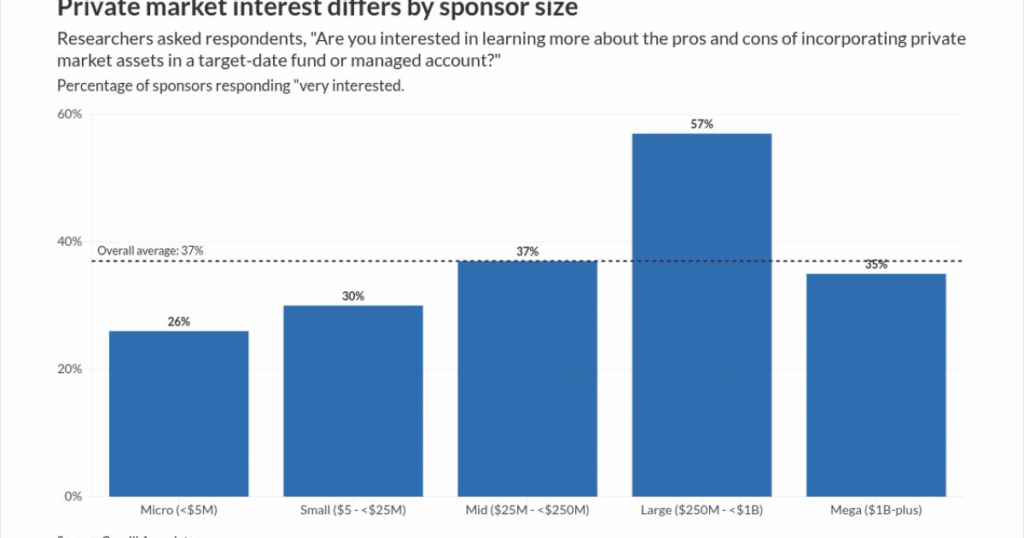

Researchers suggested that larger plans may be first to adopt these investment options, given their greater sophistication and, in some cases, prior experience with private market assets.

On the other end of the spectrum, “micro” plans with less than $5 million in assets showed the least enthusiasm, with just 26% expressing strong interest in learning more about such investments.

Despite the general interest, the report notes that curiosity alone will not lead to an immediate wave of implementation.

“Interest does not equal immediate adoption,” Chris Bailey, director of Cerulli’s retirement practice, said in a statement. “Sponsors tell Cerulli they are concerned about fees and the

The adoption gap in retirement plans

Despite the buzz, actual usage is expected to grow slowly. Asset managers and defined contribution (DC) consultants predict that in five years, only about 7% of plan sponsors will have adopted a target-date or managed account containing private market assets. By 2035, that figure is estimated to rise to between 15% and 20%.

A few core hurdles are preventing sponsors from moving forward, according to Cerulli research. Sponsors told Cerulli that litigation risks and the higher costs associated with private market investments weigh heavily on their lineup decisions.

Simple inertia could also be a roadblock to adoption. Sponsors are generally reluctant to change target-date managers, with fewer than 5% of plans making a switch in the past year, according to DC consultants in Cerulli’s study.

Advisors are ahead of the curve

While many sponsors hesitate, a majority of financial advisors appear ready to recommend these strategies. A Financial Planning survey of more than 200 advisors found that 51% of advisors believe private markets will become “somewhat more” or “much more” popular in 2026.

This tracks with data from market research firm Escalent, which found that roughly

“We know from previous research that interest in alternative investments has been rising on the retail side,” Linda York, a senior vice president in Escalent’s Cogent Syndicated division, said in a statement. “These findings show that the same enthusiasm is starting to take hold within the DC plan space. Advisors have traditionally turned to alternatives as a diversification lever for high net worth and institutional clients. Now, these options are becoming more relevant for employees across all income levels.”

Target-date funds lead the private market adoption

Industry experts note that private markets will likely enter 401(k) plans through professionally managed solutions rather than as standalone investment options. In the report, Cerulli researchers predicted that

Using a target-date fund structure solves several operational problems. It allows asset managers to handle the liquidity and valuation complexities inherent in private assets, rather than passing those risks to the participant.

Hal Ratner, head of research for investment management at Morningstar, has shared a similar view, although his research has highlighted that the integration of private markets into target-date funds may have a

Ratner’s research found that while semi-liquid private market allocations can improve retirement outcomes, the boost to overall returns is “modest.”

“The main benefit of these vehicles may likely be a diversification benefit, which is important, as opposed to astronomical returns,” Ratner told Financial Planning. “And that should be factored into the equation.”

Work remains for plan sponsor PE adoption

For now, the story of private markets in 401(k) plans remains one of strong interest but limited action. Cerulli says asset managers can help narrow that gap by focusing on plan sponsor education and shifting investment discussions away from lowest-cost options and toward participant outcomes. Still, significant hurdles remain.

President Donald Trump’s

Until the government spells out rules around liquidity, disclosures and ERISA standards, litigation concerns flagged by Cerulli are likely to keep many plan sponsors in a wait-and-see posture.