Your credit score isn’t telling the whole story anymore. While you’ve been watching those three digits, lenders have quietly built evaluation systems that dig far deeper—analyzing payment patterns, account diversity, utilization trends, and dozens of other data points your score doesn’t capture. Understanding how borrowers are evaluated today reveals why errors hidden in your credit report don’t just lower a score—they corrupt the underlying data feeding these models, creating invisible barriers that can sink approvals or cost thousands in higher interest rates even when the score looks fine.

Once you grasp how borrowers are evaluated now—not how it worked five years ago—you approach credit repair differently. The same error that drops a score by 20 points may be triggering multiple red flags across different evaluation layers, placing you in the wrong risk category before a human ever reviews your file. Identifying which errors cause the most damage and correcting them strategically requires looking at your credit report through the same lens used during modern evaluations.

Beyond the Score: The Multi-Layered Evaluation Framework Lenders Actually Use

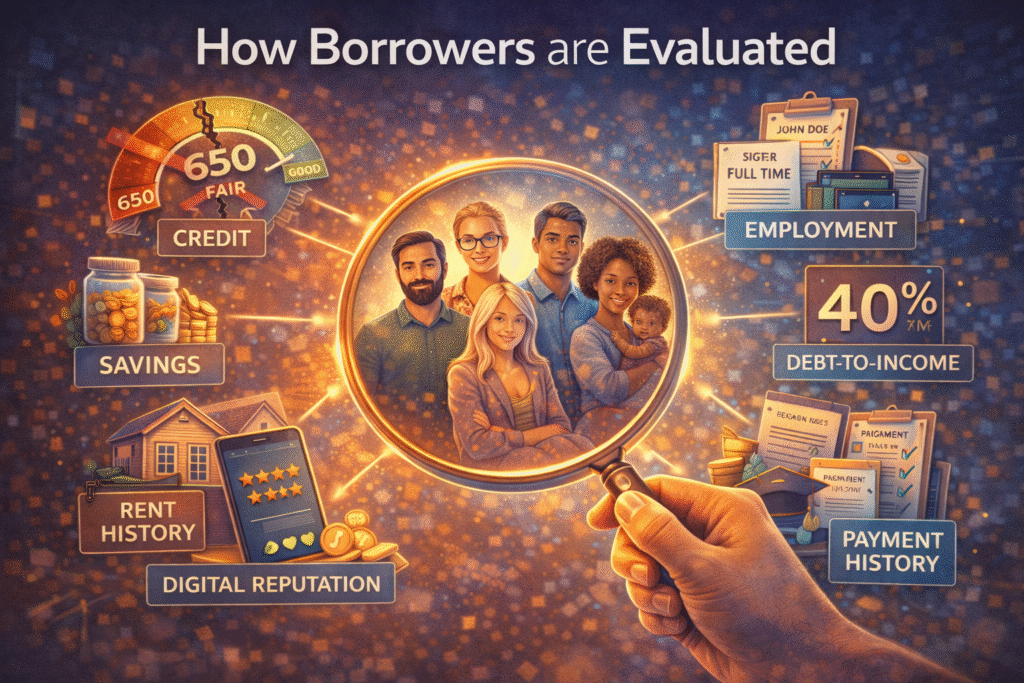

The three-digit credit score represents just the entry point in how borrowers are evaluated today. Financial institutions now deploy proprietary risk models that process dozens of variables from your credit file simultaneously, creating evaluation profiles that extend far beyond what FICO or VantageScore captures. These systems analyze payment timing patterns, account management behaviors, credit mix evolution, and utilization trends across multiple timeframes. When you apply for credit, automated underwriting platforms parse your entire credit history through algorithms calibrated to predict default probability with far greater precision than traditional scoring models.

This shift from score-based decisioning to file-based underwriting fundamentally changes how borrowers are evaluated in practice. Lenders examine your payment patterns over 24 months to identify consistency and reliability indicators that a single score cannot reveal. In modern systems, how borrowers are evaluated depends heavily on behavior trends—recent activity, disruption patterns, and whether your utilization is improving or deteriorating over time—rather than a static snapshot.

Credit report errors corrupt how borrowers are evaluated at the data-input level, creating cascading failures across multiple assessment layers. Incorrect balances don’t just affect utilization calculations—they distort trend analysis, trigger red flags in debt-to-income modeling, and misclassify account management behavior. A single misreported balance can push an application into a higher-risk pathway before any human reviewer examines the file.

The reason codes that appear on denial letters offer critical insight into how borrowers are evaluated behind the scenes. These codes often point directly to disputed or erroneous data elements that automated systems flagged as disqualifying. When a denial cites “too many accounts with balances” due to reporting errors, the issue isn’t mismanagement—it’s a breakdown in how borrowers are evaluated because corrupted data drove the decision.

Two borrowers with identical credit scores frequently receive different outcomes because how borrowers are evaluated places heavy emphasis on file composition and structure. Account diversity, credit age, inquiry behavior, and balance distribution all influence risk classification. A profile dominated by revolving credit signals different risk than one showing a healthy mix of installment and revolving accounts, even when scores match.

Scorecard segmentation represents one of the most consequential and least understood elements of how borrowers are evaluated. Applications are routed through different scorecards based on initial file characteristics, and errors can place you into the wrong tier instantly. In modern underwriting, how borrowers are evaluated determines not just approval or denial, but which pricing models, documentation standards, and risk thresholds are applied before a human ever reviews your application.

How Credit Report Errors Distort Your Evaluation Profile

Specific error types inflict disproportionate damage on modern credit assessments because they directly corrupt how borrowers are evaluated at the data level. Misreported balances rank among the most destructive issues. When creditors report incorrect balance amounts—due to transmission errors, timing mismatches, or system glitches—they artificially inflate utilization ratios. Automated underwriting systems immediately flag high utilization, fundamentally altering how borrowers are evaluated regardless of actual payment behavior. A card with a $5,000 limit and a true $500 balance should show 10% utilization, but a misreported $4,500 balance suddenly shifts how borrowers are evaluated by signaling extreme credit stress.

Incorrect payment status designations cause even deeper breakdowns in how borrowers are evaluated. When accounts show late payments that never occurred, or fail to update from delinquent to current, the error attacks payment history—the most influential evaluation factor. These mistakes don’t just lower scores; they redefine how borrowers are evaluated across automated risk models. A single false 30-day late can simultaneously damage payment history metrics, trigger negative reason codes, and route applications into higher-risk scorecards that change how borrowers are evaluated before manual review ever occurs.

Unauthorized inquiries introduce another error category with outsized influence on how borrowers are evaluated. Hard inquiries signal active credit-seeking, and clustering patterns are interpreted as financial distress. When inquiries appear from lenders you never contacted, they create a false narrative that reshapes how borrowers are evaluated, often triggering denials even when scores remain acceptable. The impact extends far beyond points—it distorts behavioral risk signals central to how borrowers are evaluated today.

Mixed-file identity errors create some of the most severe distortions in how borrowers are evaluated. When credit bureaus merge information from multiple consumers, lenders assess a fictional composite borrower. Accounts you never opened, payment histories that aren’t yours, and inflated debt loads all contaminate how borrowers are evaluated, leading to denials, subprime pricing, or restrictive conditions based on false data.

Technically accurate but misleading information also undermines how borrowers are evaluated. Settled collections reporting original balances or accounts marked “pays as agreed” while showing high balances comply with reporting rules but distort underwriting signals. These entries skew how borrowers are evaluated by exaggerating perceived debt burdens without reflecting real repayment risk.

Inconsistent lender-side data validation further complicates how borrowers are evaluated. One institution may detect discrepancies and approve an application, while another relies solely on bureau data and denies it. This inconsistency makes outcomes unpredictable when errors exist, as how borrowers are evaluated depends heavily on each lender’s internal verification processes.

Timing issues magnify the damage by disrupting how borrowers are evaluated during active applications. Even after an error is corrected, propagation delays across bureaus mean lenders may still see outdated data. A borrower may verify a clean report personally, only to face denial because the lender pulled a version that still misrepresents how borrowers are evaluated at that moment.

Medical collections and utility billing errors uniquely distort how borrowers are evaluated in mortgage underwriting. These accounts inflate debt-to-income calculations, pushing applicants past approval thresholds despite qualifying financial reality. When these errors appear, how borrowers are evaluated reflects phantom obligations rather than actual debt, resulting in denials that accurate data would not justify.

Building Your Error-Correction Campaign

The forensic approach to identifying disputable items requires distinguishing between errors, unverifiable information, and legitimately negative but improvable items. Errors include factually incorrect information: wrong balances, payments marked late when you paid on time, accounts that aren’t yours, or incorrect account statuses. Unverifiable information encompasses items where the creditor or collection agency cannot produce original documentation proving the debt’s validity or their legal right to collect. Legitimately negative items reflect actual credit missteps but might be improvable through goodwill adjustments, pay-for-delete negotiations, or simply aging off your report. Your dispute strategy must address each category differently, focusing first on clear errors that violate Fair Credit Reporting Act requirements.

Constructing effective disputes requires addressing the specific data fields that lenders evaluate rather than simply requesting deletion. When disputing a balance error, specify the incorrect amount, provide the correct amount, and explain why the error occurred if you know. Include documentation supporting your position: bank statements showing payments, creditor statements reflecting accurate balances, or correspondence confirming account status. The dispute should target the Metro 2 data fields that creditors use to report information to bureaus—fields like current balance, payment status, account status, and credit limit. By addressing specific data fields, you help bureau investigators understand exactly what needs correction and provide clear verification standards.

The Metro 2 reporting format represents the standardized data structure that furnishers use to transmit information to credit bureaus. Understanding this format reveals exactly what data elements appear in your credit file and which fields you can challenge. Each account reported contains dozens of data fields: account type, payment history codes, balance amounts, credit limits, payment amounts, account status codes, and compliance condition codes. When you dispute information, you’re essentially challenging specific Metro 2 field entries. Knowing which fields affect lender evaluations most significantly helps you prioritize disputes for maximum impact. Balance fields, payment rating codes, and account status fields typically carry the heaviest evaluation weight.

Disputing balance errors and credit limit misreporting delivers immediate utilization calculation improvements once corrected. When a creditor reports an incorrect balance, your dispute should include recent statements showing the accurate balance, payment confirmation if you’ve paid down the account, or creditor correspondence acknowledging the error. Credit limit misreporting—where a creditor fails to report your actual credit limit or reports it incorrectly—artificially inflates your utilization even when your balance is appropriate. Some creditors don’t report credit limits at all, causing bureaus to use your highest reported balance as a proxy limit, which can show 100% utilization even when you’re well below your actual limit. Disputing these omissions requires requesting that creditors report your actual credit limits to all three bureaus.

The verification gap represents a powerful dispute leverage point. Many creditors and collection agencies cannot produce original signed agreements, detailed payment histories, or proper chain-of-custody documentation when challenged. This particularly applies to older debts, accounts that have been sold multiple times, or collections from creditors with poor record-keeping systems. Your dispute should request specific documentation: the original signed credit agreement, complete payment history, verification of the debt amount including how it was calculated, and proof that the furnisher has the legal right to report the information. When furnishers cannot provide this documentation within the required investigation period, bureaus must remove the information from your report.

Timing your dispute strategy around planned credit applications requires understanding the 30-45 day investigation window that bureaus have to resolve disputes. If you plan to apply for a mortgage in three months, initiate disputes immediately to allow time for investigation, correction, and propagation of updates across all bureaus. Sequence your disputes strategically: address the most evaluation-damaging errors first, particularly those affecting utilization, payment history, or debt-to-income calculations. For less severe errors, you might delay disputes until after securing approval if those items won’t significantly impact your evaluation. This sequencing prevents overwhelming bureaus with simultaneous disputes while ensuring critical corrections complete before application submission.

Furnisher-direct disputes versus bureau disputes serve different strategic purposes. Bureau disputes trigger the standard investigation process where bureaus contact furnishers for verification. Furnisher-direct disputes go straight to the creditor or collection agency, often producing faster resolutions when the furnisher acknowledges the error. However, furnisher-direct disputes don’t trigger the same legal obligations as bureau disputes under the Fair Credit Reporting Act. The optimal strategy often involves parallel disputes: file with bureaus to establish legal compliance requirements while simultaneously contacting furnishers directly to expedite corrections. This dual approach creates paper trails supporting potential FCRA violation claims if furnishers fail to investigate properly or continue reporting inaccurate information after being notified of errors.

Addressing “soft errors” that don’t violate reporting rules but distort your evaluation requires different tactics than disputing clear inaccuracies. These situations include accounts marked “pays as agreed” but showing high balances that make you appear overextended, closed accounts still reporting as open, or authorized user accounts that don’t reflect your actual credit management. While these items may be technically accurate, they mislead lenders about your credit profile. Your approach should focus on requesting updates rather than disputing errors: ask creditors to report closed accounts correctly, request removal of authorized user accounts that don’t benefit your profile, or provide context about high balances that reflect business expenses or planned payoffs.

The rapid rescore process offers mortgage applicants an accelerated path to update corrected information before final underwriting. When you successfully dispute errors and receive confirmation of corrections, traditional bureau updates can take 30-60 days to appear in lender-pulled reports. Rapid rescore allows your mortgage lender to request expedited updates from bureaus, typically completing within 3-5 business days. This service costs money (usually $25-50 per bureau) but proves invaluable when corrections mean the difference between approval and denial or between rate tiers. Work with your loan officer to identify which corrections warrant rapid rescore and provide all documentation supporting the corrections to streamline the process.

Rebuilding Your Evaluation Signals After Error Resolution

Converting a cleaned credit file into a strong evaluation profile requires strategic account management that generates the specific signals modern underwriting algorithms reward. Error removal creates a foundation, but lenders need positive data demonstrating creditworthiness. Your post-correction strategy should focus on building payment history depth, optimizing utilization patterns, diversifying account types, and establishing the consistency patterns that automated underwriting systems interpret as low-risk behavior. This reconstruction phase determines whether your cleaned credit file translates into actual approval improvements or simply removes negative factors without adding positive evaluation strength.

Accelerating positive signal generation while errors remain in dispute prevents wasted time during the correction process. You can simultaneously dispute inaccurate information and build new positive trade lines that won’t be affected by those disputes. Opening a credit-builder loan, becoming an authorized user on a well-managed account, or obtaining a secured credit card creates new positive payment history that begins reporting immediately. These parallel improvement strategies ensure that when disputes resolve, your credit file contains both fewer negative items and more positive evaluation signals. The key is selecting account types that report to all three bureaus and that contribute to the specific evaluation factors where your profile needs strengthening.

Utilization engineering represents one of the most powerful optimization techniques for improving credit evaluations after error correction. The widely cited 30% utilization threshold represents a ceiling, not a target—optimal utilization for evaluation purposes typically falls below 10%, with the strongest profiles maintaining utilization under 7% across all revolving accounts. However, per-card utilization ratios matter as much as aggregate utilization. Lenders evaluate both your total credit usage across all cards and your utilization on individual accounts. A borrower with 15% aggregate utilization but one card at 90% utilization triggers different risk signals than someone with 15% utilization distributed evenly across multiple cards.

Structuring payments for maximum evaluation benefit requires understanding reporting cycles and timing. Most creditors report your statement balance to credit bureaus, not your current balance. If you charge $3,000 to a card with a $5,000 limit and pay it off before the due date but after the statement closes, bureaus receive a report showing 60% utilization even though you paid in full. The optimization strategy involves making payments before your statement closing date to ensure low balances get reported. For maximum evaluation impact, consider making multiple payments throughout the month to keep reported balances minimal. Some borrowers strategically prepay cards before statement dates to show near-zero utilization, then use the cards normally afterward—a technique that maintains evaluation strength while preserving credit access.

Creating payment history depth addresses the evaluation weakness that emerges when your credit file lacks sufficient positive data to demonstrate reliability. Lenders want to see consistent on-time payments across multiple account types over extended periods. Adding authorized user accounts provides immediate payment history depth if the primary cardholder maintains excellent payment patterns and the account has substantial age. The authorized user account’s entire history typically appears on your report, instantly adding years of positive payment data. However, choose authorized user relationships carefully—you inherit both positive and negative aspects of the account’s history, and some lenders discount authorized user accounts in their evaluation models.

Credit-builder loans offer another pathway to generate payment history depth, particularly valuable for borrowers with thin files after successful dispute campaigns. These specialized loans hold your borrowed amount in a savings account while you make monthly payments. The lender reports your payments to credit bureaus, building positive payment history, and you receive the loan amount after completing all payments. This structure creates no default risk for lenders while generating the payment history data that evaluation algorithms require. Credit-builder loans typically report as installment loans, adding account diversity if your profile consists primarily of credit cards.

The “thin file after cleanup” problem occurs when successful disputes remove negative items but leave insufficient positive data for approval. You might successfully eliminate erroneous collections and late payments, only to discover that your credit

The Path Forward: Understanding What Really Matters

Your credit score has never told the complete story, but now it barely scratches the surface of how lenders actually evaluate you. The sophisticated algorithms analyzing your credit file examine dozens of data points simultaneously—payment patterns, utilization trends, account diversity, and behavioral signals that traditional scores can’t capture. When errors corrupt this underlying data, they don’t just lower your three-digit number; they distort the evaluation signals that determine whether automated underwriting systems approve or deny your application before human eyes ever review your file. Understanding this multi-layered assessment framework changes everything about how you approach credit repair, shifting focus from score obsession to strategic error correction and signal optimization.

The borrowers who succeed in today’s lending environment recognize that credit management isn’t about chasing score thresholds—it’s about building evaluation profiles that speak the language of modern underwriting algorithms. Error identification and correction form the foundation, but strategic account management, utilization engineering, and payment history depth create the positive signals that translate cleaned credit files into actual approvals. The question isn’t whether your score looks acceptable; it’s whether the data feeding lender evaluation systems accurately represents your creditworthiness and generates the specific risk signals that automated decisioning platforms reward.