When it came time for the editors of Merriam-Webster to select the

Processing Content

It’s no wonder slop has achieved this dubious distinction: It’s everywhere. And for financial advisors, it’s making it harder to cut through the noise and build trust.

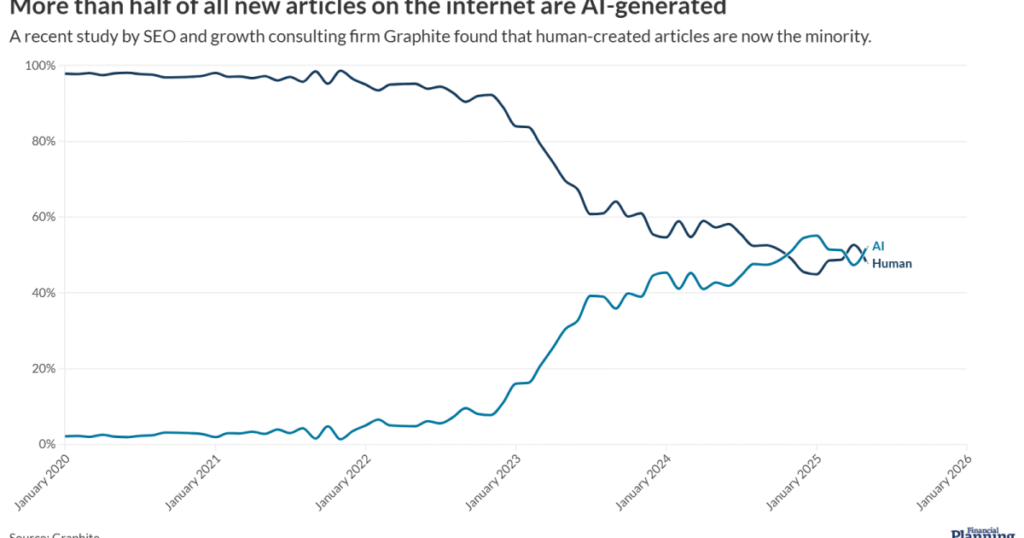

A report by the SEO and growth consulting firm Graphite found that more than half of all new articles on the internet

The implications are staggering, said Willie Roberson, managing director of the digital strategy division of FGS Global, a communications consulting firm.

AI slop is far more than an annoyance, he said.

“It’s a black hole sucking the life, connection and community out of the online experience, taking life away from good campaigns,” he said. “Companies chasing cost savings and lower overhead are accelerating this flood, numbing people’s brains and disrupting real connections.”

For advisors, this means clients are encountering a deluge of slop in their daily lives, a trend that is likely to continue to intensify and make it harder to connect with prospects.

To combat the slop — and build and maintain relationships — experts recommend advisors focus on standing out by: producing personalized posts based on their expertise and lived experience.

How AI slop affects clients and advisors

For those looking for information via

READ MORE:

“The pages often look polished, but once you read closely, the content is shallow or repetitive,” he said.

Steven Crane, founder of

“It is generic, context-free and often dangerously oversimplified,” he said about much of the information found in search results. “In wealth management, that is a problem because bad information does not just confuse people, it costs them real money.”

Clients have already brought error-ridden AI slop articles to his attention.

“They will say, ‘I read online that I can avoid all taxes,’ or ‘AI says this strategy beats the market every year,'” he said.

Crane emphasized that the issue is not curiosity, but trust.

“Many people do not yet know how to distinguish real expertise from content stitched together to rank on Google,” he said.

READ MORE:

The problem is not simply that the content is low quality, said Charles Laing, head of technical product at global business and technology consultancy Capco. It’s also being created void of responsibility, context or regulatory nuance.

“All this is made particularly dangerous for the consumers in financial decisions,” he said. “This adds an additional trust burden for regulated professionals, who now need to sift through advice that appears credible but lacks a clear author, source or duty of care.”

Tips to fight AI slop with authenticity

In this environment, Roberson said he often helps firms and organizations think through their content strategy with a focus on audience, engagement and consistency.

“Cutting through means doubling down on authenticity,” he said. “Real people behind and in front of the camera. Real experiences. Personality. Human connection. AI can help, but authenticity is the only superpower that can and will pierce through the noise.”

When advisors produce content, Laing said it should be obviously human-written, grounded in real knowledge, regularly refreshed and crafted for user intent.

“At a time when AI-created content becomes ubiquitous, provenance, credibility and relevance have been the real differentiators,” he said.

While AI can remix common knowledge, it cannot replicate real fiduciary judgment, lived experience or the nuance that comes from actually walking clients through major financial decisions, said Lochte. In his case, he writes specifically for segments of the Austin and central Texas community — retirees, technology employees and business owners.

“Real Texas tax considerations, employer benefit nuances and central Texas planning frameworks rooted in actual practice” have local relevance, he said.

When he creates content for his firm, Crane said he intentionally does the opposite of what the slop does. Instead of chasing keywords or volume, he speaks directly to the people he serves — working-class families and veterans — using plain language and his own experience in a consistent and honest way.

He has found that clients share content that comes from an actual person who understands their life, not content that comes off like it was written to game an algorithm.

“I focus on nuance, trade-offs and reality, not clickbait answers,” he said. “Real humans can feel the difference.”