“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t, pays it.” — Albert Einstein

Money doesn’t grow on trees — but with compound interest, it can almost feel like it does.

Imagine putting a small amount of money away and watching it multiply over time, not because you keep adding more, but because your money earns more money for you. That’s the magic of compounding.

In this article, we’ll dive deep into how compound interest works, why it’s so powerful, and how even tiny investments can grow into large sums if you give them enough time.

What Is Compound Interest in Simple Words?

At its core, compound interest means earning interest on your interest.

Let’s break it down with a simple example:

-

You invest $1000 at an annual interest rate of 10%.

-

After one year, you earn $100 in interest (10% of $1000).

-

In the second year, you earn 10% again — but this time it’s on $1100 (your original $1000 + $100 interest).

So you earn $110 in year two instead of $100.

This process continues, and over time, the growth accelerates — because every bit of interest you earn starts earning its own interest.

That’s why compounding is often called “the snowball effect” — your money starts small but rolls faster and faster as time goes on.

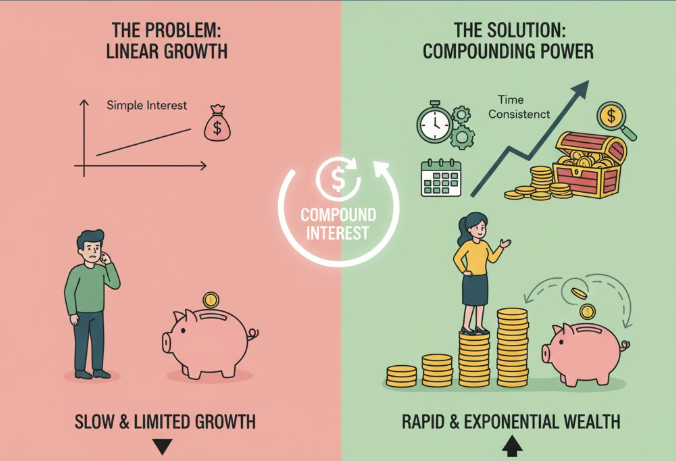

Simple Interest vs. Compound Interest

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Formula | Principal × Rate × Time | Principal × (1 + Rate)^Time – Principal |

| Growth Pattern | Linear | Exponential |

| Interest Earned On | Original amount only | Original amount + accumulated interest |

| Example (10% for 3 years on $1000) | $300 | $331 |

| Best For | Short-term loans or fixed deposits | Long-term savings, retirement, investments |

Key takeaway:

While simple interest gives you steady growth, compound interest gives you accelerating growth — the longer you invest, the faster your money multiplies.

How Compounding Actually Builds Wealth

The magic lies in time and reinvestment.

Every time you earn interest, instead of withdrawing it, you reinvest it back into your account.

That reinvested interest earns even more interest in the next cycle.

Here’s the formula to calculate compound interest:

A=P(1+r/n)ntA = P (1 + r/n)^{nt}

Where:

-

A = Future value (total amount after time)

-

P = Principal amount (initial investment)

-

r = Annual interest rate (in decimal)

-

n = Number of times interest is compounded per year

-

t = Number of years

Example: The $1,000 Miracle

Let’s see how this plays out in real numbers.

| Year | Starting Balance | Interest (10%) | Ending Balance |

|---|---|---|---|

| 1 | $1,000 | $100 | $1,100 |

| 2 | $1,100 | $110 | $1,210 |

| 3 | $1,210 | $121 | $1,331 |

| 5 | $1,610 | $161 | $1,771 |

| 10 | $2,594 | $259 | $2,853 |

| 20 | $6,727 | $673 | $7,400 |

| 30 | $17,449 | $1,745 | $19,194 |

Your $1,000 turns into nearly $19,000 in 30 years — without adding another cent!

That’s the power of compound interest.

Why Starting Early Changes Everything

If you remember one thing about compounding, let it be this:

⏳ The earlier you start, the more time your money has to grow.

Let’s compare two friends:

Case Study: Emma vs. Jack

| Person | Starts Investing At | Amount Invested Monthly | Stops Investing At | Total Invested | Value at Age 60 (10%) |

|---|---|---|---|---|---|

| Emma | 25 | $100 | 35 | $12,000 | $318,000 |

| Jack | 35 | $100 | 60 | $30,000 | $180,000 |

Even though Jack invests more money, Emma ends up with nearly twice as much because she started 10 years earlier.

That’s how time beats effort in compounding.

The Rule of 72 — Your Shortcut to Doubling Money

There’s a quick trick to estimate how fast your money doubles with compound interest — it’s called the Rule of 72.

Formula:

Years to Double=72Interest RateYears\ to\ Double = \frac{72}{Interest\ Rate}

Examples:

-

At 6% interest, your money doubles in 12 years.

-

At 8% interest, it doubles in 9 years.

-

At 12% interest, it doubles in 6 years.

This rule helps you understand how small differences in interest rate can dramatically affect your future wealth.

Frequency of Compounding — The More, The Better

Interest can be compounded at different intervals:

-

Annually (once a year)

-

Quarterly (4 times a year)

-

Monthly (12 times a year)

-

Daily (365 times a year)

The more frequently your interest is compounded, the faster your money grows.

Let’s look at an example:

| Compounding Frequency | Final Amount After 10 Years (on $10,000 @10%) |

|---|---|

| Annually | $25,937 |

| Quarterly | $26,870 |

| Monthly | $27,070 |

| Daily | $27,159 |

Even though the difference looks small, over decades, it becomes huge.

Small Steps, Big Results — The Power of Consistency

You don’t need a lot of money to start investing — you just need consistency.

Example: The Monthly Saver

If you invest $100 every month for 30 years at 10% annual return:

You’ll contribute only $36,000,

but your account will grow to $197,000+!

That’s more than 5 times your total investment — all thanks to compounding.

Visualizing the Growth — The Exponential Curve

If we were to draw it on a chart:

The curve starts off slow and then shoots upward — that’s exponential growth.

At first, compounding seems small and boring, but as the years pass, growth explodes.

Real-Life Examples of Compound Interest in Action

1. Retirement Accounts (401k, IRA, etc.)

When you contribute regularly to a retirement account, your investments compound over decades.

This is how many people retire as millionaires even on average salaries.

2. Dividend Reinvestment Plans (DRIPs)

If you invest in dividend-paying stocks and reinvest your dividends instead of cashing them out, your shares multiply over time — compounding your returns.

3. Mutual Funds and ETFs

Mutual funds reinvest profits back into the fund.

The more they earn, the more your share value grows through compounding.

4. Savings Accounts

Even though interest rates are low, high-yield savings accounts or certificates of deposit (CDs) also use compounding to grow your savings safely.

How to Make Compound Interest Work for You

Here’s how you can start building wealth through compounding — step by step:

1. Start as Early as Possible

Even if it’s just $10 or $20 a month, start today. Time is your biggest ally.

2. Automate Your Investments

Set up automatic transfers to savings or investment accounts. Consistency fuels compounding.

3. Reinvest Your Earnings

Never withdraw your interest, dividends, or profits — let them compound.

4. Increase Contributions Over Time

As your income grows, gradually raise your monthly investment.

5. Avoid Debt

High-interest debt works against you. Instead of earning compound interest, you’ll be paying it.

6. Stay Invested Long-Term

Avoid pulling money out during short-term market drops. Compounding needs time and patience.

Compound Interest in Reverse — The Debt Trap

Compound interest isn’t always your friend.

If you owe money on credit cards or loans with high interest, compounding can work against you.

Example:

If you owe $1,000 on a credit card with 20% annual interest, and don’t make payments:

-

After 1 year → $1,200

-

After 2 years → $1,440

-

After 3 years → $1,728

Your debt keeps growing even if you don’t borrow more.

That’s why it’s crucial to pay off high-interest debts quickly — or else compound interest will grow your liability instead of your wealth.

Smart Investment Options That Use Compounding

| Investment Type | Average Return | Compounding Benefit | Risk Level |

|---|---|---|---|

| Savings Account | 3–4% | Low growth, low risk | Very Low |

| Mutual Funds / ETFs | 7–10% | Steady long-term compounding | Medium |

| Stocks | 8–12% | High compounding over time | High |

| Real Estate | 6–9% | Property value + rent reinvestment | Medium |

| Fixed Deposits / Bonds | 5–7% | Stable compounding | Low |

Each of these options compounds differently, but they all reward patience and time.

How Inflation Affects Compound Interest

While compounding grows your money, inflation can eat away at its value.

If inflation is 4% and your investment earns 8%, your real return is about 4%.

So always choose investments that outpace inflation — otherwise, your money’s “buying power” decreases over time.

How to Calculate Compound Interest Easily

If you want to estimate your future wealth, use compound interest calculators online or the formula below:

A=P(1+rn)ntA = P (1 + \frac{r}{n})^{nt}

Example:

You invest $5,000 at 8% for 15 years (compounded annually):

A = 5000 (1 + 0.08)^{15} = 5000 \times 3.172 = \textbf{$15,860}

Your $5,000 turns into nearly $16,000 — tripling without any extra deposits!

Common Mistakes That Ruin Compounding

-

Starting too late — the biggest mistake of all.

-

Stopping contributions too early — breaks the momentum.

-

Withdrawing interest or dividends — slows growth.

-

Chasing quick profits — short-term trading disrupts compounding.

-

Falling into debt — paying compound interest instead of earning it.

Avoid these pitfalls, and compounding will work in your favor for life.

Quick Tips to Supercharge Compounding

-

💡 Start small, but start now.

-

💡 Reinvest everything you earn.

-

💡 Increase investments yearly (even 5–10% more helps).

-

💡 Choose long-term assets (mutual funds, index funds, etc.).

-

💡 Keep fees low — high fees reduce your returns over time.

-

💡 Stay consistent and patient — the real magic happens after years, not months.

The Emotional Side — Building a Wealth Mindset

Compound interest isn’t just about numbers — it’s about mindset.

When you invest regularly and see your money grow, you develop:

-

Discipline — sticking to long-term plans.

-

Patience — waiting for results instead of chasing quick wins.

-

Confidence — seeing your wealth build steadily.

-

Freedom — knowing your money is working for you, not the other way around.

That’s what real financial independence feels like.

Conclusion — Let Time Be Your Best Investor

The power of compound interest proves that wealth isn’t about luck, it’s about time, patience, and smart habits.

Even small, consistent investments can grow into life-changing amounts when given years to multiply.

Every dollar you invest today is a seed — plant it, nurture it, and give it time to grow.

Years from now, you’ll thank yourself for starting early.

Final Words of Wisdom:

“Do not wait to invest until you have a lot of money.

Invest so that one day, you will have a lot of money.”