Derek Hagen, CFA, CFP®, FBS®, CFT™

“There is nothing so useless as doing efficiently that which should not be done at all.”

-Peter Drucker

Meaningful spending isn’t about choosing experiences over things. It’s about understanding what your money makes possible.

Why “Buy Experiences, Not Things” Is Popular Advice

Advisors have likely heard, and repeated, the familiar guidance that people should buy experiences rather than things if they want a more meaningful life. The research supporting this idea is real: experiences are often social, create stronger anticipation, and generate richer memories than many material purchases.

Viewed through the anticipation–experience–memory framework, experiences frequently outperform things at every stage.

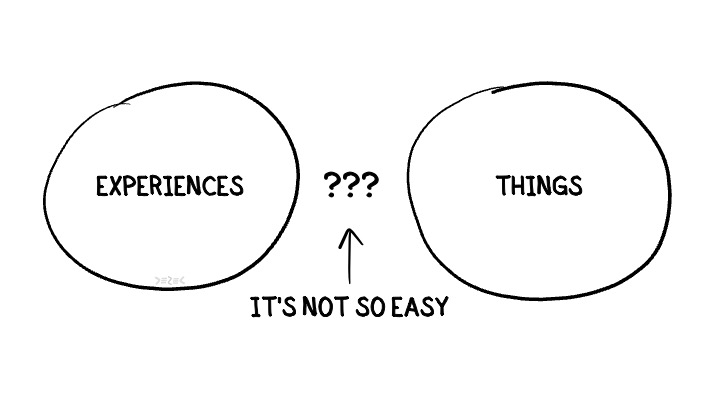

But the advice becomes problematic when taken too literally. It creates a false dichotomy.

A television may appear to be “just a thing.” Yet if it enables weekly family movie nights, shared rituals, or regular connection, the purchase is functioning as an experience. Likewise, skiing is clearly an experience, but it cannot happen without skis.

Experiences versus things is not a clean divide.

Why Experiences vs. Things Is a False Dichotomy

The central flaw in the advice is this: experiences often require things, and things frequently provide experiences.

Most purchases that look like “things” on the surface, like cars, furniture, kitchen tools, sports equipment, may actually be funding something deeper:

- Weekly family movie nights

- Camping trips

- Shared meals

- Active hobbies

- Time together

What matters most is not what is being purchased, but why.

What Matters Is Not the Purchase, but What It Enables

A more useful client conversation focuses on whether a purchase is being made for an experience or instead of an experience.

Clients often buy things because:

- “People like us buy things like this”

- It signals status or success

- It promises comfort or convenience

- It supports a story they tell themselves

But in many cases, things are experience-enablers. They make meaningful activities possible.

Skiing is the experience. Skis are the enabler.

Hiking boots can be about fashion or about getting outside consistently.

Kitchen gadgets can reinforce an identity or enable shared meals and connection.

The advisor’s role is not to judge the purchase, but to help clients distinguish signal from substance.

Want to watch instead?

Get notified when the latest articles are published.

When Buying Things Actually Works

In some cases, renting an experience-enabling item is rational. In others, ownership is the better choice.

A helpful lens here is cost per use.

If a client skis once, renting equipment may cost $50. Buying $2,000 worth of gear for a single use is inefficient.

But if the client skis weekly for four months, ownership quickly lowers the cost per use, and adds convenience, consistency, and commitment.

The math is only part of the story. Regular use also increases:

- Memory accumulation

- Anticipation

- Skill development

- Identity reinforcement

From Spending Rules to Spending Clarity

Any framework that encourages spending requires caution. Humans are excellent at justifying purchases after the fact.

That’s why questions like “Do I need this?” or even “Does this enable an experience?” are often insufficient. A new pair of skis enables skiing… unless the client already owns last year’s skis and is really purchasing novelty, status, or optimization.

The real objective is clarity.

When advisors help clients understand how their spending connects to the experiences they value, money becomes less about restraint and more about alignment.

That’s where meaningful planning lives.

FAQ: “Buy Experiences, Not Things” in Financial Planning

Why is “buy experiences, not things” considered oversimplified advice?

Because many experiences require things to happen. The advice creates a false divide between experiences and material purchases, ignoring how closely they are connected.

What does it mean for a purchase to “enable an experience”?

An experience-enabling purchase supports meaningful activities or connection, such as family movie nights, shared meals, or active hobbies.

How can advisors evaluate whether a purchase is aligned or not?

Advisors can explore how often the item will be used, what experience it supports, and whether it reinforces a valued identity or simply novelty or status.

When does buying things actually make sense?

Buying things works when ownership lowers cost per use, increases consistency, and deepens commitment to experiences the client truly values.

What’s the advisor’s role in spending decisions?

The advisor’s role is not to judge purchases, but to help clients distinguish between spending that aligns with their values and spending driven by habit, status, or impulse.

Want to Learn More?

Money Quotient trains financial professionals in the True Wealth process and helps them implement the concepts into their practices. The first step is to learn about the Fundamentals of True Wealth Planning.

References and Influences

Ariely, Dan & Jeff Kreisler: Dollars and Sense

Clements, Jonathan: How to Think About Money

Dunn, Elizabeth & Michael Norton: Happy Money

Gilbert, Daniel: Stumbling on Happiness

Hagen, Derek: Your Money, Your Values, and Your Life

Housel, Morgan: The Psychology of Money

Robin, Vicki: Your Money or Your Life