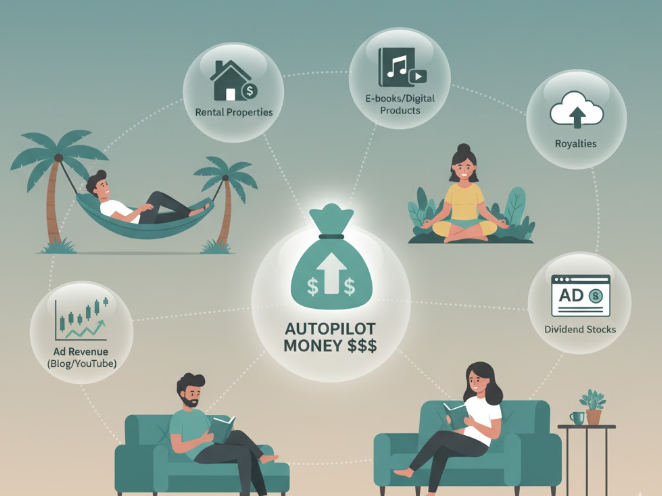

In today’s fast-paced world, everyone dreams of earning money without working around the clock. Imagine waking up in the morning and seeing your bank balance grow—without putting in hours at an office or hustling nonstop. That’s the magic of passive income.

But here’s the truth: not all passive income ideas are truly “set it and forget it.” Some require months—or even years—of setup. Yet, once they’re built properly, they can run on autopilot with little to no maintenance.

This article will show you proven, low-effort passive income streams that can earn money consistently while freeing up your time for what really matters.

What Is Passive Income Really About?

Passive income is money you earn automatically after the initial work is done. Think of it as earning while you sleep.

Unlike your regular job—where you trade hours for dollars—passive income continues to generate money long after you’ve stopped working on it.

The Basic Formula

-

Initial Setup Effort: You put in time, effort, or money once.

-

Automation / Outsourcing: You set up systems that do the work for you.

-

Ongoing Earnings: You keep earning with minimal attention.

Why Passive Income Matters in 2025

The global economy is changing fast. AI, automation, and inflation are reshaping the way we earn money. Having multiple income streams isn’t a luxury anymore—it’s a necessity.

Key benefits of passive income:

-

✅ Financial stability even if you lose your job.

-

✅ Freedom to travel, learn, or pursue passion projects.

-

✅ Long-term wealth building.

-

✅ Better work-life balance.

Top Passive Income Streams That Need Little or No Maintenance

Let’s dive into the best and most realistic ways to make money passively—with honest insights about effort, costs, and earning potential.

1. Dividend-Paying Stocks

If you’re looking for one of the easiest forms of passive income, dividend stocks are a top pick. These are shares of companies that pay a portion of their profits back to shareholders.

How It Works

You buy shares in a company like Coca-Cola or Johnson & Johnson. Every quarter (or month), they send you dividend payments—whether or not you sell your shares.

Why It’s Low Maintenance

-

Once you buy the stock, you do nothing but collect dividends.

-

Many brokers offer automatic reinvestment to grow your earnings faster.

Potential Returns

| Dividend Yield | Investment | Annual Passive Income |

|---|---|---|

| 3% | $10,000 | $300/year |

| 5% | $20,000 | $1,000/year |

| 7% | $30,000 | $2,100/year |

Tip: Use apps like Fidelity, Vanguard, or Robinhood to invest with minimal fees.

2. High-Yield Savings Accounts and CDs

It doesn’t get more passive than this. A high-yield savings account or certificate of deposit (CD) lets you earn interest on your money without any effort.

Why It’s Great

-

FDIC-insured (safe and risk-free).

-

No management required.

-

Instant liquidity (in savings accounts).

Average Returns (2025 Update)

| Account Type | Average Annual Yield | Risk Level | Maintenance |

|---|---|---|---|

| High-Yield Savings | 4.5% | Very Low | None |

| 1-Year CD | 5.0% | Very Low | None |

| Treasury Bonds | 5.2% | Very Low | None |

Pro Tip: Online banks like Ally, SoFi, and Marcus by Goldman Sachs often offer the best rates.

3. Real Estate Crowdfunding

You don’t need to be a landlord to earn from real estate anymore. With crowdfunding platforms, you can invest in properties without dealing with tenants or repairs.

How It Works

Platforms like Fundrise, RealtyMogul, or Crowdstreet pool money from many investors and buy rental or commercial properties. You earn rental income and property appreciation.

Why It’s Passive

-

You don’t manage tenants.

-

Monthly or quarterly payouts.

-

Professionally managed by experts.

Example Return:

A $5,000 investment could earn around $400–$600 per year with zero effort.

4. Digital Products (Ebooks, Courses, Templates)

Once you create a digital product, it can sell forever. This is one of the most scalable and low-maintenance income streams.

What You Can Sell

-

Ebooks or guides

-

Printable planners

-

Excel templates

-

Online mini-courses

-

Stock photos or designs

Why It’s Low Effort

You create it once and automate sales using marketplaces like:

-

Etsy

-

Gumroad

-

Udemy

-

Teachable

Bonus Tip: Set up automatic delivery using tools like Shopify Digital Downloads or Payhip—so you never handle customer service manually.

5. Affiliate Marketing with Evergreen Content

Affiliate marketing is a goldmine for long-term, low-maintenance income—if you build it right.

How It Works

You promote someone else’s product through a blog, YouTube channel, or email newsletter. Every time someone buys through your unique link, you earn a commission.

Why It’s Passive

-

Once your content ranks or goes viral, it keeps generating clicks.

-

No product creation or customer support needed.

-

You can earn for years from one blog post or video.

Example Niches

| Niche | Product Type | Average Commission |

|---|---|---|

| Fitness | Supplements | 15–30% |

| Tech | Gadgets / Apps | 5–20% |

| Finance | Credit Cards / Courses | $50–$300 per sale |

Popular Platforms: Amazon Associates, ClickBank, Impact Radius, and ShareASale.

6. Rent Out Storage Space

If you have an empty garage, basement, or shed, you can make steady monthly income without lifting a finger.

How

Use websites like Neighbor.com or Stache to rent storage space to people in your area.

Why It’s Truly Hands-Off

-

No maintenance required.

-

Tenants store their own items.

-

You get automatic monthly payments.

Average Earnings

| Space Type | Monthly Income | Effort Level |

|---|---|---|

| Garage | $100–$300 | Very Low |

| Basement | $80–$250 | Very Low |

| Spare Room | $150–$400 | Low |

7. Print-on-Demand Stores

Want to sell T-shirts, mugs, or phone cases without handling shipping or inventory? Enter the print-on-demand (POD) model.

How It Works

-

Upload your designs to a platform like Redbubble, TeeSpring, or Printful.

-

When someone buys, the platform prints and ships the item.

-

You earn a profit per sale.

Why It’s Low Maintenance

-

No upfront investment in stock.

-

No customer handling.

-

Once designs are uploaded, income becomes 100% passive.

Pro Tip: Focus on timeless (evergreen) designs—like motivational quotes, hobbies, or minimal art—to keep sales going for years.

8. YouTube Automation Channels

You don’t need to show your face to make money on YouTube. Channels that use voiceovers, stock footage, and automated editing can generate thousands in ad revenue.

Steps to Start

-

Choose a niche (finance, tech, travel, or facts).

-

Hire a scriptwriter and voiceover artist from Fiverr or Upwork.

-

Upload consistent videos.

-

Monetize with YouTube Partner Program or affiliate links.

Once your videos start ranking, they can bring passive ad revenue for years.

9. Licensing Your Photos, Music, or Art

If you’re creative, you can earn royalties without constant uploads.

Examples

-

Upload photos to Shutterstock or Adobe Stock.

-

Sell your music on Epidemic Sound or AudioJungle.

-

License artwork on Society6 or Fine Art America.

Each time someone downloads or uses your work, you get paid automatically.

Average Earnings:

| Type | Monthly Potential | Effort After Upload |

|---|---|---|

| Stock Photos | $100–$1,000 | None |

| Digital Music | $200–$2,000 | None |

| Art Prints | $100–$1,500 | None |

10. Create a Mobile App

Building a simple app once can lead to years of passive ad income.

Examples of Simple Apps

-

Habit trackers

-

To-do lists

-

Quote of the day apps

-

Flashlight or sound generator apps

You can hire a freelancer to develop your idea on Upwork for under $1,000.

Monetization Options:

-

Display ads (AdMob)

-

Paid downloads

-

In-app purchases

Once live, app stores handle everything—from hosting to payments—making it a nearly hands-free source of revenue.

11. Automated Dropshipping Store

Unlike traditional e-commerce, automated dropshipping can be mostly hands-free.

How It Works

-

You list products from suppliers on Shopify or WooCommerce.

-

When someone buys, the supplier ships it directly to the customer.

-

Software like Oberlo or AutoDS automates orders.

Why It’s Semi-Passive

-

Minimal manual work once automation is in place.

-

You can outsource marketing or customer service.

12. REITs (Real Estate Investment Trusts)

If you want to earn from real estate but skip the maintenance, REITs are your best friend.

How It Works

You invest in companies that own and manage real estate. They pay out dividends—usually every month or quarter.

Top REITs to Watch

| REIT Type | Example Company | Dividend Yield |

|---|---|---|

| Residential | AvalonBay | 3.8% |

| Commercial | Realty Income | 5.0% |

| Healthcare | Welltower | 4.2% |

Why It’s Perfectly Passive:

No tenants. No maintenance. Just regular income.

13. Peer-to-Peer Lending

Websites like LendingClub and Prosper let you lend money to individuals or small businesses. You earn interest as they repay.

Low Maintenance Setup

-

You deposit funds once.

-

The platform handles payments and collections.

-

Earnings are deposited automatically.

Expected Returns

5%–10% annually, depending on loan risk.

14. Rent Out Your Car

Platforms like Turo or Getaround let you earn from your car when you’re not using it.

Why It’s Easy

-

The platform handles insurance and payments.

-

You can even use remote key access for a fully hands-free experience.

Example:

If your car rents for $40/day and you rent it 10 days a month, that’s $400/month passive income.

15. Buy and Sell Domain Names

Domain flipping is the digital version of real estate. You buy attractive domain names and sell them for a profit.

How

-

Purchase names with high keyword value (like “BestFitnessPlans.com”).

-

List them on GoDaddy Auctions or Namecheap Marketplace.

-

Wait for a buyer.

Some people earn $100–$10,000+ per sale—and it costs only a few dollars per year to renew.

Quick Comparison Table

| Passive Income Stream | Initial Effort | Ongoing Maintenance | Income Potential | Risk Level |

|---|---|---|---|---|

| Dividend Stocks | Low | None | Moderate | Low |

| High-Yield Savings | Very Low | None | Low | Very Low |

| Real Estate Crowdfunding | Low | None | Moderate | Medium |

| Digital Products | High (once) | Very Low | High | Low |

| Affiliate Marketing | Medium | Low | High | Medium |

| Print-on-Demand | Medium | Very Low | Moderate | Low |

| REITs | Low | None | Moderate | Low |

| Storage Space Rental | Low | Very Low | Moderate | Very Low |

| YouTube Automation | Medium | Low | High | Medium |

| P2P Lending | Low | None | Moderate | Medium |

How to Make Your Passive Income Truly Hands-Free

Even the best passive income idea needs a bit of setup. Follow these steps to keep things running automatically:

✅ 1. Automate Everything

Use software tools for scheduling, payments, and analytics.

✅ 2. Reinvest Earnings

Use your returns to build more streams instead of spending early.

✅ 3. Diversify

Don’t rely on one method—spread across 3–4 income streams.

✅ 4. Outsource Maintenance

Hire freelancers for updates or minor issues so your system runs smoothly.

Final Thoughts: Build Once, Earn Forever

The beauty of passive income is freedom—financial, personal, and creative. Whether it’s dividends, digital products, or automated online stores, these income streams prove that you don’t need to work 9 to 5 forever.

Start small. Choose one or two ideas that match your skills and budget. Put in the setup work once—and watch your money grow with minimal effort.

💡 The best time to build passive income was yesterday. The next best time is today.