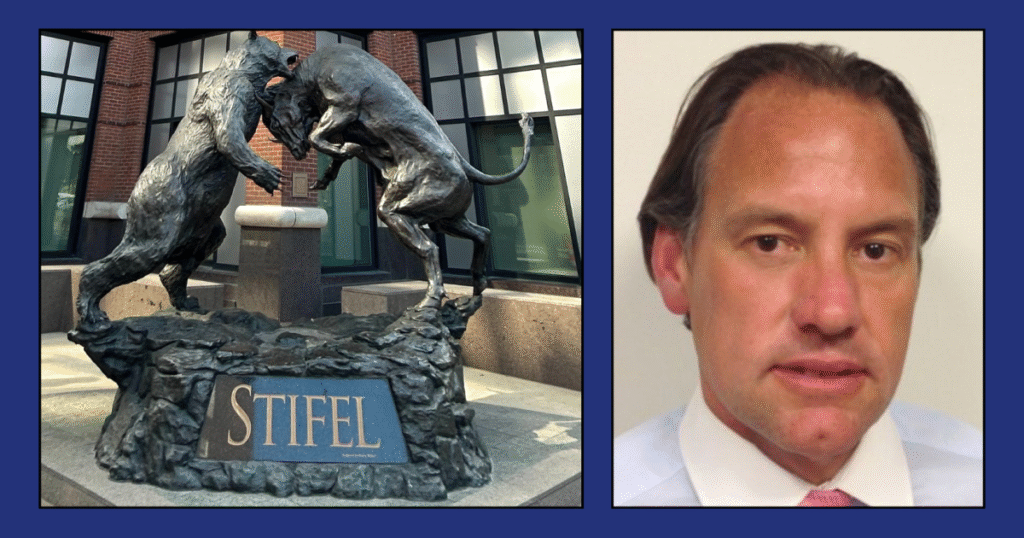

Stifel is adding $850,000 to its growing tab related to a now-barred broker accused of steering clients into unnecessarily risky investments.

Processing Content

The settlement, reached earlier this month over allegations concerning former Stifel advisor Chuck A. Roberts, brings the firm’s tally for settlements and arbitration awards involving him to nearly $200 million. Roberts, who ran a Stifel-affiliated CR Wealth Management Group in Miami and New York, was

Jeffrey Erez, the lawyer representing clients in the disputes against Roberts, said some of the cases also involve regular stock trades and leverage — or using borrowed money in the hopes of boosting investor returns. Erez, the managing partner of Erez Law, said he helped file two new customer disputes against Roberts this month, adding to a pipeline of cases that could increase Stifel’s legal tab still further.

“Clients have continued to contact us seeking recourse, and we continue to pursue claims on their behalf,” he said.

Stifel did not immediately respond to a request for comment.

A $132.5 million arbitration was just the start

Roberts, who resigned from Stifel about a month before his industry ban, has been at the center of several large settlements and arbitration awards. The biggest came in March, when

Stifel

Roberts’ BrokerCheck page shows nearly 40 customer complaints filed against him since 2022. Stifel has settled nine of them for nearly $46.2 million. Three of the complaints have been denied.

When banning Roberts from the industry, FINRA said in its disciplinary notice that he had initially cooperated with its investigation into customer complaints about his recommendations of structured notes. But he later refused to respond to a request FINRA sent in May seeking additional on-the-record testimony from him. Roberts later consented to an industry bar forbidding him to associate with any FINRA member in any capacity.