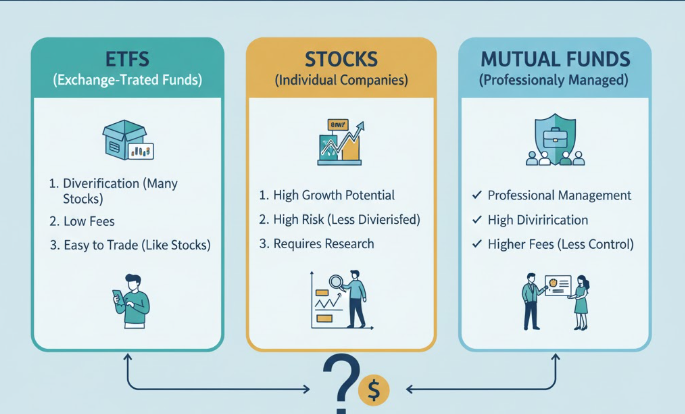

When you first step into the world of investing, you’ll quickly come across three popular options — ETFs (Exchange-Traded Funds), Stocks, and Mutual Funds. Each offers a different way to grow your money, but they also come with their own levels of risk, management style, and costs.

If you’re new to investing and wondering “Which one is best for me?” — this article will break everything down in simple, easy-to-understand language. By the end, you’ll know exactly how these investment options work, how they differ, and which one fits your beginner investing goals best.

What Are Stocks, ETFs, and Mutual Funds?

Before comparing them, let’s make sure we clearly understand what each one means in simple terms.

1. Stocks — Owning a Piece of a Company

When you buy a stock, you’re buying a small portion (called a share) of a company. For example, if you buy Apple stock, you become a part-owner of Apple.

How you make money:

-

If Apple’s stock price goes up, the value of your investment increases.

-

You may also receive dividends, which are small cash payments companies give to shareholders.

Key takeaway:

Stocks are direct investments in a company — simple but can be risky since your money depends on that one company’s performance.

2. Mutual Funds — Professionally Managed Pools of Money

A mutual fund gathers money from many investors and invests it in a diversified mix of stocks, bonds, or other assets.

How it works:

You and thousands of other investors contribute to one large pool. A professional fund manager uses this pool to buy a variety of investments based on the fund’s goal.

Key takeaway:

Mutual funds are perfect for those who want diversification (spreading risk) and professional management without personally choosing stocks.

3. ETFs (Exchange-Traded Funds) — The Modern Blend

An ETF is similar to a mutual fund — it also holds a basket of investments. The difference is that ETFs trade on the stock market just like stocks.

That means you can buy and sell ETFs throughout the day, and their prices change in real time.

Key takeaway:

ETFs offer the diversification of mutual funds plus the flexibility and trading convenience of stocks.

At a Glance: Quick Comparison Table

| Feature | Stocks | ETFs | Mutual Funds |

|---|---|---|---|

| Ownership | One company | Basket of companies/assets | Basket of companies/assets |

| Diversification | Low | High | High |

| Management | Self-managed | Passive or active | Mostly active |

| Trading Style | Real-time trading | Real-time trading | End-of-day pricing |

| Fees | Low (except trading costs) | Low | Moderate to high |

| Minimum Investment | 1 share | 1 share | Often $500+ |

| Tax Efficiency | High | Very high | Low to moderate |

| Best For | Confident, active investors | Beginners and passive investors | Hands-off investors |

How They Differ: Breaking Down the Key Features

Let’s dive deeper into how ETFs, stocks, and mutual funds differ in important aspects like cost, risk, management, and flexibility.

1. Risk and Diversification

-

Stocks: When you buy a single stock, your money is tied to that company. If it performs well, you gain big. But if it crashes, you lose heavily.

-

ETFs: ETFs hold many stocks (or other assets), so your risk is spread out. If one company fails, others in the ETF may balance it out.

-

Mutual Funds: Also diversified, but often actively managed — meaning a manager picks which stocks to buy or sell.

📊 Example Comparison Chart:

| Investment Type | Risk Level | Diversification | Example |

|---|---|---|---|

| Stocks | High | Low | Tesla stock |

| ETFs | Moderate | High | S&P 500 ETF |

| Mutual Funds | Moderate | High | Vanguard Total Market Fund |

Winner for Beginners: ✅ ETFs or Mutual Funds — because they reduce risk through diversification.

2. Cost and Fees

Fees might seem small, but they can eat up a huge chunk of your profits over time.

-

Stocks: You only pay when you buy or sell (small brokerage fee).

-

ETFs: Have expense ratios (small annual management fees), but they’re usually very low — often below 0.1%.

-

Mutual Funds: Have higher expense ratios (0.5% to 2%+), and sometimes sales charges (front-load or back-load fees).

📉 Example:

If you invest $10,000:

-

ETF fee (0.1%) = $10 per year

-

Mutual fund fee (1%) = $100 per year

Over 20 years, that difference can add up to thousands of dollars!

Winner for Beginners: ✅ ETFs — low-cost and efficient.

3. Management Style

-

Stocks: You manage everything yourself. You decide what to buy, when to sell, and how much to invest.

-

ETFs: Usually passively managed — they track an index like the S&P 500, so no manager is making daily decisions.

-

Mutual Funds: Usually actively managed by professionals who try to beat the market (though few consistently do).

Winner for Beginners: ✅ ETFs — you get diversification and professional design without constant management or high fees.

4. Liquidity and Trading Flexibility

-

Stocks: Can be bought or sold anytime during market hours at real-time prices.

-

ETFs: Same as stocks — you can trade throughout the day.

-

Mutual Funds: Only trade once a day, after markets close. You don’t know the exact price until then.

Winner for Beginners: ✅ ETFs or Stocks — easy to trade whenever you want.

5. Tax Efficiency

Taxes can quietly take away your gains. Here’s how they compare:

-

Stocks: You pay tax when you sell (capital gains) or receive dividends.

-

ETFs: Very tax-efficient due to their structure; they rarely trigger capital gains for investors.

-

Mutual Funds: Can generate capital gains taxes even if you didn’t sell your shares, because the manager buys and sells assets inside the fund.

Winner for Beginners: ✅ ETFs — lower taxes mean higher long-term returns.

6. Minimum Investment Requirements

-

Stocks: You can buy as little as one share.

-

ETFs: Same — you can start with the price of one share (some brokers even allow fractional shares).

-

Mutual Funds: Many require a minimum investment, usually between $500 and $3,000.

Winner for Beginners: ✅ ETFs or Stocks — low entry barriers.

Real-Life Example: Comparing Three Investors

Let’s say three beginners — Ayesha, Bilal, and Hassan — each have $1,000 to invest.

| Investor | Option | Investment Style | Result After 1 Year (Hypothetical) |

|---|---|---|---|

| Ayesha | Stocks (Tesla) | Bought one stock | +25% gain but high risk |

| Bilal | ETF (S&P 500 ETF) | Bought index ETF | +10% gain, low risk |

| Hassan | Mutual Fund | Actively managed fund | +8% gain after 1% fee deduction |

This simple scenario shows that while all three made money, Bilal (ETF investor) got steady growth with lower risk and cost — making ETFs a solid option for most beginners.

Pros and Cons of Each Investment Type

Stocks

Pros:

-

Direct ownership in a company

-

High return potential

-

No management fees

Cons:

-

High risk (no diversification)

-

Requires research and monitoring

-

Emotional decisions can hurt returns

ETFs

Pros:

-

Diversified and low-risk

-

Low fees and taxes

-

Easy to buy/sell anytime

-

Perfect for passive investing

Cons:

-

Still affected by market volatility

-

Tracking errors can occur (minor difference from index)

Mutual Funds

Pros:

-

Professionally managed

-

Good diversification

-

Automatic reinvestment options

Cons:

-

Higher fees

-

Limited trading flexibility

-

Tax inefficiency

Which One Fits Your Beginner Investor Personality?

Here’s a quick personality-based guide:

| Investor Type | Ideal Choice | Why |

|---|---|---|

| Hands-off beginner | ETF | Set it and forget it — easy and cheap |

| Curious learner | Stocks | Great for learning about companies and markets |

| Conservative saver | Mutual Fund | Professional management with moderate returns |

| Long-term builder | ETF or Mutual Fund | Diversification and compounding potential |

| Risk-taker | Stocks | High potential returns but more volatility |

Performance Comparison Over Time

Imagine you invested $10,000 in 2003 in each option and held it for 20 years:

| Investment Type | Average Annual Return | Value in 2023 (Approx.) |

|---|---|---|

| S&P 500 ETF | 9.5% | $61,000 |

| Actively Managed Mutual Fund | 8% | $46,600 |

| Individual Stock (e.g., Apple) | 20%+ (if lucky) or -50% (if unlucky) | $160,000 or $5,000 |

Takeaway: ETFs offer a balanced path — not too risky, not too boring, and great for long-term growth.

The Power of Diversification in ETFs and Mutual Funds

Think of diversification like spreading your eggs into different baskets.

-

A single stock = 1 basket.

-

An ETF or mutual fund = hundreds of baskets.

Here’s an example:

| Asset | Stock | ETF | Mutual Fund |

|---|---|---|---|

| Technology | 100% Apple | 20% Apple, 20% Google, 20% Amazon, etc. | Similar mix, decided by manager |

When one company’s performance drops, others can lift your overall returns — protecting you from big losses.

Costs Over 10 Years: A Hidden but Crucial Difference

| Type | Annual Fee | Investment | 10-Year Cost | Ending Value (Assuming 8% Returns) |

|---|---|---|---|---|

| Stocks | 0% | $10,000 | $0 | $21,589 |

| ETFs | 0.1% | $10,000 | $100 | $21,470 |

| Mutual Funds | 1.0% | $10,000 | $1,000 | $19,417 |

The difference may not look huge yearly, but over time, those fees can cost you thousands.

How Beginners Can Start Investing in ETFs, Stocks, or Mutual Funds

Here’s a step-by-step guide for absolute beginners:

Step 1: Set Your Financial Goal

Decide what you’re investing for — retirement, education, or passive income.

Step 2: Choose a Reliable Brokerage Account

Popular platforms include:

-

Vanguard

-

Fidelity

-

Charles Schwab

-

Robinhood

-

Interactive Brokers

Step 3: Start Small

Even $50–$100 a month can make a big difference thanks to compound growth.

Step 4: Diversify Early

Don’t put all your money into one company. Choose a broad ETF or mutual fund.

Step 5: Stay Consistent

Invest regularly and avoid emotional trading — long-term consistency beats short-term luck.

Bonus: Simple ETF Portfolio for Beginners

| ETF Type | Example | Purpose |

|---|---|---|

| U.S. Market | Vanguard Total Stock Market ETF (VTI) | Covers the entire U.S. stock market |

| International | iShares MSCI ACWI ETF (ACWI) | Global diversification |

| Bonds | iShares U.S. Treasury Bond ETF (GOVT) | Adds safety and stability |

With just 3 ETFs, you can build a complete, low-cost diversified portfolio.

Final Verdict: Which Is Better for Beginners?

Here’s the summary table:

| Feature | Stocks | ETFs | Mutual Funds |

|---|---|---|---|

| Risk | High | Moderate | Moderate |

| Cost | Low | Very low | High |

| Diversification | Low | High | High |

| Tax Efficiency | Good | Excellent | Average |

| Ease for Beginners | Medium | Excellent | Good |

| Long-Term Growth Potential | High (with skill) | High | Moderate |

✅ Best Choice for Beginners: ETFs

ETFs give you the diversification of mutual funds, low costs, and flexibility of stocks — all in one package.

Conclusion: The Smart Start to Your Investment Journey

If you’re new to investing, the most important thing is to start early, stay consistent, and avoid unnecessary risks.

-

Stocks can be exciting but volatile.

-

Mutual Funds offer professional management but come with higher costs.

-

ETFs, on the other hand, provide balance, simplicity, and affordability, making them a perfect choice for beginners.

Remember: you don’t need to be an expert to begin — you just need to take the first step.

Even small investments today can grow into something big tomorrow through the power of time and compounding.

So, whether you choose ETFs, stocks, or mutual funds — the best investment is the one you actually start.