Stop letting your money control you—start controlling your money.

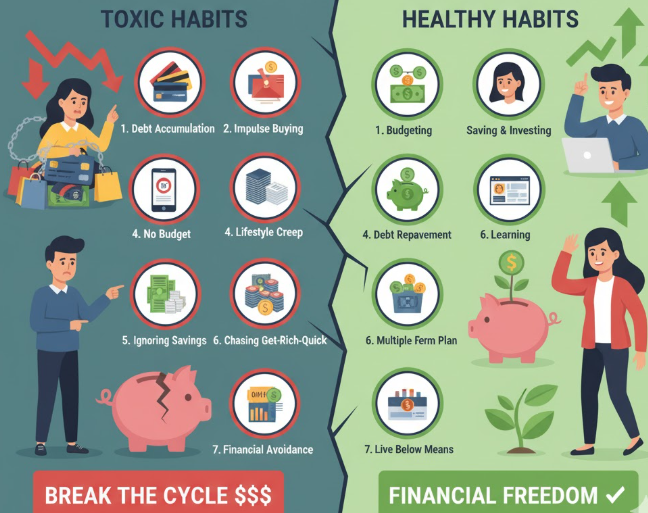

Your 20s and 30s are some of the most important years of your financial life. These decades shape how you’ll live for the rest of your future—whether you’ll struggle paycheck to paycheck or build lasting financial security. Sadly, many people unknowingly develop toxic money habits that silently sabotage their goals, no matter how much they earn.

In this guide, we’ll explore the 7 most damaging money habits that keep people broke and how to break free from them. By the end, you’ll have a practical roadmap to shift your financial mindset and take control of your future wealth.

🧠 Why Your Money Habits Matter More Than Your Income

You might think that earning more money is the solution to all your financial problems. But here’s a harsh truth: even high earners stay broke if they have bad money habits.

According to a recent financial survey, over 60% of people earning $100,000+ still live paycheck to paycheck. Why? Because their spending and saving patterns are toxic—they prioritize short-term satisfaction over long-term security.

Your money habits, not your paycheck, determine your wealth.

Let’s dive into the most common toxic habits—and how you can break them before they wreck your financial future.

1️⃣ Living Beyond Your Means

The Habit:

You earn $3,000 a month but spend $3,200. You justify it by saying, “I’ll pay it off later.” But that “later” never comes.

Many people fall into this trap because they want to look successful—buying the latest phone, eating out daily, or upgrading apartments they can’t afford. This habit is one of the biggest financial killers in your 20s and 30s.

The Problem:

Living beyond your means forces you into a cycle of debt and stress. You’re constantly catching up instead of moving forward.

Here’s a quick comparison:

| Lifestyle Type | Monthly Income | Monthly Spending | Savings | Financial Health |

|---|---|---|---|---|

| Living Beyond Means | $3,000 | $3,200 | $0 | Debt, stress |

| Living Within Means | $3,000 | $2,400 | $600 | Stability, progress |

How to Break It:

-

Track your spending using apps like Mint or Notion. Awareness is your first weapon.

-

Follow the 50/30/20 rule:

-

50% needs (rent, bills, groceries)

-

30% wants (entertainment, dining)

-

20% savings/investments

-

-

Downsize temporarily to catch up financially. A small lifestyle cut now can save years of struggle later.

💡 Remember: If you can’t buy it twice, you can’t afford it.

2️⃣ Ignoring an Emergency Fund

The Habit:

You spend every dollar you make, assuming your next paycheck will cover everything. Then one day your car breaks down or you lose your job—and you panic.

The Problem:

Without an emergency fund, one unexpected event can throw your entire life off balance. Most people then rely on credit cards or personal loans, digging themselves deeper into debt.

The Fix:

Start small—save even $10 a week. Build momentum.

Your goal:

Save at least 3–6 months of living expenses in a separate savings account.

Here’s what that looks like:

| Monthly Expenses | Recommended Emergency Fund |

|---|---|

| $1,000 | $3,000–$6,000 |

| $2,000 | $6,000–$12,000 |

| $3,000 | $9,000–$18,000 |

Simple Steps:

-

Automate a small transfer to your savings every payday.

-

Treat your emergency fund like a “do not touch” vault.

-

Store it in a high-yield savings account so it grows over time.

You’ll sleep better knowing you can handle life’s surprises without debt.

3️⃣ Depending on Credit Cards for Lifestyle

The Habit:

Swiping the card for every want—coffee, clothes, gadgets—and just paying the minimum balance each month.

The Problem:

You may feel like you’re managing it, but interest is silently eating your income. With rates often over 25%, that $500 phone might actually cost you $700–$800 over time.

The Cycle of Credit Card Debt (Simplified Chart):

| Stage | Description |

|---|---|

| 1️⃣ Spend | Swipe card for non-essentials |

| 2️⃣ Delay | Pay only minimum amount |

| 3️⃣ Interest | Balance grows every month |

| 4️⃣ Trap | Your next paycheck vanishes to pay debt |

How to Break It:

-

Stop using credit cards for non-essential items.

-

Pay off balances in full each month.

-

Use the debt avalanche or snowball method to eliminate existing debts.

-

Switch to cash or debit for everyday spending—it creates a real sense of cost.

💬 Pro tip: If you want to build credit, use one card for small recurring expenses (like Netflix) and pay it off every month.

4️⃣ Neglecting to Budget and Track Money

The Habit:

You “guess” how much you spend instead of tracking it. You have no idea where your money actually goes.

The Problem:

Without a budget, money leaks out silently—coffee runs, impulse buys, unused subscriptions—and suddenly you’re broke without realizing why.

How to Break It:

Budgeting doesn’t mean restriction—it means awareness.

Try the 3-Step Simple Budget System:

-

List your income sources.

-

Track fixed expenses (rent, bills, insurance).

-

Assign limits to variable expenses (food, entertainment, shopping).

Example:

| Category | Monthly Limit | Actual Spending | Status |

|---|---|---|---|

| Rent & Bills | $1,200 | $1,200 | ✅ |

| Groceries | $400 | $350 | ✅ |

| Dining Out | $200 | $310 | ❌ Over |

| Savings | $300 | $250 | ⚠️ Needs improvement |

Tools You Can Use:

-

Mobile apps: PocketGuard, YNAB (You Need A Budget)

-

Manual: Google Sheets or Excel templates

Once you know where your money goes, you can redirect it toward your goals—not your impulses.

5️⃣ Ignoring Investments and Relying Only on Savings

The Habit:

“I’ll start investing when I earn more.”

This mindset delays one of the most powerful financial tools—compound interest.

The Problem:

Inflation eats away at your savings every year. That means your money loses value while it sits in the bank. Meanwhile, people who invest early watch their money grow effortlessly.

Real Example:

If you invest $200/month at an average return of 8% starting at age 25, by age 45 you’ll have:

| Starting Age | Monthly Investment | Return (8%) | Value at 45 |

|---|---|---|---|

| 25 | $200 | 8% | $118,000+ |

| 35 | $200 | 8% | $54,000+ |

Ten years’ delay costs you over $60,000!

How to Break It:

-

Start small—even $50/month counts.

-

Use index funds, ETFs, or retirement plans (401k, IRA).

-

Automate your contributions so investing happens on autopilot.

💡 You don’t need to time the market—you need time in the market.

6️⃣ Comparing Your Lifestyle to Others

The Habit:

Scrolling through social media, seeing your friends travel or buy new gadgets, and feeling pressure to “keep up.” So you spend just to match their lifestyle.

The Problem:

Social comparison is a silent wealth killer. You end up chasing status, not stability.

According to studies, people who compare themselves financially are twice as likely to fall into debt-related stress.

Signs You’re Caught in This Trap:

-

Buying things for validation, not need.

-

Measuring your success by others’ possessions.

-

Feeling anxious or guilty after scrolling online.

How to Break It:

-

Unfollow financial triggers on social media.

-

Focus on your own goals, not others’ highlight reels.

-

Celebrate progress—no matter how small.

🔑 Your financial journey is unique. Someone else’s pace doesn’t define your success.

7️⃣ Avoiding Financial Education

The Habit:

You believe personal finance is “too complicated” and avoid learning about it. You rely solely on guesswork or advice from friends who may not know better.

The Problem:

Financial ignorance is expensive. Every uninformed decision—from loans to taxes—can cost you thousands over time.

In your 20s and 30s, not learning about money means missing decades of growth and opportunity.

How to Break It:

-

Spend 15 minutes a day learning about money.

-

Follow reliable finance creators or podcasts.

-

Read beginner-friendly books like:

-

“The Psychology of Money” by Morgan Housel

-

“Rich Dad Poor Dad” by Robert Kiyosaki

-

“Your Money or Your Life” by Vicki Robin

-

Simple Mindset Shift:

Money isn’t about math—it’s about behavior.

Once you understand how money works, you’ll make confident decisions instead of fearful ones.

💸 Bonus: Quick Checklist to Clean Up Your Financial Habits

Here’s a simple table you can use to track your progress:

| Toxic Habit | Replace With | Progress |

|---|---|---|

| Living beyond means | 50/30/20 budgeting | ☐ ☐ ☐ |

| No emergency fund | Automatic savings transfer | ☐ ☐ ☐ |

| Relying on credit | Cash-only challenges | ☐ ☐ ☐ |

| No budget | Expense tracking app | ☐ ☐ ☐ |

| Avoiding investments | Start with ETFs or index funds | ☐ ☐ ☐ |

| Comparing with others | Personal goal tracking | ☐ ☐ ☐ |

| Ignoring financial learning | 15-minute daily finance read | ☐ ☐ ☐ |

✅ Check them off one by one each month until your finances feel lighter, stronger, and more under control.

💬 Common Excuses That Keep You Stuck

Let’s tackle some lies people tell themselves:

| Excuse | Truth |

|---|---|

| “I don’t earn enough to save.” | Saving is a habit, not an amount. Start with $5. |

| “I’ll invest when I’m older.” | Time matters more than amount—start now. |

| “I’m bad with money.” | No one’s born good with money—it’s a skill you can learn. |

| “Everyone uses credit cards.” | Most people are in debt; don’t copy them. |

Breaking these excuses is the first step toward a healthier money life.

📊 Visualizing Your Financial Future

Here’s what happens when you break toxic money habits early:

| Age | With Bad Habits | With Smart Habits |

|---|---|---|

| 25 | $0 savings, rising debt | $2,000+ saved, investing started |

| 30 | Constant stress, no goals | Emergency fund built, budget control |

| 35 | Living paycheck to paycheck | Multiple income streams |

| 40 | Dependent on credit | Financial freedom growing |

| 50+ | Struggling to retire | Confident, independent lifestyle |

Your decisions today decide which column you end up in.

🪞 Final Thoughts: Your Future Self Is Counting on You

Money mistakes in your 20s and 30s are common—but not permanent.

Breaking toxic habits isn’t about being perfect—it’s about being aware, consistent, and intentional.

Start small:

-

Save a little each month.

-

Learn something new about money weekly.

-

Avoid lifestyle traps that drain your future wealth.

Because every dollar you manage wisely today becomes a building block for your freedom tomorrow.