Financial advisors see artificial intelligence eclipsing every other technology trend in wealth management this year, with AI-driven portfolio recommendations and construction emerging as the most consequential shifts in how they expect to deliver advice, new research shows.

Processing Content

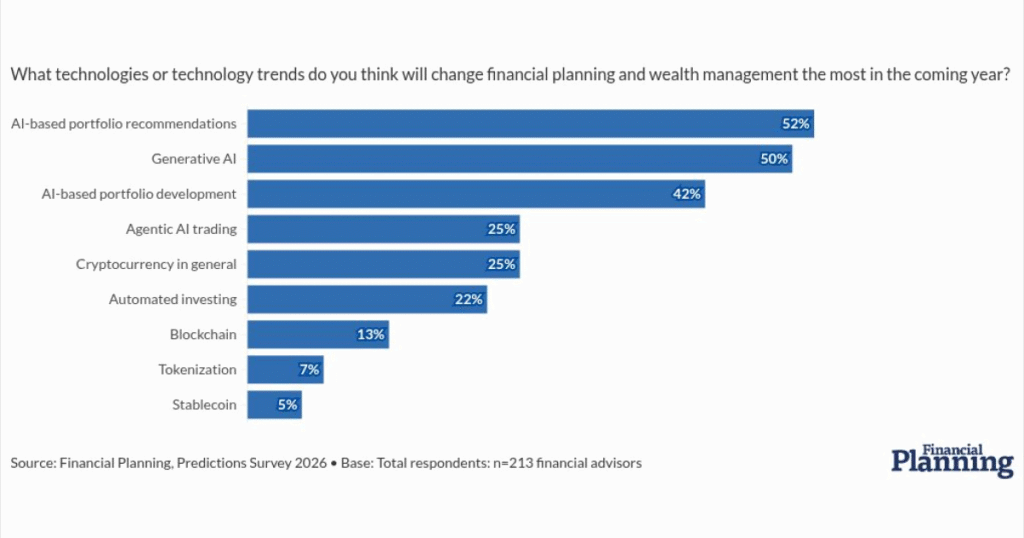

Financial Planning’s Predictions 2026 survey, fielded in November and December 2025, asked financial advisors which technologies they believe will most change the field this year.

More than half of the respondents, who were allowed to select more than one answer, cited AI-based portfolio recommendations (52%).

As the technology moves from the back office to more client-facing uses, advisors are already seeing fintechs pop up

But experts say advisors who use these technologies should retain oversight and final decision-making authority to preserve client confidence and avoid regulatory scrutiny.

READ MORE:

Results reflect a growing trend

FP’s survey results resonate with Jack Fu, co-founder of AI-powered investment platform

“Where it adds the most value is in research, risk monitoring and implementation discipline,” he said. “What it will not do well on its own is replace economic judgment, portfolio construction experience or accountability.”

Marlon Williams, founder of machine learning-powered investment platform Dextrader.ai, said he expects traditional finance to integrate AI primarily to enhance forecasting, personalization and automated portfolio construction.

This shift also enables more reliable capital allocation across bull and bear cycles, while preserving investor autonomy through self-custodial, noncentralized portfolio delivery, he said.

“It’s important to note that investors increasingly expect AI guidance without surrendering self-custody or depending on centralized exchanges,” he said. “This creates demand for AI engines that deliver actionable portfolio insights directly on-chain or through noncustodial wallets.”

READ MORE:

The dangers of a lack of oversight

One of the most significant risks is retail investors relying on generative AI-driven portfolio recommendations without guidance from a qualified financial advisor or planner, said Ugur Hamaloglu, a wealth and asset management consulting leader at

This raises critical questions around fiduciary responsibility, because that responsibility does not fall on the AI agent, he said.

“Without proper oversight, investors could make decisions that expose them to unnecessary risk or misaligned strategies,” he said.

Many large firms have already started leveraging AI-driven portfolio construction for clients paired with expert human oversight, said Kapil Vora, senior director of wealth intelligence at J.D. Power.

This human intervention will remain in place for the foreseeable future due to regulatory and compliance requirements, as well as the need to catch potential AI-driven errors, he said.

“It is expected that this AI-plus-human model will expand to mid-sized and smaller firms in the coming years, with advisors and firms maintaining ultimate fiduciary responsibility for their clients,” he said.

Similarly, Fu said he does not believe in giving AI free rein across all data.

“We treat AI more like a child than an oracle,” he said. “You have to guide it, feed it economically relevant data, and impose constraints. Without structure and limits, AI can find patterns that look impressive but have no durable investment logic behind them.”

Ensuring accountability

In addition to overconfidence by advisors and firms in AI-driven recommendations, there is also a risk of a lack of transparency, said Jared Kessler, founder of global foreign exchange market advice platform

“Therefore, AI must be considered as a support tool for making decisions rather than a decision-making tool,” he said. “A human element is necessary for the development of the portfolio to meet the client’s financial objectives, risk tolerance and real-world constraints.”

Models and quantitative tools have influenced portfolio recommendations for decades, so new modeling paradigms under the banner of AI are not necessarily a huge strategic shift, said Anthony Habayeb, co-founder and CEO at AI governance software platform Monitaur AI. Where he expects greater change is in client service and engagement. With these advancements, advisors should also prepare for heightened expectations around transparency, he said.

That means disclosing where AI is used, how recommendations are validated and who is accountable when something goes wrong.

“Regulators are increasingly modeling these expectations themselves, and those standards will likely cascade across the industry,” he said. “Firms that invest early in governance and documentation will be better positioned than those racing to deploy AI without guardrails.”

The natural first step should be AI providing insights and recommendations to advisors, who maintain final decision authority, said Brooks Canavesi, chief product officer at AI-powered mentorship platform Baryons and a former financial advisor with UBS and Stifel.

“This allows the AI to be tuned and calibrated over time while preserving the fiduciary relationship between advisor and client,” he said.