Introduction: Why Your Credit Score Matters More Than You Think

Your credit score is more than just a number—it’s your financial reputation. Whether you want to buy a house, lease a car, or get a business loan, your credit score determines how much you pay in interest, or whether you even qualify at all.

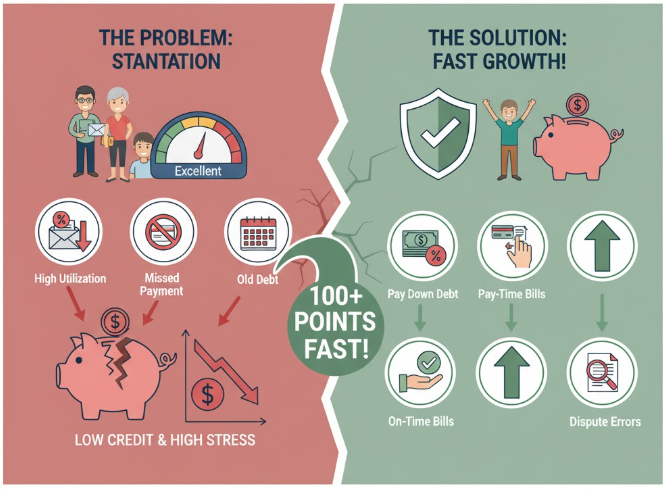

A good credit score can open doors to better financial opportunities, while a poor one can keep them firmly shut. The good news? You don’t have to wait years to boost your score. With the right strategies and discipline, it’s possible to improve your credit score by 100 points fast, sometimes within just a few months.

In this guide, you’ll learn step-by-step, practical ways to quickly raise your credit score — without gimmicks or expensive “credit repair” services.

What Is a Credit Score and Why It Drops

Before we jump into fixing it, let’s quickly look at what makes your credit score go up or down.

| Credit Factor | Impact on Score | Description |

|---|---|---|

| Payment History | 35% | Whether you pay bills on time or not |

| Credit Utilization | 30% | How much of your available credit you’re using |

| Credit Age | 15% | How long you’ve had credit accounts open |

| Credit Mix | 10% | The variety of credit types (loans, cards, etc.) |

| New Credit Inquiries | 10% | How often you apply for new credit accounts |

If your score has recently dropped, it’s usually because of missed payments, high credit card balances, or too many hard inquiries. The good news? These can be fixed.

Step-by-Step Plan to Improve Your Credit Score by 100 Points Fast

Let’s break down exactly what you can do—starting today—to give your credit score a serious boost.

1. Check Your Credit Report for Errors

Estimated time: 1 day

One of the quickest ways to raise your score is to find and fix mistakes on your credit report. According to studies, nearly 1 in 5 credit reports contain errors that could be lowering scores.

Here’s what to do:

-

Visit AnnualCreditReport.com to get a free copy of your report from Experian, TransUnion, and Equifax.

-

Carefully look for:

-

Accounts you don’t recognize

-

Incorrect payment statuses

-

Wrong balances

-

Duplicate accounts

-

-

If you spot an error, dispute it directly with the credit bureau online. They’re required by law to investigate within 30 days.

Pro Tip: Even one corrected late payment entry can raise your score by 20–50 points!

2. Pay Down Your Credit Card Balances

Estimated time: 1–2 billing cycles

Your credit utilization ratio—the amount of credit you use compared to your total limit—makes up 30% of your score.

If your cards are maxed out, it’s one of the fastest ways to tank your score. Luckily, paying down balances is also one of the quickest ways to boost it.

Example:

-

Total credit limit: $5,000

-

Current balance: $2,500

-

Utilization = 50% → Too high

Ideally, keep utilization below 30%, and for the biggest score increase, aim for below 10%.

| Utilization Range | Impact on Score |

|---|---|

| 0% – 9% | Excellent |

| 10% – 29% | Good |

| 30% – 49% | Fair |

| 50%+ | Poor |

Tip: If you can’t pay off balances immediately, ask your card issuer for a credit limit increase—this lowers your utilization instantly.

3. Pay Every Bill on Time — No Exceptions

Estimated time: Immediate and ongoing

Your payment history is the single most important factor in your credit score. Even one 30-day late payment can drop your score by 60–100 points.

Action steps:

-

Set up automatic payments for at least the minimum due.

-

Use calendar reminders or apps like Mint or Credit Karma.

-

If you miss a payment by a few days, pay it immediately—creditors usually report delinquencies after 30 days.

Pro Tip: If you have a solid payment history and just one late mark, call your lender and request a “goodwill adjustment.” They may remove it as a courtesy.

4. Keep Old Accounts Open

Estimated time: Immediate

The age of your credit accounts contributes to 15% of your score. Closing an old card can shorten your credit history and increase utilization, both of which hurt your score.

Best practice:

-

Keep your oldest credit accounts open, even if you rarely use them.

-

If the card has an annual fee, ask the issuer to downgrade it to a no-fee version.

Example:

If you close a 10-year-old account, your “average account age” drops — which could cost you 10–20 points.

5. Become an Authorized User on a Trusted Account

Estimated time: 1–2 months

This is one of the easiest credit hacks out there.

If a family member or friend has excellent credit, ask them to add you as an authorized user on their credit card. Their positive payment history and low utilization can instantly improve your score.

Important:

-

Make sure the card reports authorized users to all three bureaus.

-

Choose someone with on-time payments and low balances.

Even if you never use the card, you’ll benefit from their strong credit behavior.

6. Ask for a Credit Limit Increase

Estimated time: 1 week

If you’ve been a responsible borrower, your credit card company may be willing to raise your credit limit.

This trick can instantly lower your utilization ratio—without paying off debt.

For example:

-

Old limit: $3,000

-

Balance: $1,500 → Utilization = 50%

-

New limit: $6,000 → Utilization = 25%

Tip: Request an increase online or by phone, but ask if it involves a hard pull. If it does, that may temporarily lower your score by a few points.

7. Diversify Your Credit Mix

Estimated time: 2–3 months

Lenders like to see that you can handle different types of credit responsibly—credit cards, installment loans, car loans, etc.

If all you have are credit cards, consider:

-

A credit-builder loan

-

A secured loan

-

A store card or small personal loan

These help show you can manage various credit forms, which can add 10–20 points over time.

8. Deal With Collections the Smart Way

Estimated time: 1–2 months

Collections can severely damage your credit, but they’re not permanent.

Two strategies to try:

-

“Pay for Delete” — Negotiate with the collector to remove the account from your report once you pay it.

-

“Goodwill Letter” — If you’ve already paid, write to the creditor asking them to remove it as a gesture of goodwill.

Note: Not all collectors will agree, but even getting one removed can improve your score significantly.

9. Limit New Credit Applications

Estimated time: Ongoing

Every time you apply for new credit, a hard inquiry appears on your report, lowering your score by 5–10 points.

Avoid this by:

-

Only applying when necessary

-

Checking pre-qualification offers (these use soft pulls)

-

Spacing applications by at least 6 months

10. Use Experian Boost or Similar Tools

Estimated time: 5 minutes

Services like Experian Boost can give you an instant score increase—sometimes 10–20 points—by adding utility bills and phone payments to your credit file.

How it works:

-

Connect your bank account securely.

-

Experian verifies your payment history on eligible bills.

-

Positive history gets added to your credit report.

This is especially helpful if you have a thin credit file or limited history.

Bonus Tips to Supercharge Your Credit Growth

If you’ve already done the basics, here are a few advanced moves to speed things up.

11. Use the “15/3” Payment Strategy

Instead of paying your bill once a month, pay it twice:

-

15 days before the due date

-

3 days before the due date

This ensures your balance stays low when reported to the bureaus, which can give you a 10–30 point bump faster.

12. Don’t Close Paid Installment Loans Early

It’s tempting to pay off your car or student loan early—but don’t rush.

An open installment loan adds to your credit mix and payment history, both of which help your score.

13. Track Progress with Free Tools

Use Credit Karma, Credit Sesame, or your bank’s credit monitoring tool to watch your score improve.

These apps also:

-

Alert you about changes or new inquiries

-

Suggest personalized improvement tips

-

Help catch fraud early

Timeline: How Fast Can You Raise Your Score by 100 Points?

Here’s a realistic timeline if you follow these strategies consistently:

| Time Frame | Actions Taken | Expected Gain |

|---|---|---|

| Week 1 | Fix errors, pay off small balances | +20–30 points |

| Month 1–2 | Lower utilization, pay on time, authorized user | +30–40 points |

| Month 3–4 | Add new credit mix, goodwill adjustments | +20–30 points |

| Month 5+ | Continue on-time payments and low utilization | +20–40 points |

Total possible gain: 100+ points (depending on your starting score)

Common Credit Score Myths You Should Stop Believing

| Myth | Truth |

|---|---|

| Checking your credit score lowers it | Checking your own score is a soft inquiry—it doesn’t hurt your score. |

| Carrying a balance helps your score | False. Always pay your cards in full if possible. |

| Closing unused cards is good | It usually hurts your score by shortening your history. |

| Paying off a collection removes it automatically | No—it stays unless the collector agrees to remove it. |

| You need to be in debt to have a good score | Not true. Just keep small active credit lines and pay them on time. |

Quick Summary Chart: Actions That Boost Your Score Fast

| Action | Impact Speed | Potential Gain |

|---|---|---|

| Dispute errors | 30 days | 10–50 points |

| Pay down balances | 1–2 months | 20–50 points |

| Pay on time | 1 month onward | 30–100 points |

| Authorized user | 1–2 months | 20–50 points |

| Credit limit increase | Immediate | 10–30 points |

| Goodwill deletions | 1–2 months | 20–40 points |

How to Maintain a High Credit Score for Life

Once your score hits that sweet spot—700 or higher—keep it there by following a few golden rules:

-

Always pay on time. Even one late payment can undo months of effort.

-

Keep balances low. Stay under 10% utilization if you can.

-

Avoid unnecessary applications. Too many inquiries signal risk.

-

Check your reports regularly. Identity theft can sneak up fast.

-

Mix your credit. Maintain a blend of revolving and installment accounts.

Infographic: The 5 Pillars of a Strong Credit Score

Conclusion: You Have More Control Than You Think

Raising your credit score by 100 points fast isn’t magic—it’s about taking smart, consistent actions that show lenders you’re trustworthy.

Start by fixing errors, lowering balances, and paying on time. Then add strategies like becoming an authorized user, requesting higher limits, and keeping old accounts open. Within a few months, you’ll not only see your score climb—but also feel a newfound sense of financial confidence.

Your credit score isn’t permanent—it’s a reflection of habits. And with the right habits, you can turn that three-digit number into a powerful tool for your future.