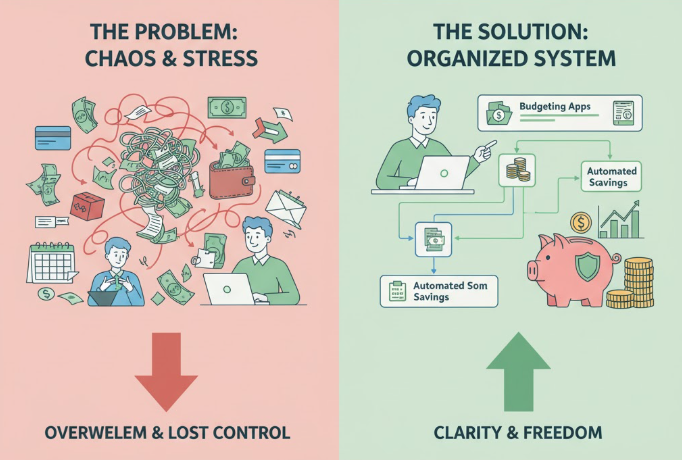

Money can be a source of peace or constant stress — it all depends on how you manage it. Many people live paycheck to paycheck, not because they don’t earn enough, but because their finances are disorganized. The truth is: financial control isn’t about being rich — it’s about being intentional.

If you’ve ever felt lost with your bills, savings, or debt, this guide will walk you step-by-step through how to organize your finances, take control of your money, and finally build financial confidence.

Why Organizing Your Finances Matters

Imagine trying to drive at night with no headlights — that’s what handling your money without organization looks like.

When your finances are in order, you:

-

Know exactly where your money goes

-

Save more without stress

-

Pay off debt faster

-

Feel less anxious about the future

-

Build a safety net for emergencies

Money organization gives you clarity, control, and the ability to make smarter choices — and that’s what financial freedom is all about.

Step 1: Start With a Financial Reality Check

Before you fix anything, you need to see where you stand.

1. Track Every Dollar You Spend

For at least one month, record everything — from rent to snacks. Use any of these tools:

| Method | Description | Best For |

|---|---|---|

| Notebook or Excel Sheet | Write down all expenses manually | Those who prefer a hands-on approach |

| Budget Apps (Mint, YNAB, PocketGuard) | Automatically tracks and categorizes expenses | Busy individuals who want automation |

| Bank Statements Review | Analyze past 3 months’ statements | Quick snapshot of past spending |

When you track expenses, you’ll often find “money leaks” — small, unnecessary costs that quietly drain your budget.

2. Calculate Your Net Worth

This single number shows your overall financial health.

Formula:

Net Worth = Total Assets – Total Liabilities

Assets include:

-

Cash

-

Savings and investments

-

Home or car value

Liabilities include:

-

Credit card balances

-

Loans

-

Mortgages

If the result is negative, don’t panic — it simply means you need a better financial plan.

Step 2: Build a Budget That Actually Works

A budget isn’t about restriction — it’s a roadmap for your money. It tells each dollar where to go instead of wondering where it went.

1. Pick a Budgeting Style

Here are three popular types of budgets — choose what fits your lifestyle:

| Budget Type | Description | Ideal For |

|---|---|---|

| 50/30/20 Rule | 50% needs, 30% wants, 20% savings/debt | Beginners |

| Zero-Based Budget | Every dollar is assigned a purpose | Those who want full control |

| Envelope Method | Cash is divided into spending categories | People who overspend easily |

2. Use the 50/30/20 Rule as a Starting Point

Here’s how your paycheck should ideally be divided:

| Category | Percentage | Example (Monthly Income: $2,000) |

|---|---|---|

| Needs (rent, utilities, groceries) | 50% | $1,000 |

| Wants (dining out, entertainment) | 30% | $600 |

| Savings/Debt Repayment | 20% | $400 |

The goal is to maintain balance — not perfection. Even if you can’t save 20% now, start small and grow from there.

Step 3: Automate Your Finances

Automation removes the emotional friction from money management. Once you set it up, it keeps your financial life flowing smoothly.

What to Automate

-

Bill Payments:

-

Automate rent, utilities, and credit card payments to avoid late fees.

-

-

Savings Transfers:

-

Set automatic transfers to your savings account right after payday.

-

Tip: Treat savings like a non-negotiable bill.

-

-

Debt Payments:

-

Use auto-pay for minimum payments, and pay extra manually when possible.

-

Benefits of Automation

✅ Prevents missed payments

✅ Reduces financial stress

✅ Builds consistent savings

✅ Improves credit score

Automation = consistency. Consistency = progress.

Step 4: Declutter and Organize Your Financial Documents

A messy desk equals a messy mind — and that applies to finances too.

1. Go Digital

Create a digital folder system on your computer or cloud storage:

Example Folder Setup:

2. Label Clearly

Use consistent naming, like:ElectricBill_May2025.pdf or CarInsurance_Renewal2025.pdf

3. Back Everything Up

Store copies on an external drive or secure cloud (like Google Drive or Dropbox).

Step 5: Build an Emergency Fund

Life throws curveballs — job loss, medical bills, or unexpected repairs. An emergency fund acts as your financial cushion.

How Much Should You Save?

| Situation | Recommended Amount |

|---|---|

| Beginner | 1 month of expenses |

| Comfortable | 3–6 months of expenses |

| Financially Secure | 6–12 months of expenses |

Start small — even $20 a week adds up. The key is consistency, not perfection.

Where to Keep It

-

High-yield savings account (so it earns interest)

-

Easily accessible, but separate from daily spending money

Step 6: Manage and Eliminate Debt

Debt can feel like a heavy chain, but it’s manageable with a plan.

1. List All Your Debts

| Debt Type | Amount | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card | $1,200 | 19% | $60 |

| Car Loan | $6,000 | 7% | $180 |

| Student Loan | $8,000 | 5% | $100 |

2. Choose a Debt Payoff Strategy

a. Debt Snowball Method:

Focus on paying off the smallest debt first.

-

Builds quick motivation

-

Ideal if you need emotional wins

b. Debt Avalanche Method:

Pay off the highest interest debt first.

-

Saves more money long-term

-

Best for disciplined savers

3. Negotiate or Refinance

Call lenders and ask for:

-

Lower interest rates

-

Extended repayment terms

-

Debt consolidation options

These small adjustments can free up extra cash each month.

Step 7: Strengthen Your Savings Habits

Saving isn’t just for emergencies — it’s how you build a future.

Set Clear Saving Goals

Examples:

-

Vacation fund

-

Home down payment

-

Retirement

-

New car

Make It Visual

Create a Savings Goal Tracker Chart like this:

| Goal | Target Amount | Monthly Saving | Timeframe | Progress |

|---|---|---|---|---|

| Emergency Fund | $3,000 | $200 | 15 months | 🔵🔵⚪⚪⚪⚪⚪⚪⚪⚪ |

| Vacation | $1,500 | $125 | 12 months | 🔵🔵🔵⚪⚪⚪⚪⚪⚪⚪ |

Visual motivation works — you’ll stay excited to save!

Step 8: Build Credit Wisely

Good credit makes life easier — it affects everything from loan approvals to renting apartments.

Tips to Build and Maintain Good Credit

-

Pay bills on time (automatic payments help)

-

Keep credit utilization under 30%

-

Don’t apply for too many credit cards at once

-

Check your credit report annually for errors

Pro Tip:

If you’re just starting, use a secured credit card to build credit safely.

Step 9: Start Investing Early

Saving alone won’t make you wealthy — investing does.

Why You Should Invest

-

Your money grows through compound interest

-

Beats inflation

-

Builds long-term wealth

Beginner Investment Options

| Investment Type | Risk Level | Description |

|---|---|---|

| Index Funds / ETFs | Moderate | Invest in a mix of top companies |

| Retirement Accounts (401k, IRA) | Low–Moderate | Tax benefits + long-term growth |

| Stocks | Moderate–High | Higher risk, higher return |

| Bonds | Low | Fixed income with minimal risk |

Start small — even $50 a month grows significantly over time.

Step 10: Review and Adjust Regularly

Financial organization isn’t a one-time task — it’s an ongoing habit.

Monthly Tasks

-

Review expenses and budget categories

-

Pay off credit card balances

-

Transfer money to savings/investments

Quarterly Tasks

-

Recalculate net worth

-

Revisit short-term goals

-

Adjust savings or debt payments

Yearly Tasks

-

Check credit report

-

Review insurance policies

-

Rebalance investment portfolio

Step 11: Protect Your Financial Future

Financial stability isn’t just about earning — it’s about protecting what you’ve built.

1. Get Insurance Coverage

Essential types of insurance include:

-

Health insurance – covers medical emergencies

-

Life insurance – supports family in case of tragedy

-

Auto/home insurance – protects valuable assets

2. Create a Will or Estate Plan

Even a simple will ensures your assets go where you want them to.

3. Keep Emergency Contacts & Passwords Safe

Store them securely in a document accessible to trusted family members.

Step 12: Simplify Your Financial Life

Too many accounts or apps can create chaos. Simplify to stay in control.

Tips to Simplify:

-

Close unused credit cards

-

Consolidate accounts where possible

-

Use one budgeting app instead of many

-

Unsubscribe from unnecessary emails and financial services

The less clutter you have, the clearer your decisions become.

Step 13: Build Better Financial Habits

Money organization isn’t just about systems — it’s about mindset.

Daily Habits to Practice:

-

Check your account balance each morning

-

Avoid impulse purchases — use the 24-hour rule

-

Set spending limits for non-essentials

-

Read one financial article or book chapter weekly

Example Books:

-

“The Total Money Makeover” by Dave Ramsey

-

“Rich Dad Poor Dad” by Robert Kiyosaki

-

“Your Money or Your Life” by Vicki Robin

Learning a little each week compounds just like money.

Financial Organization Checklist

Here’s a quick summary you can print or save:

| Step | Task | Status |

|---|---|---|

| 1 | Track spending for one month | ☐ |

| 2 | Create a realistic budget | ☐ |

| 3 | Automate bills and savings | ☐ |

| 4 | Organize financial documents | ☐ |

| 5 | Build an emergency fund | ☐ |

| 6 | Make a debt repayment plan | ☐ |

| 7 | Set clear saving goals | ☐ |

| 8 | Improve your credit score | ☐ |

| 9 | Start investing | ☐ |

| 10 | Review finances monthly | ☐ |

Bonus: 5 Free Tools to Simplify Your Financial Life

| Tool | Use | Platform |

|---|---|---|

| Mint | Budgeting & expense tracking | Android / iOS |

| YNAB (You Need a Budget) | Zero-based budgeting | Web / Mobile |

| PocketGuard | Monitors spending limits | Android / iOS |

| Personal Capital | Tracks net worth & investments | Web / Mobile |

| Google Sheets Budget Template | Customizable manual control | Desktop / Mobile |

All of these can help you stay on top of your money effortlessly.

Conclusion: Take Control, Not Chances

Money management doesn’t have to be overwhelming — it just needs structure. By following these steps — tracking, budgeting, saving, automating, and reviewing — you’ll finally feel confident and in control.

The goal isn’t perfection; it’s progress. Even small improvements each month lead to financial freedom and peace of mind over time.

So today, grab a notebook, open your banking app, and take the first step.

Because the best time to organize your finances was yesterday — and the next best time is right now.