Introduction: When Feelings Start Controlling Your Wallet

Have you ever found yourself buying something you didn’t really need—maybe a new pair of shoes, the latest gadget, or a fancy dinner—just because you were feeling down, bored, or stressed?

If yes, you’ve experienced what’s called emotional spending.

It’s not about buying things out of necessity—it’s about shopping as a way to feel better. For a few minutes, it works. That new purchase gives you a rush, a small spark of happiness. But soon, guilt or regret replaces that joy, and your bank account feels lighter.

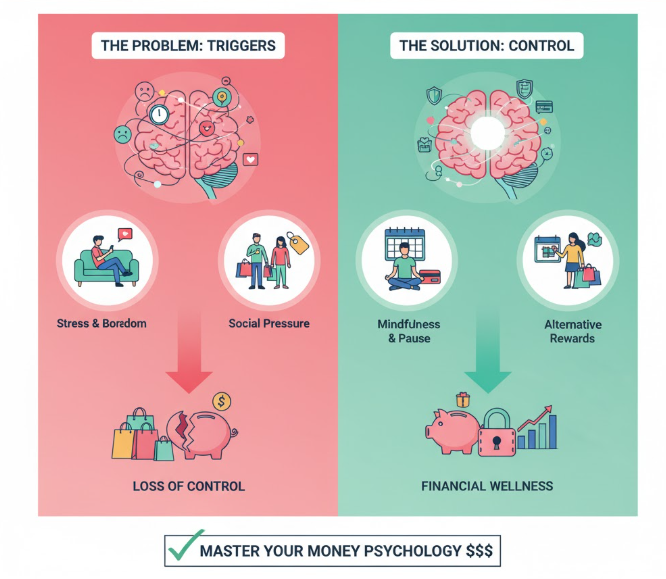

Emotional spending can silently drain your savings, increase debt, and damage your long-term financial goals. The good news? Once you identify what triggers your emotional spending, you can regain control and make smarter money choices.

In this guide, we’ll explore:

-

The most common emotional triggers that cause overspending

-

How emotions link to financial decisions

-

Practical, proven strategies to stop emotional shopping

-

Helpful tools and daily habits to strengthen your financial mindset

Let’s break the cycle and take charge of both your emotions and your wallet.

What Is Emotional Spending?

Emotional spending happens when your emotions—not logic or necessity—drive your purchases.

It’s not limited to luxury splurges. It can be as small as buying snacks when you’re stressed, ordering takeout after a bad day, or adding “just one more thing” to your online cart during a late-night scroll.

The Psychology Behind It

-

The Dopamine Effect: Shopping triggers a feel-good chemical called dopamine, which rewards your brain for spending. It’s the same chemical released during enjoyable activities like eating or listening to music.

-

Instant Gratification: Buying something new gives an instant sense of control and happiness—especially when emotions feel out of control.

-

Social Influence: Seeing others online enjoying products or lifestyles can make emotional purchases feel like a way to “fit in” or boost self-esteem.

Top Emotional Spending Triggers (and What They Really Mean)

Here are the most common feelings that lead people to spend emotionally—and how they show up in daily life.

| Emotion | Typical Trigger Behavior | Example Purchase | Underlying Need |

|---|---|---|---|

| Stress | Buying as a relief mechanism | Ordering takeout after a tough day | Comfort & control |

| Sadness | Shopping to “feel better” | New clothes, sweets, online shopping | Emotional comfort |

| Boredom | Spending for entertainment | Random Amazon orders | Excitement & engagement |

| Loneliness | Buying for connection | Gifting others, subscriptions | Belonging & attention |

| Happiness | Celebratory overspending | Expensive dinners, party items | Reward & validation |

| Insecurity | Buying to impress others | Designer items, trendy gadgets | Approval & confidence |

1. The “Bad Day” Purchases – Stress and Fatigue Spending

After a long, exhausting day, it’s tempting to treat yourself—maybe a nice dinner, a drink, or new clothes “just because.” This behavior is known as stress spending.

Why It Happens

When you’re stressed, your brain seeks immediate comfort. Buying something provides a short-term sense of relief, even though it doesn’t fix the real problem.

How to Take Control

-

Pause before purchasing: Take a 10-minute break before buying anything online or in-store. Often, the urge fades.

-

Create non-spending stress relievers: Exercise, journaling, or calling a friend can help without hurting your wallet.

-

Budget a “comfort fund”: Allocate a small monthly amount for guilt-free treats—so you don’t overspend impulsively.

2. The “Feel Better” Trap – Sadness and Emotional Pain

Retail therapy is a popular term for a reason—it gives temporary relief from sadness or heartbreak. But it often leads to regret once the emotional fog lifts.

How It Feels

You might think: “I deserve this. It’ll make me feel better.”

And for a moment, it does. But the emotional relief fades quickly.

Smart Strategies

-

Find your real comfort sources: Spend time with loved ones, take a walk, or write your feelings instead of spending.

-

Avoid emotional shopping environments: Don’t visit malls or open shopping apps when feeling low.

-

Track your “emotional purchase” patterns: Write down what emotions you felt before buying something. Over time, patterns become clear.

3. The “I’m Bored” Spending – Shopping for Entertainment

Boredom is a sneaky spending trigger. When there’s nothing exciting happening, shopping becomes a quick way to fill the void.

Signs of Boredom Spending

-

You scroll online stores without a goal.

-

You buy things you “might need someday.”

-

You frequently return or forget about purchases.

How to Beat It

-

Replace the habit: Try a hobby, watch a series, or read a book when you feel bored.

-

Unsubscribe from tempting emails: Retail newsletters and app notifications are designed to trigger impulse buys.

-

Set spending-free weekends: Plan low-cost activities like hiking, cooking challenges, or game nights instead.

4. The “I Deserve It” Mindset – Reward-Based Spending

This type of emotional spending feels earned. Maybe you hit a milestone, worked hard all week, or survived a stressful situation—so you “reward” yourself.

The Problem

When every success turns into a spending excuse, rewards start to become expensive habits.

A Better Approach

-

Reward with intention: Instead of buying material things, celebrate with experiences (a picnic, a spa day at home, etc.).

-

Set savings goals with rewards built-in: For example, “Once I save $500, I’ll spend $50 on something small.”

-

Recognize non-monetary wins: Self-care, rest, and time with loved ones are just as rewarding.

5. The “I Want to Belong” Spending – Social and Peer Pressure

In today’s social media world, comparison culture is everywhere. When we see others showing off new purchases or luxury lifestyles, it’s easy to feel left out.

How It Affects You

You start believing, “If I buy that, I’ll feel more confident or accepted.”

But it usually ends in financial stress and more insecurity.

How to Take Back Control

-

Unfollow comparison triggers: Curate your social media feed to include creators who promote mindful spending or financial wellness.

-

Practice gratitude daily: Write down three things you already have that make you happy.

-

Remind yourself: Online appearances rarely reflect financial realities.

6. The “Impulse Joy” – Happy Spending Gone Overboard

Sometimes, even happiness can lead to overspending. You’re celebrating, feeling excited, or in a good mood—so you splurge more freely.

How to Manage It

-

Pre-plan celebrations: Decide in advance how much to spend when celebrating milestones or holidays.

-

Use cash instead of cards: Physical money makes spending more tangible.

-

Track spending right after the event: Awareness reduces future impulse buys.

The Financial Cost of Emotional Spending

Even small emotional purchases add up over time.

Let’s see how emotional spending can silently damage your finances:

| Habit | Average Monthly Cost | Annual Total |

|---|---|---|

| Weekly stress takeout ($15/week) | $60 | $720 |

| Online impulse buys ($50/month) | $50 | $600 |

| Retail therapy weekends ($100/month) | $100 | $1,200 |

| Total Emotional Spending | $2,520/year |

That’s over $2,500 a year—enough to cover a vacation, emergency fund, or pay off credit card debt.

How to Identify Your Personal Spending Triggers

Before you can change your habits, you must recognize what drives them.

Steps to Discover Your Triggers

-

Keep a Spending Journal: Record every purchase, including how you felt before and after buying.

-

Notice Timing Patterns: Are you more likely to spend at night, weekends, or after stressful days?

-

Look at Purchase Categories: Are your emotional buys food, fashion, or entertainment related?

-

Assess Emotional States: Identify which emotions lead to your biggest impulse decisions.

Once you map these triggers, you’ll see where to make changes.

Practical Strategies to Take Control of Emotional Spending

1. Build an “Awareness Pause” Habit

Before buying, ask yourself:

-

“Do I need this or want this?”

-

“Will this purchase make me happy next week?”

-

“Is this emotion-driven?”

This 30-second pause can stop countless impulse purchases.

2. Create a Realistic Budget That Includes Emotions

Most budgets fail because they don’t consider emotional needs.

Create a balanced budget that includes small rewards.

| Budget Category | Monthly Amount | Purpose |

|---|---|---|

| Essentials (Rent, Bills) | 60% | Needs |

| Savings & Investments | 20% | Future goals |

| Emotional Spending / Fun | 10% | Controlled comfort |

| Learning & Growth | 10% | Personal development |

This way, you’re not restricting yourself—you’re simply managing emotions wisely.

3. Use the “24-Hour Rule”

When you want to buy something non-essential, wait 24 hours.

If you still want it after a day, it’s likely a genuine desire, not an emotional reaction.

4. Limit Easy Access to Spending Tools

-

Remove saved cards from shopping apps.

-

Unsubscribe from marketing emails.

-

Use separate bank accounts for spending and savings.

Making it harder to spend gives your logical brain more time to catch up.

5. Practice Emotional Regulation Daily

Your emotions drive spending—so manage emotions first. Try:

-

Meditation or prayer: Helps calm impulses.

-

Exercise: Releases endorphins that naturally reduce stress.

-

Talking to someone: Sharing feelings helps prevent using money as therapy.

6. Replace Emotional Triggers with Healthy Alternatives

| Trigger Emotion | Old Response | New Response |

|---|---|---|

| Stress | Online shopping | 10-minute walk |

| Sadness | Ordering junk food | Journaling or watching a funny video |

| Boredom | Scrolling stores | Reading, cooking, or learning something new |

| Loneliness | Buying gifts | Calling a friend |

| Happiness | Splurging big | Planning a small celebration within budget |

Replacing habits gradually rewires your emotional responses to money.

7. Track Progress and Celebrate Wins

Every time you resist emotional spending, note it down.

At the end of the week, reward yourself (in non-financial ways)—a self-care evening or your favorite show. Positive reinforcement builds long-term discipline.

Helpful Tools to Stay Accountable

Here are some tools and apps that can make emotional spending easier to manage:

| Tool/App | Purpose | Key Feature |

|---|---|---|

| Mint | Budgeting & expense tracking | Categorizes emotional purchases |

| You Need a Budget (YNAB) | Goal-based budgeting | Encourages mindful spending |

| PocketGuard | Spending control | Shows how much you can safely spend |

| Notion or Google Sheets | Manual tracking | Visualizes emotional spending triggers |

| Clever Girl Finance Blog | Education | Financial empowerment for emotional buyers |

The Mindset Shift: From Emotional Spender to Mindful Earner

Taking control of emotional spending isn’t about deprivation—it’s about empowerment.

When you manage emotions, you make space for what truly matters: financial peace, confidence, and control.

Shift Your Thinking

-

Replace “I deserve this” with “I deserve financial stability.”

-

Replace “Buying will make me happy” with “Saving will make me secure.”

-

Replace “I’ll deal with it later” with “I’ll decide when I’m calm.”

These small shifts can transform your relationship with money completely.

Quick Infographic: The Emotional Spending Cycle

Trigger Emotion → Impulse → Purchase → Short-Term Relief → Regret → Stress → Repeat

To break it:

Recognize → Pause → Reflect → Replace → Reward (non-financially)

(You can visualize this as a simple circular diagram in your blog post for higher engagement.)

Long-Term Habits for Emotional Spending Control

-

Review finances weekly: Stay aware of where your money goes.

-

Set meaningful goals: Saving for travel, education, or a dream project keeps you focused.

-

Build an emergency fund: Knowing you’re secure reduces stress-based spending.

-

Learn personal finance basics: Knowledge strengthens self-control.

-

Surround yourself with mindful spenders: Positive influence shapes better money habits.

Conclusion: Mastering Your Money, One Emotion at a Time

Emotional spending isn’t about weakness—it’s about being human. We all crave comfort, excitement, or validation at times. But when those emotions start dictating our financial life, it’s time to take back control.

By identifying your emotional triggers, creating smart money systems, and practicing self-awareness, you can transform spending from an emotional escape into a purposeful choice.

Remember, every time you resist an impulse buy, you’re not just saving money—you’re building emotional strength.

And that’s worth far more than anything money can buy.