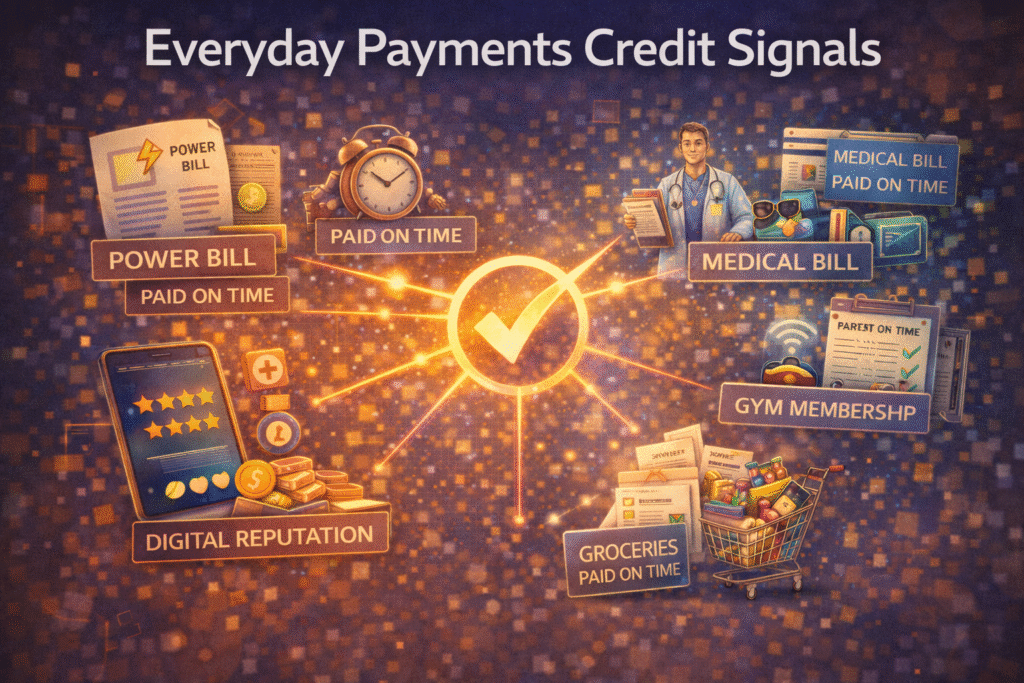

You’ve paid rent on time for years. Your phone bill has never been late. Your utilities? Always current. Yet when you check your credit score, it barely budges—or worse, you don’t have enough credit history to generate a score at all. For decades, the financial behaviors that actually demonstrate responsibility have been invisible to the credit system, leaving millions of people locked out despite doing everything right. This disconnect exists because everyday payments credit signals were never part of how traditional credit models measured trustworthiness.

The gap between your actual financial discipline and what shows up on your credit report isn’t an accident. It’s the result of how credit reporting was built: a system designed around loans and credit cards while systematically ignoring the payments you make every single month. But that’s starting to change. Rent, utilities, and phone bills can now influence your credit profile—if you know how to make them count. As everyday payments credit signals gain acceptance through alternative data reporting, understanding which payments matter, why on-time history may not appear automatically, and how to activate reporting becomes essential for turning routine bills into real credit progress.

The Invisible Financial Identity: Why Traditional Credit Scoring Excludes Your Most Consistent Payments

The credit reporting system emerged in the 1960s and 1970s around a specific financial product category: consumer lending. Credit bureaus built their infrastructure to track loans and credit cards because these products generated the most revenue for lenders and created the clearest risk assessment framework. At the time, everyday payments credit signals were never considered relevant inputs. The technical architecture centered on “tradeline” debt—financial products with formal credit agreements, defined repayment terms, and legal obligations that could be enforced through collections. This design choice created a fundamental classification system that determined which financial behaviors would be visible and which would remain in the shadows.

Rent, utilities, and telecom payments fell into the “non-tradeline” category because they didn’t fit the lending model. You’re not borrowing money when you pay rent; you’re fulfilling a lease obligation. Your electric bill represents payment for services already consumed. The technical distinction seems minor, but it excluded everyday payments credit signals from the system entirely. Traditional credit scoring models like FICO and VantageScore were calibrated only on tradeline data because that was all the bureaus collected. The algorithms learned to predict risk based on borrowed money behavior, not on how consumers consistently managed recurring obligations.

The economic structure of data furnishing reinforced this divide. Credit card companies and lenders report to credit bureaus because it directly benefits their business models. In contrast, landlords, utility companies, and phone providers had no incentive to report everyday payments credit signals. The technical requirements—Metro 2® compliance, data transmission protocols, and ongoing bureau relationships—represented cost without revenue upside. A property management company overseeing hundreds of units would need to invest in software, training, and compliance without gaining any competitive advantage, making participation impractical.

This structural exclusion produced what the Consumer Financial Protection Bureau calls the “thin file” problem. Consumers with limited tradelines—or those entirely credit invisible—face systemic barriers despite demonstrating reliability through everyday payments credit signals. Renters, recent immigrants, young adults, and individuals rebuilding after financial hardship often manage monthly obligations flawlessly, yet remain disadvantaged because those behaviors never reached their credit reports.

The paradox becomes clearer when you consider that rent is often the largest recurring payment consumers make. Paying $1,500 monthly in rent demonstrates the ability to manage $18,000 in annual obligations—far more than many credit card limits. Yet these everyday payments credit signals were historically ignored by scoring models, creating a gap between real financial responsibility and measured creditworthiness. The system evolved around lending products and failed to adapt to the broader reality of how people actually pay their bills.

How Non-Traditional Payments Enter Credit Reporting Systems

Third-party rent reporting services emerged to bridge the gap between rental payments and credit bureaus, bringing everyday payments credit signals into a system that historically ignored them. Companies like RentTrack, Rental Kharma, and ClearNow function as intermediaries, collecting payment data from either tenants or landlords and formatting it according to credit bureau specifications. The technical process requires converting rental payment information into the Metro 2® format—the standardized data structure that credit bureaus use to process tradeline information. This conversion presents challenges because rent doesn’t naturally fit the credit product categories that Metro 2® was designed to accommodate. Reporting services typically classify rent as an installment loan with a fixed monthly payment, even though the underlying financial relationship differs significantly from a traditional loan.

The distinction between “active” and “passive” reporting mechanisms matters considerably for how everyday payments credit signals reach your credit file. Active reporting requires deliberate action—you sign up for a rent reporting service, provide documentation of your lease and payment history, and authorize the service to submit data on your behalf. Some services require your landlord’s participation; others work independently by verifying payments through bank account access. Passive capture represents a newer approach pioneered by products like Experian Boost and UltraFICO, which focus on surfacing everyday payments credit signals without requiring landlord involvement.

The technical implementation of bank account aggregation reveals the complexity behind turning everyday payments credit signals into usable credit data. When you link your bank account to Experian Boost, you grant access through secure APIs that connect to your financial institution. The platform scans transaction history for specific merchant names and recurring payment patterns tied to utilities, telecom providers, and subscription services. It then creates a synthetic tradeline—a bureau-recognized entry representing your payment history with these non-traditional creditors—allowing everyday payments credit signals to appear on your credit report without direct reporting from the service provider.

FICO Score XD and VantageScore 4.0 represent the scoring model evolution designed to incorporate everyday payments credit signals alongside traditional tradelines. These models use updated algorithms capable of processing non-traditional payment behavior, but adoption remains inconsistent. Most mortgage lenders still rely on older FICO models that ignore alternative data entirely, while auto lenders and credit card issuers vary widely in which scoring systems they use. This fragmentation means strategies built around everyday payments credit signals can improve credit outcomes in some lending scenarios while having no impact in others.

The timing dynamics of alternative data reporting often surprise consumers trying to activate everyday payments credit signals quickly. Rent reporting services typically need 30–45 days to verify information, format data, and transmit it to credit bureaus. Additional processing time is required for bureaus to match the data to an existing credit file. Even after the tradeline appears, scoring models may not reflect the change until the next calculation cycle, delaying measurable results by several months.

The most consequential technical distinction in alternative data reporting separates positive reporting from collections-based reporting, underscoring why everyday payments credit signals matter so much. Utility and telecom providers usually report only when accounts become seriously delinquent, meaning years of on-time payments remain invisible while a single missed bill can damage your credit profile immediately. This asymmetry—where negative data flows automatically but positive behavior requires intentional activation—explains why many consumers with flawless payment habits still struggle with poor or thin credit files.

Why Your On-Time Payments Aren’t Appearing on Credit Reports

Data furnishing to credit bureaus operates on a voluntary basis for most non-lending entities, which is one of the biggest reasons everyday payments credit signals often fail to appear on credit reports. Your landlord faces no legal requirement to report your rent payments, and most choose not to because it creates administrative burden without providing business value. Large property management companies might have the technical infrastructure to report everyday payments credit signals, but they often reserve this capability as a premium service or simply don’t activate it. Individual landlords renting out a single property almost never report because the setup costs and ongoing compliance requirements exceed any benefit they might receive. This voluntary structure means that even when you pay on time every month, your everyday payments credit signals may never enter the credit ecosystem at all.

Technical errors in data transmission create another major breakdown point for everyday payments credit signals, independent of your actual payment behavior. Credit bureaus match incoming data to consumer files using identifiers like Social Security number, name, date of birth, and address. When a rent reporting service submits payment history with even minor discrepancies—a missing middle initial, an outdated address, or a transposed digit—the bureau’s matching algorithm may fail. In those cases, everyday payments credit signals are submitted but effectively disappear because the system can’t confidently attach them to the correct credit file.

Name variations introduce particularly stubborn problems for everyday payments credit signals. A lease under “Robert Smith” may not match a credit file listed as “Bob Smith.” Hyphenated last names, suffixes, or name changes after marriage further complicate matching logic. Credit bureaus intentionally err on the side of caution—they would rather suppress legitimate everyday payments credit signals than risk attributing them to the wrong consumer. The result is missing positive data even when the payment history is accurate and verifiable.

The “closed loop” problem affects renters who pay through property management software that doesn’t integrate with credit reporting services, effectively trapping everyday payments credit signals inside private systems. Many large apartment complexes use proprietary payment portals that track rent internally but don’t transmit data to credit bureaus. Even if you want those payments reported, extracting the data and routing it through a third-party service requires steps most consumers don’t realize are necessary. Your perfect payment history exists—but your everyday payments credit signals never leave the platform.

Corporate changes create another hidden disruption to everyday payments credit signals. When a utility provider merges, changes billing systems, or rebrands, reporting pipelines often break temporarily. Account numbers change, furnishing entities reset, and integrations must be rebuilt. During this transition, your on-time payments continue, but everyday payments credit signals may stop flowing to credit bureaus entirely, creating unexplained gaps in your reported history.

Payment intermediaries further complicate how everyday payments credit signals are captured. Paying rent through Venmo, Zelle, or Cash App inserts a third party between you and the original payee. To credit bureaus, these transactions look like peer-to-peer transfers, not housing payments. Even if a landlord participates in reporting, they may only capture payments made through specific channels, leaving valid everyday payments credit signals unrecognized.

Certain payment categories face structural limits that prevent everyday payments credit signals from being reported at all. Streaming services, gym memberships, and subscriptions don’t furnish data to credit bureaus because they aren’t credit products and don’t require credit approval. Even years of flawless payments remain invisible unless surfaced through bank aggregation tools designed to convert everyday payments credit signals into reportable data.

Timing mismatches between payment, processing, and reporting create additional friction for everyday payments credit signals. A payment made on time can appear late if reporting cycles close before the transaction posts. While these discrepancies rarely cause severe damage, they highlight how fragile the system is—and how easily responsible financial behavior can be misrepresented.

Converting Routine Bills Into Credit Score Improvements

Verifying your current reporting status requires examining all three credit reports with specific attention to non-traditional tradelines. Request your free annual credit reports from Experian, Equifax, and TransUnion through AnnualCreditReport.com, then scan for entries labeled as “rent,” “lease,” or listing your landlord or property management company as the creditor. Utility accounts appear less frequently, but when they do, they’re typically listed under the utility company name with an account type designation of “open” or “installment.” Telecom accounts follow similar patterns, appearing under your phone or internet provider’s name. The absence of these entries doesn’t necessarily mean you have credit report inaccuracies—it more likely indicates that these payments simply aren’t being reported at all.

The cost-benefit analysis of rent reporting services requires evaluating both immediate expenses and long-term credit impact. Most services charge between $8 and $25 monthly, with some offering annual payment options at a discount. One-time setup fees can range from $25 to $100 depending on the service and whether you want retroactive reporting. The retroactive capability matters significantly—services like Rental Kharma can add up to 24 months of past rent payments to your credit file, instantly creating a substantial positive payment history rather than starting from zero. However, not all services report to all three bureaus. Some only report to one or two, which means your improved credit profile might be visible to some lenders but not others.

Strategic sequencing of alternative data additions prevents overwhelming your credit profile with simultaneous changes that scoring algorithms might interpret as risk signals. Start with your largest, most consistent payment—typically rent—because it demonstrates the highest payment capacity and creates the most substantial tradeline. Allow 60-90 days for this addition to stabilize on your credit reports and influence your scores before adding additional alternative data. Next, consider utility payments credit score impact, prioritizing utilities with the longest payment history and most consistent on-time record. Phone bills and other telecom payments should come third, followed by any other recurring payments that can be verified through bank account aggregation.

Approaching landlords about reporting requires framing the request around their business interests rather than your credit needs. Property managers care about tenant retention, on-time payment rates, and reducing turnover costs. Position rent reporting as a tenant benefit that increases lease renewal rates—renters who are building credit through their rent payments have an incentive to stay rather than move. Some property management software platforms now include credit reporting as a feature, so your landlord might only need to activate existing functionality rather than implement new systems. If they’re unwilling to report directly, ask if they’ll provide documentation of your payment history that you can submit through a third-party reporting service. Most landlords will at least provide a letter confirming your tenancy dates and payment record.

Bank account linking through Experian Boost and similar platforms offers a lower-cost alternative to paid reporting services, but it requires careful consideration of privacy implications. You’re granting access to your complete transaction history, not just specific bill payments. The platforms use this access to identify recurring payments to utility companies, telecom providers, and subscription services. Payments to major providers like AT&T, Verizon, your local electric company, and water utility typically have the most scoring impact because they’re easily verified and represent essential services. Smaller or less recognizable merchants may not be identified correctly by the algorithms, limiting their credit-building value.

Documentation requirements for initiating reporting vary by service but generally include proof of your lease agreement, recent payment receipts or bank statements showing consistent payments, and verification of your identity. For retroactive reporting, you’ll need documentation covering the entire period you want to add—bank statements showing 24 months of rent payments, for example, if you want to add two years of history. Organize these documents chronologically and ensure that payment amounts match your lease terms. Discrepancies between your stated rent amount and actual payment records can trigger verification delays or rejections.

Timeline expectations for credit score improvement through alternative data require patience and realistic assessment. After initiating reporting, expect 30-45 days before the tradeline appears on your credit reports. Once it appears, the scoring impact depends on your existing credit profile. If you have a thin credit file with only one or two tradelines, adding rent reporting can produce significant score increases—sometimes 20-40 points—because you’re substantially expanding your credit history. If you already have multiple established tradelines, the impact will be more modest, perhaps 5-15 points, because the new data represents a smaller proportion of your overall credit profile. The most substantial improvements typically occur within the first three months after the tradeline begins appearing consistently on your reports.

Correcting Misreported Alternative Payment Data

Alternative data reporting errors manifest in distinct patterns that differ from traditional credit report inaccuracies. Payments marked late when you have documentation proving on-time payment represent the most common dispute scenario. This error typically occurs due to timing discrepancies—your payment was processed after the reporting service’s data cutoff date, or there was a delay between when you paid and when your landlord recorded the payment. Duplicate accounts appear when reporting services create multiple entries for the same rental property, often because of address variations or changes in how your landlord’s business is registered. Incorrect payment amounts can occur when your rent increased mid-lease but the reporting service continued showing the old amount, creating a discrepancy between reported and actual payment history.

The dispute process for alternative data operates on multiple levels because the data flows through more intermediaries than traditional credit reporting. You may need to dispute credit report errors with the rent reporting service first, since they’re the data furnisher. If they correct their records but the error persists on your credit report, you’ll need to dispute directly with the credit bureau. If the reporting service insists their data is correct but you have documentation proving otherwise, you may need to address the issue with your landlord or property manager who provided the original information. This multi-party dispute process can extend resolution timelines significantly beyond the standard 30-day credit bureau dispute window.

Documentation for successful disputes requires creating a comprehensive evidence package that proves your case at each level. Canceled checks showing payment dates and amounts provide the strongest evidence for on-time payment disputes. Bank statements showing electronic

The Path From Invisible to Visible: Making Your Financial Discipline Count

The disconnect between your actual financial responsibility and what appears on your credit report isn’t a reflection of your behavior—it’s a structural artifact of how credit reporting evolved. For decades, the payments that best demonstrate your capacity to manage obligations remained invisible simply because they didn’t fit the lending industry’s data collection framework. But the emergence of alternative data reporting has created pathways to translate rent, utilities, and phone bills into credit-building opportunities, provided you understand the technical realities and take deliberate action to make these payments count.

Your consistent payment history represents financial discipline that deserves recognition in the credit system. Whether through third-party reporting services, bank account aggregation platforms, or direct landlord reporting, the infrastructure now exists to convert your everyday bills into measurable credit progress. The challenge isn’t whether these payments can influence your credit profile—it’s understanding which payments actually matter, how to initiate reporting, and why your on-time behavior might not be showing up despite your best efforts. The credit system was built around borrowed money, but it’s finally beginning to recognize that how you manage your cash flow obligations reveals just as much about your creditworthiness as how you handle a credit card—and that recognition is long overdue.