Introduction: The Simple Math Behind Financial Freedom

Have you ever felt like your paycheck disappears the moment it hits your bank account? Bills, groceries, and small luxuries can add up fast — leaving you wondering where your money actually goes.

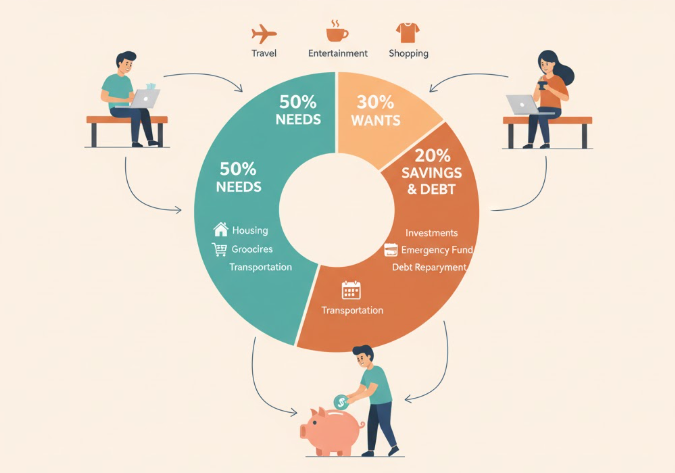

That’s where the 50/30/20 rule steps in. It’s one of the simplest and most effective budgeting strategies ever created. Designed to help you control spending, save money, and reach financial goals, this rule gives your income a clear direction without needing complicated formulas or financial jargon.

In this guide, we’ll break down what the 50/30/20 rule means, how it works, and most importantly, how you can adapt it to your lifestyle — no matter your income or expenses.

What Exactly Is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting framework that divides your after-tax income into three main categories:

| Category | Percentage | Purpose |

|---|---|---|

| Needs | 50% | Essential expenses — rent, food, utilities, insurance, transportation |

| Wants | 30% | Non-essentials that make life enjoyable — dining out, entertainment, hobbies |

| Savings & Debt Repayment | 20% | Savings, investments, emergency funds, or extra debt payments |

In short:

-

50% = Must-haves

-

30% = Nice-to-haves

-

20% = Future security

This rule was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan. The beauty of this method is its simplicity — it gives you control over your spending without tracking every penny.

Why the 50/30/20 Rule Works So Well

Many people struggle with budgeting because traditional methods can feel too strict or complicated. The 50/30/20 rule works because it’s:

-

Simple: Just three categories to remember.

-

Flexible: You can adjust percentages based on your situation.

-

Goal-Oriented: It ensures you’re not just spending — but saving too.

-

Balanced: It lets you enjoy life while still planning for the future.

This method turns budgeting from a stressful chore into an easy habit that naturally aligns with your lifestyle.

Step-by-Step: How to Apply the 50/30/20 Rule

Let’s break it down into clear, manageable steps you can follow today.

Step 1: Know Your Take-Home Pay

The rule applies to after-tax income, not your gross salary.

To calculate this:

-

Start with your monthly paycheck.

-

Subtract taxes, retirement contributions, and insurance deductions.

-

What’s left is your net (take-home) income.

Example:

If you earn $3,500 per month after taxes, that’s the number you’ll use for your 50/30/20 breakdown.

Step 2: Allocate Your Income

Now divide your net income into the three categories:

| Category | Percentage | Amount (Based on $3,500) | Examples |

|---|---|---|---|

| Needs | 50% | $1,750 | Rent, food, transport, insurance, utilities |

| Wants | 30% | $1,050 | Dining out, Netflix, shopping, vacations |

| Savings/Debt | 20% | $700 | Savings, investments, paying off loans |

This simple table gives you a clear spending plan each month.

Step 3: Identify “Needs” — The Must-Have Essentials

Your “Needs” are non-negotiable — the expenses you must pay to live and work.

Examples include:

-

Rent or mortgage

-

Utilities (electricity, water, internet)

-

Groceries and household essentials

-

Health and car insurance

-

Transportation or fuel

-

Minimum debt payments

If your needs exceed 50%, that’s a signal to revisit your spending — maybe by finding a cheaper apartment, carpooling, or cutting unused subscriptions.

💡 Tip: Keep your “needs” as close to 50% as possible. The lower, the better — it leaves more room for savings.

Step 4: Understand “Wants” — The Fun Stuff

“Wants” are what make life enjoyable. These are non-essential but improve your quality of life.

Examples:

-

Eating at restaurants or ordering takeout

-

Buying new clothes or gadgets

-

Subscriptions (Netflix, Spotify, etc.)

-

Vacations or weekend trips

-

Hobbies like gaming, art, or sports

However, “wants” can easily spiral out of control. Setting a clear 30% boundary ensures you enjoy your money responsibly.

💡 Pro Tip: If you find it hard to differentiate between “wants” and “needs,” ask yourself:

“Can I live without this for a few months?”

If yes — it’s a want.

Step 5: Build Your “Savings and Debt” Category

This 20% portion is your financial growth zone — it builds your future stability.

Here’s how to use it effectively:

-

Emergency Fund: Aim for 3–6 months’ worth of expenses.

-

Debt Repayment: Pay more than the minimum on credit cards or loans.

-

Investing: Contribute to retirement accounts, stocks, or mutual funds.

-

Future Goals: Save for big dreams — like a house, business, or education.

💡 Tip: Automate savings and investments right after payday — so you “pay yourself first.”

Example: Real-Life Breakdown of the 50/30/20 Rule

Let’s say you earn $4,000/month after taxes.

| Category | % | Monthly Amount | Breakdown |

|---|---|---|---|

| Needs | 50% | $2,000 | Rent ($1,200), Groceries ($400), Utilities ($150), Car expenses ($250) |

| Wants | 30% | $1,200 | Dining out ($300), Shopping ($200), Gym ($100), Streaming ($50), Vacations ($550) |

| Savings/Debt | 20% | $800 | Emergency Fund ($400), Loan Repayment ($200), Investments ($200) |

This example shows how every dollar has a purpose, while still leaving room for fun and flexibility.

Adjusting the Rule for Different Incomes

The 50/30/20 rule isn’t rigid. You can customize it to fit your unique situation.

💼 For Low-Income Earners

If your basic expenses take up more than 50%:

-

Try a 60/25/15 split instead.

-

Focus first on covering essentials.

-

Save smaller amounts but stay consistent.

💰 For High-Income Earners

If your needs are under 50%:

-

Increase savings to 25–30% or more.

-

Invest extra in long-term assets (real estate, index funds, etc.).

🧾 For People with Debt

Consider a 50/20/30 version:

-

Keep needs at 50%.

-

Reduce wants to 20%.

-

Use 30% to pay off high-interest debt faster.

Benefits of Using the 50/30/20 Rule

Let’s look at why millions of people swear by this budgeting style:

1. Easy to Follow

You don’t need financial software — just basic math.

2. Promotes Smart Habits

You automatically learn to save and spend wisely.

3. Reduces Financial Stress

Knowing where your money goes brings peace of mind.

4. Builds Long-Term Wealth

Regular saving and investing compounds over time.

5. Encourages Balance

You can enjoy today while planning for tomorrow.

Common Mistakes to Avoid

Even a simple plan like this can go wrong if not managed carefully. Watch out for these traps:

-

Ignoring Hidden Expenses – Small costs like snacks or delivery fees can quietly wreck your budget.

-

Mixing Wants with Needs – Be honest about what’s essential.

-

No Tracking System – Use a budget app or notebook to stay on target.

-

Skipping Savings – Don’t wait for “extra” money to save — make it a fixed rule.

-

Not Reviewing Regularly – Life changes — review your budget every 3–6 months.

Tools to Help You Stick to the Rule

Here are a few easy tools and apps to keep you consistent:

| Type | Examples | Use |

|---|---|---|

| Budgeting Apps | Mint, YNAB, PocketGuard | Track spending automatically |

| Spreadsheets | Google Sheets, Excel Templates | Customize and visualize your budget |

| Bank Tools | Auto-transfer features | Automate savings or bill payments |

💡 Bonus Tip: Set up separate bank accounts — one for “needs,” one for “wants,” and one for “savings.” It’s a simple psychological trick that keeps you disciplined.

When the 50/30/20 Rule Might Not Fit

While it works for most people, there are times when it may not be ideal:

-

High cost-of-living areas — housing alone can exceed 50%.

-

Irregular income — freelancers may need flexible budgeting.

-

Debt-heavy situations — debt payments might require a higher percentage.

👉 In such cases, adjust the ratios while keeping the same principle:

Cover your needs → Limit your wants → Grow your savings.

Advanced Tips to Maximize the 50/30/20 Rule

Once you’ve mastered the basics, you can take it to the next level.

1. Automate Everything

Set automatic transfers for bills, savings, and investments. Automation eliminates temptation.

2. Use Cash or Envelopes for “Wants”

Withdraw your “wants” money in cash. When it’s gone, it’s gone — no overspending.

3. Increase Savings Gradually

Every time you get a raise, boost your savings rate by 2–5%. You won’t even feel the difference.

4. Review Monthly

Compare your actual spending with your targets. Adjust if you’re going off-track.

5. Add Mini Goals

Break down savings goals (e.g., $1,000 emergency fund → $100/month for 10 months). This keeps motivation high.

Quick Visual Recap (Infographic)

Here’s how your money ideally flows each month:

This simple “money tree” shows how your earnings grow when properly divided.

Comparing the 50/30/20 Rule to Other Budgeting Methods

| Method | Description | Pros | Cons |

|---|---|---|---|

| Zero-Based Budgeting | Every dollar has a specific purpose | Very precise | Time-consuming |

| Envelope System | Cash divided into envelopes | Great for discipline | Not digital-friendly |

| Pay Yourself First | Savings prioritized before spending | Builds wealth fast | May ignore lifestyle needs |

| 50/30/20 Rule | Balanced division of needs, wants, and savings | Simple, flexible | May need tweaking for high expenses |

This comparison shows that the 50/30/20 rule strikes the perfect balance between flexibility and control.

FAQs About the 50/30/20 Rule

1. Should I include taxes in my calculation?

No, always use your after-tax income.

2. What if I can’t save 20% right now?

Start with 5–10%. The key is consistency.

3. Can couples use this rule together?

Yes! Combine your after-tax incomes and plan joint expenses.

4. Does it work for students or part-timers?

Absolutely. Even small incomes benefit from structured budgeting.

5. How often should I update my budget?

At least every three months or whenever your income/expenses change.

Real-Life Success Story: From Paycheck-to-Paycheck to Progress

Let’s take Sarah’s example.

She earned $3,200/month but always ran out before the next payday. After using the 50/30/20 rule:

-

She realized her “wants” were eating up 45% of her income.

-

She cut dining out and shopping costs by $300/month.

-

Within a year, she built a $5,000 emergency fund and paid off a credit card.

Sarah’s story shows how a simple structure can transform your financial life — no extra income required, just smarter planning.

Conclusion: Take Control of Your Money — One Rule at a Time

The 50/30/20 rule isn’t about restrictions; it’s about clarity and freedom. It helps you:

-

Spend confidently on what matters,

-

Save wisely for the future, and

-

Enjoy your life today without guilt.

You don’t need complex apps or financial degrees — just this simple framework and a bit of consistency.

Remember:

“It’s not about how much you earn, but how you manage what you have.”

So, grab your calculator, divide your income, and start building the financial future you deserve — one balanced month at a time.