In today’s fast-paced world, financial freedom isn’t just a dream — it’s a goal within reach for anyone willing to make smart decisions. But here’s the truth: working harder isn’t the only way to grow your wealth. The real secret lies in making your money work for you, and that’s where passive income investments come into play.

Imagine waking up each morning knowing your investments are generating income — even while you sleep. Whether you’re saving for early retirement, building generational wealth, or simply looking for financial security, passive income is the foundation of lasting prosperity.

This article will explore the best passive income investments for long-term financial freedom, breaking down each opportunity, the risks involved, and practical ways to get started — all in plain, beginner-friendly language.

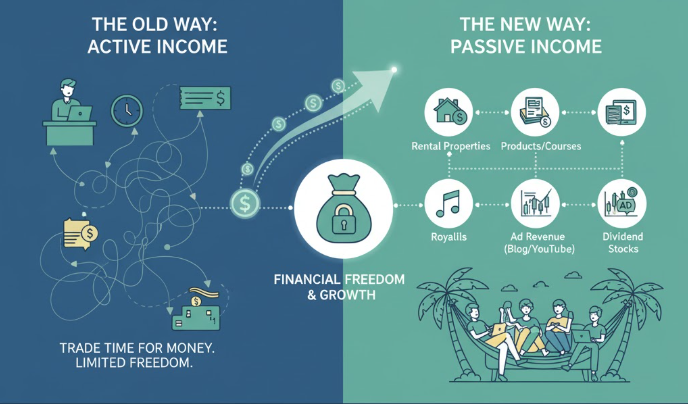

What Is Passive Income?

Passive income is money you earn with little to no active involvement after the initial setup. Unlike a 9-to-5 job where you exchange time for money, passive income keeps flowing even when you’re not working.

Simple Examples of Passive Income:

-

Earning dividends from stocks

-

Rental income from property

-

Royalties from digital products or books

-

Interest from bonds or savings accounts

-

Revenue from a blog, YouTube channel, or affiliate marketing

The key advantage of passive income is freedom — time freedom, financial freedom, and mental peace. You gain the ability to focus on what truly matters in life while your assets quietly generate income in the background.

Why You Should Invest in Passive Income Streams

Let’s be clear — the goal isn’t just to get rich; it’s to become financially independent. Here are a few powerful reasons to build multiple streams of passive income:

-

✅ Financial Stability: You’re not fully dependent on one job or business.

-

🕒 Time Freedom: More time for family, hobbies, or travel.

-

💰 Wealth Growth: Compounding income accelerates your net worth over time.

-

📈 Inflation Protection: Investments like real estate and dividend stocks keep up with rising prices.

-

🌍 Retirement Readiness: You build a consistent flow of income even after you stop working.

Top Passive Income Investments for Long-Term Financial Freedom

Below are the most reliable, profitable, and sustainable passive income ideas that can help you create lasting wealth. Each one suits different risk levels, budgets, and time commitments — so choose wisely.

🏦 1. Dividend-Paying Stocks

Dividend stocks are shares of companies that pay you a portion of their profits regularly (usually quarterly). You earn money in two ways:

-

Dividend payouts — cash distributed to shareholders.

-

Capital appreciation — when the stock price increases.

Why It’s a Great Investment

-

Consistent cash flow

-

Long-term capital growth potential

-

Passive after initial setup

Best Dividend Sectors

| Sector | Example Companies | Average Dividend Yield |

|---|---|---|

| Consumer Goods | Procter & Gamble, Coca-Cola | 2–3% |

| Energy | ExxonMobil, Chevron | 3–5% |

| Utilities | Duke Energy, NextEra | 3–4% |

| REITs | Realty Income, Digital Realty | 4–6% |

Tips for Beginners

-

Reinvest dividends using a DRIP (Dividend Reinvestment Plan)

-

Choose blue-chip companies with a history of steady payouts

-

Use platforms like M1 Finance, Robinhood, or Charles Schwab to start small

💡 Pro Tip: Focus on companies with Dividend Aristocrat status — firms that have raised dividends for 25+ consecutive years.

🏠 2. Real Estate Investments

Real estate has created more millionaires than any other asset class — and it’s not hard to see why. You can earn from rental income, property appreciation, or both.

Passive Real Estate Options

-

Rental Properties: Buy a home or apartment and rent it out.

-

Real Estate Investment Trusts (REITs): Invest in a pool of income-generating properties — no landlord duties needed.

-

Crowdfunded Real Estate: Platforms like Fundrise or Roofstock let you invest with as little as $100.

Pros

-

Tangible asset with long-term appreciation

-

Steady monthly cash flow

-

Tax advantages (mortgage interest and depreciation deductions)

Cons

-

Requires significant upfront investment

-

Maintenance and tenant issues for direct ownership

| Investment Type | Effort Level | Average Returns | Starting Cost |

|---|---|---|---|

| Direct Rental | High | 8–12% annually | $20,000+ |

| REITs | Low | 6–10% annually | $100+ |

| Crowdfunded | Low | 5–9% annually | $100–$500 |

💡 Pro Tip: Start with REITs or real estate ETFs if you don’t want the hassle of property management.

💳 3. Peer-to-Peer (P2P) Lending

In P2P lending, you lend money to individuals or small businesses through online platforms and earn interest in return — similar to being your own mini-bank.

How It Works

-

You sign up on platforms like LendingClub, Prosper, or Mintos.

-

You choose borrowers and loan amounts.

-

Borrowers pay you back with interest.

Potential Returns

-

Average: 5–12% annually

-

Risk Level: Moderate to high (depends on borrower creditworthiness)

Advantages

-

Predictable monthly income

-

Diversification beyond stocks and real estate

-

Start with as little as $25

💡 Pro Tip: Spread your money across multiple loans to reduce risk.

💵 4. Bonds and Treasury Securities

Bonds are one of the safest forms of passive income, especially for long-term stability. When you buy a bond, you’re essentially lending money to a company or government in exchange for regular interest payments.

Types of Bonds

-

Government Bonds (Treasuries) – Very low risk, 3–5% returns

-

Corporate Bonds – Higher risk, 5–8% returns

-

Municipal Bonds – Tax-free income for U.S. investors

| Bond Type | Risk Level | Return Range | Ideal For |

|---|---|---|---|

| Treasury | Very Low | 3–5% | Conservative investors |

| Corporate | Medium | 5–8% | Moderate risk takers |

| Municipal | Low | 4–6% | Tax-conscious investors |

💡 Pro Tip: Consider bond ETFs for diversified exposure without buying individual bonds.

🌐 5. Index Funds and ETFs

If you want to invest passively without constantly monitoring the stock market, index funds and ETFs (Exchange-Traded Funds) are perfect.

These funds track a market index (like the S&P 500) and give you exposure to hundreds of companies at once.

Why They’re Ideal for Passive Investors

-

Minimal management required

-

Lower fees compared to mutual funds

-

Proven long-term returns (7–10% average annually)

Best Long-Term ETFs

| ETF Name | Focus | Average Return (10 years) |

|---|---|---|

| VOO (Vanguard S&P 500) | U.S. Large Cap Stocks | 10% |

| QQQ (Invesco Nasdaq 100) | Tech Companies | 12% |

| SCHD (Schwab Dividend ETF) | Dividend Stocks | 8% |

💡 Pro Tip: Use a dollar-cost averaging strategy — invest the same amount monthly to reduce market timing risk.

📚 6. Create and Sell Digital Products

Digital products are one of the most scalable passive income sources in the modern world. Once created, they can generate sales repeatedly without extra effort.

Examples of Digital Products

-

E-books

-

Online courses

-

Templates or printables

-

Mobile apps

-

Stock photos or music

Benefits

-

Low startup cost

-

Unlimited scalability

-

Global audience reach

Platforms to Sell

-

Etsy (for templates, printables)

-

Udemy or Teachable (for courses)

-

Amazon Kindle Direct Publishing (KDP) (for e-books)

💡 Pro Tip: Focus on solving real problems — that’s how digital products go viral.

💻 7. Affiliate Marketing

Affiliate marketing is a brilliant way to earn money by promoting other people’s products online. You earn a commission each time someone buys through your link.

Steps to Start

-

Create a blog, YouTube channel, or social media page.

-

Join affiliate programs (like Amazon Associates, ClickBank, or ShareASale).

-

Promote products you trust and earn a percentage of each sale.

Income Potential

-

Small creators: $100–$500/month

-

Experienced affiliates: $1,000–$10,000/month or more

Advantages

-

No inventory or product management

-

Fully remote and scalable

-

Can be automated through SEO and email marketing

💡 Pro Tip: Build evergreen content — blog posts or videos that stay relevant for years and keep generating clicks.

🏢 8. Real Estate Investment Trusts (REITs)

If you love real estate but don’t want to buy property, REITs are your go-to option. They pool investor funds to purchase income-producing properties like apartments, malls, and offices.

Why Investors Love REITs

-

Legally required to pay 90% of income as dividends

-

Easy to buy/sell like regular stocks

-

Diversified exposure to real estate markets

| REIT Category | Example | Average Yield |

|---|---|---|

| Residential | AvalonBay Communities | 4% |

| Commercial | Simon Property Group | 5% |

| Industrial | Prologis | 3% |

| Healthcare | Welltower | 4.5% |

💡 Pro Tip: Combine REITs + Dividend Stocks for steady monthly cash flow.

🪙 9. Investing in Cryptocurrencies (for the Brave)

Crypto can be risky — but with the right approach, it can also generate passive income. Instead of just trading, investors now earn from staking and yield farming.

Ways to Earn Passive Crypto Income

-

Staking: Lock coins (like Ethereum or Cardano) to earn interest.

-

Yield Farming: Lend your crypto in decentralized platforms for returns.

-

Dividends from Crypto Tokens: Some coins share revenue with holders.

| Method | Typical Annual Return | Risk Level |

|---|---|---|

| Staking | 5–12% | Moderate |

| Yield Farming | 10–30% | High |

| Dividend Tokens | 3–8% | Moderate |

💡 Pro Tip: Stick with established coins and use secure wallets or trusted platforms like Binance or Coinbase.

🎨 10. Licensing and Royalties

If you’re a creator — artist, writer, musician, or designer — you can license your work and earn royalties each time it’s used or sold.

Examples

-

Musicians earn when their songs are streamed or used in media.

-

Writers earn royalties from book sales.

-

Photographers get paid when their photos are downloaded.

Best Platforms

-

Shutterstock for photographers

-

Spotify and Apple Music for musicians

-

Amazon KDP for writers

💡 Pro Tip: Focus on evergreen content — music, art, or writing that remains valuable over time.

Comparison Table: Best Passive Income Investments

| Investment Type | Risk | Return (Annual) | Effort | Suitable For |

|---|---|---|---|---|

| Dividend Stocks | Medium | 6–10% | Low | Beginners & long-term investors |

| Real Estate | Medium | 8–12% | Medium | Investors with capital |

| P2P Lending | High | 5–12% | Medium | Risk-tolerant investors |

| Bonds | Low | 3–5% | Very Low | Conservative investors |

| Index Funds / ETFs | Low | 7–10% | Very Low | Passive investors |

| Digital Products | Medium | Unlimited | High upfront | Creators |

| Affiliate Marketing | Medium | 5–20% | Medium | Online marketers |

| REITs | Low | 4–6% | Very Low | Real estate lovers |

| Cryptocurrencies | High | 8–30% | Medium | Tech-savvy investors |

| Royalties | Medium | Variable | High upfront | Creatives |

How to Build a Balanced Passive Income Portfolio

To achieve long-term financial freedom, it’s crucial to diversify your income sources. Here’s how you can structure your portfolio:

-

Low-Risk (40%)

-

Bonds, ETFs, and REITs for stability

-

-

Medium-Risk (40%)

-

Dividend stocks and real estate

-

-

High-Risk (20%)

-

Crypto, startups, or P2P lending

-

This combination provides steady growth, security, and the excitement of high potential returns.

Common Mistakes to Avoid

Even the best passive income ideas can fail if managed poorly. Watch out for these traps:

-

❌ Chasing unrealistic returns

-

❌ Ignoring diversification

-

❌ Investing without research

-

❌ Forgetting taxes and fees

-

❌ Expecting instant results

Remember — passive income takes time to build but compounds beautifully over the years.

Final Thoughts: Your Path to Financial Freedom

Building passive income is not about luck; it’s about strategy, patience, and consistency. The goal is to create a self-sustaining system that works even when you don’t.

Start small — maybe with dividend stocks or a simple REIT investment. As you gain experience and confidence, diversify into digital assets, real estate, or online ventures. Every dollar you invest today is a step closer to the day when your money works harder than you ever did.

Financial freedom isn’t a dream — it’s a decision. Start now, stay consistent, and let time do the heavy lifting.