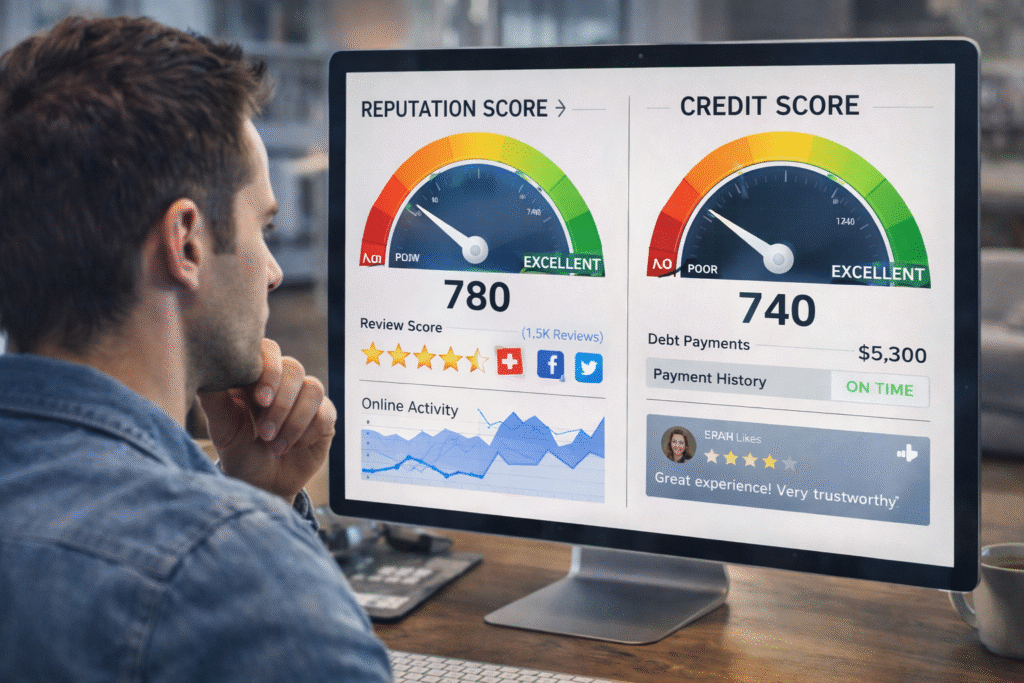

Your credit report tracks payment history, debt levels, and account information. But what if your Instagram posts, LinkedIn activity, and Google search history started shaping your online reputation credit score? Financial institutions are increasingly looking beyond traditional credit data, using sophisticated algorithms to analyze digital behavior patterns that may predict loan repayment ability.

This shift raises serious questions about privacy, fairness, and data power in financial decisions. As some lenders already factor in social media sentiment and online activity, your online reputation credit score may be influenced by signals you never intended to share. Understanding this digital-financial convergence is now essential to protect both your reputation and your credit future.

The Digital-Financial Convergence: Where Online Behavior Meets Credit Assessment

Traditional credit reporting agencies have relied on payment history, debt-to-income ratios, and account longevity for decades. Today, financial institutions increasingly supplement these metrics with alternative data sources that shape your online reputation credit score, reflecting a broader view of borrower behavior. This shift marks a fundamental change in how creditworthiness is assessed, expanding beyond financial transactions into digital behavior patterns that influence online reputation credit score models.

Fintech companies have led the use of social media sentiment analysis in lending, evaluating posting frequency, engagement style, and network connections. Machine learning systems examine not just what you post, but how you interact, the tone of your communications, and the perceived stability of your digital networks—all factors that can indirectly affect your online reputation credit score.

Understanding the difference between correlation and causation is critical as digital behavior feeds into credit risk assessment. Professional online activity may signal stability, but algorithms often treat correlation as justification, shaping online reputation credit score outcomes without clear causal proof. These models create digital credit personas based on browsing habits, app usage, and engagement patterns that may appear unrelated to finances.

Regulatory frameworks continue to lag behind these developments. While laws like the Fair Credit Reporting Act govern traditional credit data, they offer limited clarity on how digital footprints influence online reputation credit score calculations. This gap leaves many consumers unaware that everyday online activity may quietly shape their financial opportunities.

Digital credit assessment now extends far beyond visible social media posts to include metadata from online activity that feeds into your online reputation credit score. Financial institutions analyze transaction timing, device usage, and even how quickly you complete online forms. These subtle digital behaviors can signal employment stability, consistency, and attention to detail—factors increasingly reflected in online reputation credit score models.

Location data and mobility patterns add another dimension to online reputation credit score analysis. Smartphone location services generate detailed records of daily routines, commuting consistency, and lifestyle behaviors. Algorithms may interpret stable movement patterns as reliability, while frequent or irregular travel can be assessed as either financial strength or instability depending on associated spending behavior.

Digital relationship networks further influence online reputation credit score calculations through association-based analysis. Algorithms evaluate not only your direct social media connections, but also email contacts, professional networks, shared devices, and IP addresses. When connected individuals exhibit risky financial behavior, these associations may indirectly affect how your own creditworthiness is assessed.

The algorithmic interpretation of digital communication styles and linguistic patterns adds another dimension to automated risk evaluation. Natural language processing can analyze your writing style, vocabulary choices, and communication patterns across various digital platforms to assess personality traits associated with financial responsibility. These systems might evaluate:

- Consistency in communication tone across platforms

- Use of financial terminology and demonstrated financial literacy

- Response times to important communications

- Grammar and spelling patterns that might indicate attention to detail

- Emotional sentiment in digital communications

Professional online presence carries different weight than personal social media activity in these assessment models. LinkedIn profiles, professional portfolios, and industry-specific platforms often receive more favorable algorithmic treatment than casual social media posts. Your professional digital footprint can demonstrate career progression, skill development, and industry connections that directly correlate with earning potential and financial stability.

The Reputation-Credit Feedback Loop: When Digital Damage Compounds Financial Harm

Negative online content can trigger cascading effects that extend far beyond reputation damage to impact long-term financial opportunities and your online reputation credit score. When negative information appears in search results tied to your name, it can affect employment prospects, which in turn influences income stability and the ability to manage credit obligations. This creates a self-reinforcing cycle where digital reputation issues directly weaken your online reputation credit score over time.

The pathway from online reputation to creditworthiness operates through multiple channels that shape online reputation credit score outcomes. Employers increasingly conduct digital background checks that include social media activity, news mentions, and online reviews. A negative digital footprint can limit job opportunities, reduce salary negotiation leverage, or even lead to job loss—each of which undermines factors that contribute to a healthy online reputation credit score.

Insurance underwriting and loan approval processes have also begun factoring online reputation signals into risk models that influence online reputation credit score assessments. Negative business reviews, controversial social media content, or association with adverse news events can affect financial decisions even when the content has no direct link to repayment behavior. The long lifespan of online content worsens this issue, as reputation recovery often lags far behind traditional credit repair timelines.

The amplification effect of negative online content is especially damaging for individuals already facing financial challenges. Search engines prioritize recent and highly engaged content, allowing negative material to dominate results for extended periods. This digital permanence can suppress recovery by continually influencing lenders, employers, and insurers who indirectly shape your online reputation credit score.

Certain professions face heightened exposure to these risks. Healthcare workers, financial professionals, educators, and licensed specialists undergo greater scrutiny of their digital presence. Negative online content in these fields can trigger licensing reviews, increase insurance costs, or reduce client acquisition—creating direct financial consequences that further erode online reputation credit score stability.

Proactive Digital-Financial Hygiene: Strategic Protection for Your Dual Reputation

Strategic online engagement requires a deliberate approach to digital participation that considers both immediate social goals and long-term financial implications. Creating positive digital footprints involves actively building an online presence that demonstrates the qualities financial institutions value in borrowers. This means maintaining consistent professional profiles, engaging thoughtfully in industry discussions, and demonstrating financial literacy through your digital communications.

Privacy settings and selective content sharing provide essential tools for minimizing risk exposure while maintaining authentic online engagement. Understanding platform-specific privacy controls allows you to share personal content with intended audiences while maintaining a professional public presence. The strategic use of these tools involves regularly auditing your privacy settings, understanding how platform changes might affect your content visibility, and maintaining separate digital personas for different aspects of your life.

The permanence of digital records necessitates proactive content auditing to identify and address potentially problematic information before it impacts financial opportunities. This process involves conducting regular searches of your name across multiple platforms, monitoring what information appears in search results, and taking steps to address negative or misleading content. Professional reputation management often requires ongoing effort rather than one-time cleanup, as new content continuously affects your digital footprint.

Developing a cohesive online presence that aligns personal and professional financial objectives requires careful consideration of how different digital activities support your overall financial goals. Your LinkedIn profile should demonstrate career progression and professional competence, while your social media activity should avoid content that could be interpreted as financially irresponsible or professionally inappropriate. This alignment extends to your digital communication style, the causes you support online, and even the timing of your digital activity.

The balance between authentic self-expression and financial prudence in digital spaces represents one of the most challenging aspects of modern digital-financial hygiene. Complete self-censorship doesn’t prove necessary or healthy, but understanding the potential financial implications of your digital choices allows you to make informed decisions about what to share publicly versus privately. This balance requires ongoing attention as social media platforms evolve and financial institutions develop more sophisticated analysis tools.

Future-Proofing Your Financial Identity: Preparing for the Convergence Era

Alternative credit scoring models continue evolving toward greater integration of digital behavior data, with adoption timelines varying across different types of financial institutions. Traditional banks tend to move more slowly in implementing these technologies due to regulatory constraints and established processes, while fintech lenders and alternative financial services providers often lead in adopting new assessment methods. Understanding these adoption patterns helps you prioritize which aspects of your digital presence require immediate attention versus longer-term planning.

Positioning yourself advantageously for future digital-financial integration involves building positive digital assets that demonstrate financial responsibility and professional competence. This includes maintaining updated professional profiles that showcase career growth, participating constructively in industry discussions, and demonstrating financial literacy through your online communications. Your digital footprint should tell a coherent story about your professional development and financial management capabilities.

Financial education becomes increasingly important as credit ecosystems grow more complex and incorporate additional data sources. Understanding how different types of digital activity might be interpreted by algorithmic assessment systems allows you to make more informed decisions about your online behavior. This education extends beyond traditional credit management to include digital privacy, online reputation management, and the intersection of professional and personal digital presence.

Building resilience against potential algorithmic bias in automated financial decision-making requires diversifying your positive digital presence across multiple platforms and contexts. Relying too heavily on any single platform or type of digital activity creates vulnerability if that platform’s data becomes less favorable in algorithmic assessments. A robust digital presence spans professional networks, industry publications, educational platforms, and appropriate social media engagement that collectively demonstrates your reliability and competence.

Professional credit repair services increasingly need to address both traditional credit report errors and emerging digital reputation challenges that impact financial opportunities. These services must evolve to include digital footprint analysis, online reputation monitoring, and strategies for addressing negative digital content that could influence credit decisions. The integration of these services reflects the growing recognition that credit health and digital reputation are becoming inseparably linked in modern financial assessment processes.

Conclusion: Navigating the New Reality of Digital-Financial Identity

The convergence of online reputation and credit assessment represents more than a technological shift—it’s a fundamental transformation in how financial opportunity is determined. Your digital footprint now carries weight that extends far beyond social connections or professional networking, shaping your online reputation credit score and influencing access to credit, employment, and financial services. While traditional credit metrics remain important, algorithms analyzing online behavior are quietly redefining financial assessment, often without consumers’ knowledge or explicit consent.

This new reality doesn’t require you to abandon authentic digital expression, but it does demand strategic awareness of how your online presence might be interpreted by financial institutions. The gap between current regulations and technological capabilities leaves consumers vulnerable to decisions made by algorithms they don’t understand, using data they may not even realize is being collected. As this digital-financial integration accelerates, your ability to maintain both authentic online engagement and financial opportunity will depend on understanding that in the modern economy, your reputation isn’t just your brand—it’s becoming your credit score.