DIY Credit Repair: How to Fix Your Credit Without Paying for Help

Your step-by-step roadmap to rebuilding your financial reputation—without hiring anyone.

Introduction: Why Fixing Your Credit Is Worth the Effort

Your credit score is more than just a number—it’s a reflection of your financial health. It determines whether you can get a loan, rent an apartment, buy a car, or even land a job in some cases.

But here’s the good news: you don’t need to pay expensive “credit repair companies” to fix your credit. In fact, you can do everything they do—often better—by yourself for free.

This guide will walk you through practical, step-by-step methods to repair your credit score, clean up errors, manage debts smartly, and rebuild your financial future—all on your own.

Let’s dive in and start taking back control of your credit life.

What Exactly Is a Credit Score?

Before fixing your credit, it’s important to know how the system works.

Your credit score is a three-digit number (usually between 300 and 850) that lenders use to assess your creditworthiness. It’s based on your credit report, which includes your payment history, outstanding debts, length of credit history, types of credit, and recent inquiries.

Credit Score Ranges (FICO Model)

| Score Range | Rating | What It Means |

|---|---|---|

| 800–850 | Excellent | You’re a credit superstar—eligible for the best rates. |

| 740–799 | Very Good | You’re financially responsible and trusted by lenders. |

| 670–739 | Good | Average or slightly above—acceptable to most lenders. |

| 580–669 | Fair | Lenders may view you as risky—higher interest rates likely. |

| 300–579 | Poor | You may face loan denials or need a co-signer. |

Step 1: Get Your Free Credit Reports

Your first move in the DIY credit repair process is to know exactly what’s on your credit report.

Where to Get It

You’re entitled to a free credit report once per year from each of the three major credit bureaus:

-

Equifax

-

Experian

-

TransUnion

Visit AnnualCreditReport.com — it’s the official site authorized by federal law.

💡 Pro Tip: During special times (like after COVID-19), the bureaus often allow free weekly reports, so check their sites directly.

Step 2: Review Your Credit Report for Errors

Once you have your reports, go through each line carefully.

You might be surprised—errors are more common than you think.

Common Mistakes to Look For

-

Accounts that don’t belong to you

-

Incorrect balances or credit limits

-

Late payments that were actually paid on time

-

Duplicate accounts

-

Old debts that should’ve been removed (most drop off after 7 years)

-

Misspelled names or wrong addresses

Make a list of everything that looks suspicious or incorrect.

Even one mistake can cost you dozens of credit points.

Step 3: Dispute Errors the Smart Way

Credit bureaus are required by law (under the Fair Credit Reporting Act) to investigate any errors you dispute.

You can file disputes online, by mail, or by phone, but writing a formal letter is often the most effective.

How to Write a Credit Dispute Letter

Here’s a simple format:

Where to Send It

Each bureau has its own mailing address and online dispute form:

-

Experian: experian.com/disputes

-

Equifax: equifax.com/personal/credit-report-services/credit-dispute/

-

TransUnion: transunion.com/credit-disputes/dispute-your-credit

The bureau must investigate within 30 days and notify you of the result.

Step 4: Tackle Past-Due Accounts

Now it’s time to face your actual debt—not just errors.

If you have accounts marked as “past due,” take action fast.

These damage your score more than almost anything else.

What You Can Do:

-

Bring accounts current:

Pay the overdue amount to get back on track. -

Negotiate with lenders:

Many creditors will accept a “pay for delete” or settlement offer—especially if you’ve been consistent recently. -

Ask for goodwill adjustments:

If you missed a payment but have been a loyal customer, write a goodwill letter asking them to remove the late mark as a courtesy.

Step 5: Reduce Your Credit Card Balances

Your credit utilization ratio—the percentage of your available credit you’re using—makes up about 30% of your score.

Here’s how it works:

| Example | Credit Limit | Balance | Utilization |

|---|---|---|---|

| Card A | $1,000 | $300 | 30% |

| Card B | $2,000 | $1,800 | 90% |

Experts recommend keeping your utilization below 30%—ideally under 10%.

Tips to Lower Utilization

-

Pay off small balances first (known as the snowball method)

-

Ask for a credit limit increase (if your finances are stable)

-

Make multiple payments per month instead of waiting for the due date

-

Avoid closing old credit cards—it reduces your total available credit

Step 6: Create a Realistic Budget

You can’t fix what you can’t control.

A budget helps you manage money, avoid new debt, and keep payments on time.

Simple Budget Formula

| Category | Ideal % of Income |

|---|---|

| Housing | 30% |

| Transportation | 15% |

| Food | 10–15% |

| Savings/Debt Repayment | 20% |

| Utilities | 10% |

| Entertainment & Other | 10% |

You can use free apps like Mint, YNAB, or Excel sheets to track your spending.

🧩 Pro Tip: Automate your bill payments and savings. It helps build consistency—something lenders love to see.

Step 7: Deal with Collection Accounts Wisely

If a debt has gone to collections, don’t panic—you still have options.

Your Action Plan:

-

Verify the debt:

Ask for a “debt validation letter” from the collector. They must prove the debt is yours. -

Negotiate a settlement:

Offer to pay a percentage (like 50–70%) in exchange for a “paid in full” status. -

Request removal:

Once paid, ask the collector to remove the account from your report.

(They’re not required to, but some will agree in writing.)

Remember: Paying off collections won’t erase them immediately, but it looks better to lenders and can still boost your score.

Step 8: Build Positive Credit History

After cleaning up negative items, focus on adding good credit behavior.

Ways to Rebuild:

-

Apply for a secured credit card (you deposit money as collateral)

-

Become an authorized user on a responsible person’s account

-

Use credit-builder loans from online banks or credit unions

-

Pay every bill on time, no exceptions

Even small actions—like keeping utility or phone bills current—help prove you’re reliable.

Step 9: Keep Your Credit Mix Balanced

Credit scoring models favor a diverse mix of accounts—both revolving (credit cards) and installment loans (auto, student, or personal loans).

⚖️ A mix shows you can handle different types of credit responsibly.

If you only have one kind, consider safely adding another type—but only if you can manage it.

Step 10: Monitor Your Credit Regularly

Credit repair isn’t a one-time task—it’s ongoing.

You should check your score every month to catch new issues early.

Free Credit Monitoring Tools

-

Credit Karma

-

Experian Free Credit Monitoring

-

WalletHub

-

Capital One CreditWise

These platforms send alerts for changes—like new accounts, inquiries, or missed payments.

Step 11: Be Patient and Persistent

Credit repair takes time. Depending on your history, you may see small improvements within 3 months and significant gains in 6–12 months.

Don’t get discouraged if progress feels slow—credit scores reward consistency, not quick fixes.

Timeline Snapshot

| Time Period | What to Expect |

|---|---|

| 1–3 Months | Errors removed, minor score bumps |

| 3–6 Months | Lower balances, improved payment history |

| 6–12 Months | Noticeable rise in score and better loan offers |

Common DIY Credit Repair Myths (Busted!)

| Myth | Reality |

|---|---|

| “I can pay someone to erase all negative items.” | False. Only inaccurate items can be removed legally. |

| “Checking my credit hurts my score.” | False. Only hard inquiries from lenders affect your score. |

| “Paying off old debts resets the 7-year rule.” | Not true. The 7-year period starts from the first missed payment. |

| “Closing credit cards improves my score.” | Actually, it can hurt your score by reducing your available credit. |

Bonus Tip: Avoid Scams and Fake Credit Repair Promises

Many “credit repair agencies” claim they can boost your score overnight—but most just take your money and use the same free steps you can do yourself.

Red Flags of a Credit Repair Scam

-

They ask for upfront payment

-

They promise a specific score increase

-

They advise you to dispute everything, even true items

-

They offer to create a new identity (this is illegal!)

Always remember: No one can legally remove accurate negative information.

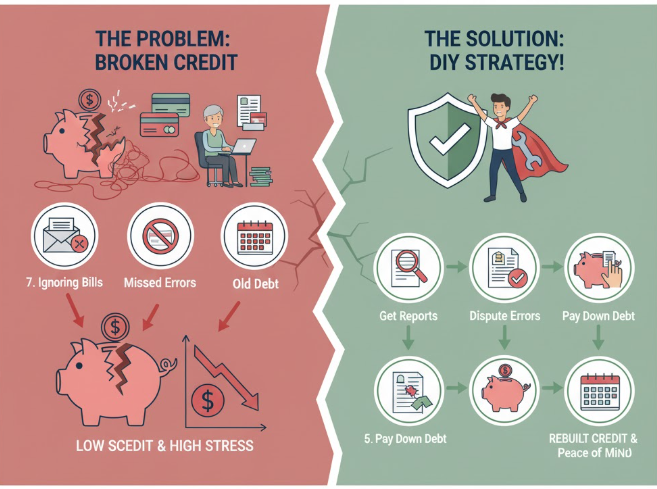

Infographic: Your DIY Credit Repair Journey

(If this were a blog post, this section would include a simple infographic showing the 10-step journey:)

-

Get Reports → 2. Check for Errors → 3. Dispute → 4. Pay Past-Due → 5. Lower Utilization → 6. Budget → 7. Handle Collections → 8. Build New Credit → 9. Mix It Up → 10. Monitor Progress

Frequently Asked Questions (FAQs)

1. How long does credit repair take?

It depends on your situation. Minor errors may improve your score within 30–60 days, while serious delinquencies can take 6–12 months of consistent effort.

2. Can I remove accurate negative marks?

No. You can only remove inaccurate or outdated information.

Accurate negatives will eventually fall off after 7 years.

3. Does paying off collections improve my score?

Usually yes, especially if the account changes to “paid in full.”

Some scoring models (like FICO 9 and VantageScore 4.0) ignore paid collections entirely.

4. Will applying for new credit cards hurt me?

Each new application triggers a hard inquiry, which can lower your score slightly (by 5–10 points). But it’s temporary and small compared to long-term benefits.

5. Should I use a credit repair company?

Not unless you have extremely complex issues.

Most people can achieve the same or better results for free using this DIY process.

Conclusion: Take Control of Your Credit Future

Fixing your credit might sound intimidating—but as you’ve seen, it’s completely doable on your own.

You don’t need fancy software, paid services, or financial gurus.

You just need:

-

Patience

-

Organization

-

Consistency

Every bill you pay on time, every balance you lower, and every dispute you win brings you one step closer to financial freedom.

So start today. Pull up your reports, clean the errors, pay what you can, and rebuild your credit story—the right way, your way.

Key Takeaways (Quick Recap)

✅ You can repair your credit for free—no paid service needed

✅ Get your reports from Equifax, Experian, and TransUnion

✅ Dispute errors and follow up within 30 days

✅ Lower your credit card utilization under 30%

✅ Pay bills on time—every time

✅ Build positive new credit accounts

✅ Track progress and protect yourself from scams

Final Thought:

Your credit score doesn’t define who you are—but it can shape your opportunities.

By taking control today, you’re investing in a future where lenders trust you, interest rates stay low, and your financial confidence soars.