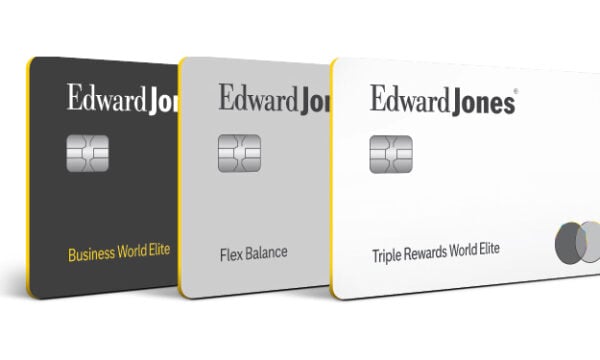

In addition to its financial services, Edward Jones offers three no-annual-fee credit card options for customers who want to manage their finances in one spot.

-

The Edward Jones Everyday Solutions Triple Rewards World Elite Mastercard.

-

The Edward Jones Everyday Solutions Flex Balance Mastercard.

-

The Edward Jones Everyday Solutions Business World Elite Mastercard.

The cards, issued by U.S. Bank, may be a match for different needs depending on your financial goals and situation. All cards earn points that can be invested or redeemed for other options at a value that varies. An Edward Jones credit card may also offer your financial advisor a fuller scope of your finances.

Here’s what you need to know about Edward Jones credit cards.

Image courtesy of Edward Jones

1. Two options earn rewards in broad categories

The Edward Jones Everyday Solutions Triple Rewards and Everyday Solutions Business credit cards offer a welcome bonus and ongoing rewards.

Edward Jones Everyday Solutions Triple Rewards Mastercard

As a new cardholder, you’re eligible for a welcome offer of 15,000 loyalty points when you spend $1,500 within 90 days of opening the account. (This bonus is accurate as of this writing.) For your personal spending, you’ll get 5 loyalty points per dollar spent on travel booked through U.S. Bank’s Travel Rewards Center, 3 points per dollar spent in your top three spending categories from a list of options, and 1 point per dollar spent on all other eligible purchases. Categories like utilities, streaming, groceries, dining and gas are among those included in the list.

Everyday Solutions Business Mastercard

If you’re a business owner, you might welcome this card’s welcome bonus of 20,000 loyalty points after spending $1,500 within 90 days of opening the account. (This bonus is accurate as of this writing.) It earns 6 loyalty points per dollar spent on travel booked through the Travel Rewards Center and 2 points per dollar spent on all other eligible purchases. There’s an introductory interest-free window on purchases, too (as of January 2026).

2. One card has a solid interest-free window

The Edward Jones Everyday Solutions Flex Balance Mastercard is an option to consider if you want to save on interest charges for purchases or debt. As of January 2026, it offers a 0% introductory APR on purchases and balance transfers for 15 billing cycles. After that, a variable APR applies.

As a balance transfer credit card for paying off debt, it’s not the best option, given that it charges 5% of the amount you’re transferring. It’s possible to find balance transfer cards elsewhere that have a lower fee of 3%. When you’re paying off debt, every bit of money you can save counts.

The card’s 0% intro APR on purchases is more competitive, although it’s possible to find even longer offers. For example, the Citi Simplicity® Card offers a 0% intro APR on purchases for 12 months and 0% intro APR on balance transfers for 21 months, and then the ongoing APR of 17.49%-28.24% Variable APR.

The Flex Balance Mastercard earns some rewards, but unlike the other Edward Jones cards, it doesn’t offer broad purchase categories. You’ll earn 4 points per dollar spent on travel booked through the Travel Rewards Center. There’s also an annual $20 statement credit.

3. Points can be invested or redeemed for other options

You can redeem your loyalty points as investments with Edward Jones Loyalty Invest, or you can use them toward a statement credit, merchandise, travel and more. Investing your rewards will offer the best value, at 1 cent per point. Redemption values for other options vary, and other rewards credit cards will be better suited for those scenarios.

If you prefer consistent value and more redemption flexibility, consider a card like the Capital One Savor Cash Rewards Credit Card. It earns 5% back on hotels, vacation rentals and rental cars booked through Capital One Travel; 3% cash back on dining, purchases at grocery stores, on entertainment and popular streaming services; and 1% cash back on all other purchases. It also has a welcome offer: Earn a one-time $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening. Cash back may be redeemed in the form of a statement credit or check, or toward gift cards, travel and eligible purchases with PayPal.

4. All 3 cards have steep interest rates

Interest rates vary depending on the card, but as with most rewards-earning credit cards, all are high enough that carrying an ongoing balance will be costly.

If you think you’ll end up carrying a balance over a long term, you’ll save more money with a credit card at a credit union that caps interest rates at 18%.

5. All 3 cards travel well

As Mastercards, all Edward Jones credit cards have broad merchant acceptance worldwide. They also don’t charge foreign transaction fees, which will save you money on international purchases.