If you’ve never had a credit card, loan, or mortgage before, you’re officially in what’s known as a “credit invisible” category. That means lenders, banks, or even landlords don’t have enough financial history to trust you with borrowing money or signing an agreement.

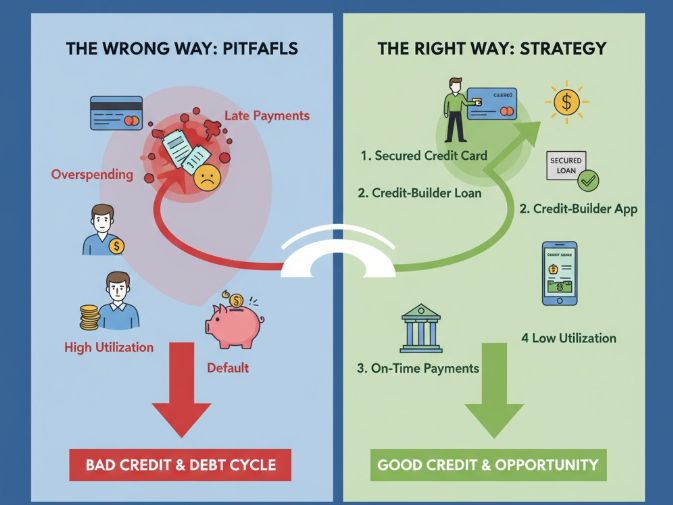

But don’t worry — everyone starts with zero credit. The key is knowing how to build credit from scratch the right way, without falling into the traps that many beginners do.

In this article, we’ll walk step-by-step through practical, safe, and proven ways to establish your credit profile, boost your score fast, and keep it healthy for life.

Why Credit Matters More Than You Think

Before we get into the “how,” let’s talk about why building credit is so important. Your credit score isn’t just about loans — it affects your entire financial life.

Here’s what good credit can help you achieve:

| Area | How Good Credit Helps |

|---|---|

| Loans | Easier approval for car loans, personal loans, and mortgages |

| Interest Rates | Lower interest rates, saving you hundreds or even thousands |

| Housing | Landlords often check credit before renting apartments |

| Jobs | Some employers review credit reports for financial positions |

| Utilities | Utility and phone companies may waive deposits for good credit |

In short: good credit opens doors; bad or no credit closes them.

Now let’s explore exactly how you can start building it from scratch — step by step.

Step 1: Learn What a Credit Score Is (And How It Works)

A credit score is a three-digit number that tells lenders how likely you are to pay back borrowed money.

In the U.S., it usually ranges between 300 and 850.

Here’s a breakdown:

| Credit Score Range | Rating | What It Means |

|---|---|---|

| 300 – 579 | Poor | You have trouble managing credit |

| 580 – 669 | Fair | Needs improvement |

| 670 – 739 | Good | Average borrower |

| 740 – 799 | Very Good | Low risk for lenders |

| 800 – 850 | Excellent | Top-tier borrower, best rates |

Your score depends on five major factors:

-

Payment history (35%) – Do you pay bills on time?

-

Credit utilization (30%) – How much of your available credit do you use?

-

Credit age (15%) – How long you’ve had credit accounts.

-

Credit mix (10%) – A mix of loans, credit cards, etc.

-

New credit (10%) – How often you apply for new accounts.

Tip: The earlier you start building credit, the longer your credit age will be — which helps boost your score in the long run.

Step 2: Start with a Secured Credit Card

If you have no credit, banks won’t trust you with a traditional card yet.

That’s where a secured credit card comes in.

A secured credit card works like a regular credit card, except you deposit your own money as collateral — usually between $200 and $500. This deposit becomes your credit limit.

How it works:

-

You make everyday purchases.

-

You pay the balance on time.

-

The bank reports your payments to major credit bureaus (Experian, Equifax, TransUnion).

After 6–12 months of consistent, responsible use, you can:

-

Upgrade to an unsecured card.

-

Get your deposit refunded.

-

Start qualifying for better cards with rewards.

Example secured cards to consider:

| Card Name | Minimum Deposit | Annual Fee | Credit Bureau Reporting |

|---|---|---|---|

| Capital One Platinum Secured | $49–$200 | $0 | All three bureaus |

| Discover it Secured | $200 | $0 | All three bureaus |

| Citi Secured Mastercard | $200 | $0 | All three bureaus |

Pro Tip: Always pay in full and on time — even a single late payment can hurt your credit early on.

Step 3: Become an Authorized User on a Trusted Person’s Card

If you have a family member or close friend with excellent credit, ask them to add you as an authorized user on their credit card.

You’ll get:

-

Their credit history added to your report.

-

The benefit of their on-time payments.

-

A boost to your score without applying for new credit yourself.

Just make sure:

-

The main account holder has a long and clean credit history.

-

They report authorized users to the credit bureaus.

This method is one of the fastest and safest ways to start building credit even without income or credit experience.

Step 4: Use a Credit Builder Loan

A credit builder loan is a small, low-risk loan designed specifically for people with no credit.

Here’s how it works:

-

You apply for a small loan (usually $300–$1,000).

-

The lender holds the money in a locked account while you make monthly payments.

-

Once you’ve paid off the loan, you get the full amount back — plus credit history.

It’s like saving money while improving your score at the same time.

Best places to get credit builder loans:

-

Local credit unions

-

Community banks

-

Online lenders like Self, SeedFi, or Credit Strong

Why it works:

Every payment you make is reported to credit bureaus, proving you’re responsible and creditworthy.

Step 5: Keep Credit Utilization Below 30%

Your credit utilization ratio shows how much of your available credit you’re using.

If your card limit is $500 and you spend $250, that’s 50% utilization — too high.

To build strong credit, always aim to keep it below 30% — ideally around 10–20%.

| Credit Limit | Max Safe Usage (30%) |

|---|---|

| $300 | $90 |

| $500 | $150 |

| $1,000 | $300 |

| $2,000 | $600 |

Pro Tip:

-

Pay your balance before the statement closing date to lower reported utilization.

-

Make two small payments per month to keep balances low.

Step 6: Pay Every Bill on Time — No Exceptions

This is the single most important rule.

Your payment history makes up 35% of your credit score, the biggest factor.

Missing even one payment can drop your score by 60–100 points — and that negative mark can stay on your report for up to 7 years.

To stay on track:

-

Set up automatic payments for minimum amounts.

-

Use calendar reminders for due dates.

-

Never ignore bills — even small ones like phone plans or subscriptions.

Step 7: Diversify Your Credit Mix Gradually

Once you’ve managed one type of credit successfully (like a secured card), you can start adding different types — such as:

-

Retail store credit cards

-

Personal loans

-

Auto loans

-

Student loans

Lenders love seeing you can handle varied types of credit responsibly.

But take it slow — applying for too many accounts too quickly can actually lower your score temporarily because of multiple “hard inquiries.”

Rule of thumb:

Wait at least 3–6 months between new credit applications.

Step 8: Monitor Your Credit Regularly

Building credit is one thing — maintaining it is another.

You should check your credit reports at least once every 3–4 months to:

-

Track progress

-

Fix errors early

-

Spot signs of identity theft

You’re legally entitled to a free report every year from each bureau at AnnualCreditReport.com.

You can also use free tools like:

-

Credit Karma

-

Experian

-

Credit Sesame

Look for:

-

Inaccurate balances

-

Duplicate accounts

-

Unknown hard inquiries

If you find any errors, file a dispute immediately through the credit bureau’s website — they must investigate within 30 days.

Step 9: Avoid Common Mistakes That Hurt Your Credit

When building credit for the first time, it’s easy to make innocent mistakes that cost you dearly.

Here are some traps to avoid:

-

Closing old accounts too soon

-

Length of credit history matters — keep your oldest accounts open.

-

-

Applying for too many cards at once

-

Each hard inquiry can reduce your score temporarily.

-

-

Carrying high balances

-

Even if you pay on time, high utilization lowers your score.

-

-

Ignoring small bills

-

Unpaid phone or utility bills can be sent to collections.

-

-

Not checking your credit report

-

Errors happen more often than you think.

-

Step 10: Be Patient and Consistent

Credit building is not an overnight process.

It usually takes 3–6 months to generate your first score and 1–2 years to establish a strong profile.

But if you’re consistent — paying on time, keeping balances low, and managing accounts wisely — your score will grow steadily.

Typical Credit Growth Timeline

| Time Period | Action Taken | Expected Result |

|---|---|---|

| 0–3 months | Open first secured card | Begin building history |

| 3–6 months | Pay on time, low balance | Score appears (580–650) |

| 6–12 months | Add credit builder loan or new card | Score improves (650–700) |

| 1–2 years | Maintain consistent habits | Reach good/excellent range (700–800+) |

Bonus: Smart Habits to Keep Your Credit Strong for Life

Once you’ve built a foundation, protecting it becomes even more important.

Here are habits that separate those with “average” credit from those with excellent credit:

-

Pay off balances in full every month.

-

Don’t co-sign loans unless you fully trust the borrower.

-

Keep older accounts open — they lengthen your credit age.

-

Review reports annually for errors or fraud.

-

Avoid payday loans or predatory lenders.

-

Negotiate with creditors if you’re struggling to pay — never default silently.

Frequently Asked Questions (FAQs)

1. How long does it take to build credit from scratch?

Typically, it takes 3–6 months of active credit use for your first score to appear and 12–18 months to reach a “good” range.

2. Can I build credit without a credit card?

Yes. You can use:

-

Credit builder loans

-

Rent reporting services

-

Authorized user status

-

Utility and phone bill reporting programs

3. Does checking my own credit hurt my score?

No. Only “hard inquiries” (like applying for new credit) affect your score. Checking your own score is considered a “soft inquiry.”

4. Can paying rent help build credit?

Yes — if your landlord or property manager reports payments to credit bureaus. You can also use services like RentTrack or Experian Boost.

5. Is it bad to have no debt while building credit?

Not necessarily. The goal is to show activity and responsibility — even with small charges you pay off monthly.

Final Thoughts: Your Credit Journey Starts Today

Building credit from scratch can feel intimidating at first — but with the right habits and patience, it’s completely achievable.

Think of credit like a reputation system — every on-time payment, responsible decision, and low balance strengthens your financial credibility.

So start today:

-

Open a secured card.

-

Make small purchases.

-

Pay on time.

-

Keep balances low.

-

Monitor and grow.

Before you know it, you’ll have a healthy credit score that opens doors to better financial opportunities, lower interest rates, and long-term stability.

Key Takeaway Table

| Action | Why It Matters | Time to Impact |

|---|---|---|

| Get a secured card | Establishes first line of credit | 1–2 months |

| Pay on time | Builds strongest positive history | Ongoing |

| Keep utilization low | Shows responsible credit use | Immediate |

| Monitor credit | Prevents fraud and errors | Continuous |

| Diversify accounts | Strengthens profile | 6–12 months |