The envelope budgeting method is one of the oldest and most effective ways to control spending and stick to a budget. This time-tested approach uses physical cash divided into labeled envelopes for different spending categories, creating a tangible, foolproof system that prevents overspending and builds financial discipline.

Originally popularized during the Great Depression when cash was king, the envelope method has experienced a resurgence in recent years as people seek to break free from credit card debt and regain control over their finances. This comprehensive guide will teach you everything you need to know about implementing the envelope budgeting system, from traditional cash envelopes to modern digital alternatives.

What is the Envelope Budgeting Method?

The envelope budgeting method is a cash-based budgeting system where you allocate predetermined amounts of cash into labeled envelopes for different spending categories. Each envelope represents a specific budget category, such as groceries, entertainment, or gas. Once the money in an envelope is spent, you cannot spend any more in that category until the next budgeting period.

The Core Principle: Physical Spending Limits

The genius of the envelope method lies in its physical nature. When you can see and touch your money, spending becomes more conscious and deliberate. The finite amount of cash in each envelope creates a hard spending limit that’s impossible to exceed, unlike credit cards or debit cards that can lead to overspending.

Historical Context

The envelope method gained popularity during the 1930s and 1940s when most transactions were cash-based. Families would divide their paychecks into envelopes labeled for rent, groceries, utilities, and other necessities. This system helped millions of families survive economic hardships by ensuring essential expenses were covered first.

How the Envelope Method Works

The Basic Process

- Determine your monthly income after taxes and deductions

- List all your expenses and categorize them

- Assign dollar amounts to each spending category

- Withdraw cash equal to your total budget

- Divide cash into labeled envelopes for each category

- Spend only from designated envelopes throughout the month

- When an envelope is empty, stop spending in that category

Visual Example

Imagine you have $3,000 monthly income and create these envelopes:

- Groceries: $400

- Gas: $150

- Dining Out: $200

- Entertainment: $100

- Personal Care: $75

- Clothing: $125

- Miscellaneous: $50

Total for envelopes: $1,100 Remaining for fixed expenses and savings: $1,900

Categories Perfect for Envelope Budgeting

Variable Expenses (Best Suited)

Groceries: One of the most popular envelope categories because grocery spending can easily spiral out of control without limits.

Dining Out: Restaurants and takeout expenses are perfect for envelope budgeting because they’re completely discretionary.

Entertainment: Movies, concerts, hobbies, and recreational activities fit perfectly into the envelope system.

Personal Care: Hair cuts, cosmetics, and non-essential personal items work well with cash limits.

Clothing: Non-essential clothing purchases are ideal for envelope budgeting.

Gas: If you drive regularly, a gas envelope helps control transportation costs.

Gifts: Holiday and birthday gifts benefit from predetermined spending limits.

Fixed Expenses (Not Suitable)

Certain expenses don’t work well with the envelope method:

- Rent or mortgage payments

- Insurance premiums

- Loan payments

- Utility bills

- Subscriptions and memberships

These fixed expenses are typically paid by check, automatic transfer, or online payment and remain the same each month.

Step-by-Step Implementation Guide

Step 1: Calculate Your Envelope Budget

Start by determining how much money you’ll allocate to envelope categories.

Example Calculation:

- Monthly income: $4,500

- Fixed expenses: $2,800 (rent, insurance, loan payments, etc.)

- Savings goals: $900

- Available for envelopes: $800

Step 2: Choose Your Categories

Select 5-8 categories where you struggle with overspending or want more control. Common beginner categories include:

- Groceries

- Dining out

- Entertainment

- Gas

- Personal care

- Miscellaneous

Step 3: Assign Dollar Amounts

Distribute your available envelope money across your chosen categories:

Example Distribution ($800 total):

- Groceries: $350

- Dining out: $150

- Entertainment: $100

- Gas: $120

- Personal care: $50

- Miscellaneous: $30

Step 4: Gather Your Supplies

Physical Envelopes:

- Regular letter envelopes

- Accordion file folders

- Small cash organizer wallet

- Labels or markers for writing

Security Considerations:

- Small fireproof safe for home storage

- Concealed wallet for carrying envelopes

- Never carry all envelopes at once

Step 5: Set Up Your System

Label each envelope clearly with the category name and budgeted amount.

Example Label: “Groceries – $350”

Organize envelopes in a logical order, such as:

- Most frequently used first

- Alphabetical order

- By spending priority

Step 6: Withdraw and Distribute Cash

Visit your bank or ATM to withdraw the total amount needed for all envelopes. Divide the cash according to your predetermined amounts.

Cash Withdrawal Strategy:

- Withdraw at the beginning of each month

- Use a mix of bills for easier spending

- Consider smaller bills for better portion control

Step 7: Use Your Envelopes

Shopping Rules:

- Take only the relevant envelope when shopping

- Count your money before and after spending

- Put receipts in the envelope for tracking

- When an envelope is empty, stop spending in that category

Advanced Envelope Budgeting Strategies

The Rollover Method

If you don’t spend all the money in an envelope, you have several options:

Option 1: Rollover to Next Month Add leftover money to next month’s envelope for that category.

Option 2: Move to Savings Transfer unused money to your savings account or emergency fund.

Option 3: Redistribute Move money to categories where you consistently overspend.

The Emergency Buffer Envelope

Create a small “emergency” or “overflow” envelope with $50-100 for unexpected expenses or when you overspend in a category.

Usage Rules:

- Only use for true emergencies or category shortfalls

- Replenish immediately when used

- Track usage to identify budget adjustments needed

The Sinking Fund Envelopes

Create envelopes for irregular expenses that occur throughout the year:

Annual Expenses Broken Down Monthly:

- Car maintenance: $600/year = $50/month

- Holiday gifts: $480/year = $40/month

- Vacation: $1,200/year = $100/month

- Clothing: $600/year = $50/month

The Percentage Method

Instead of fixed dollar amounts, use percentages of your envelope budget:

Example with $1,000 envelope budget:

- Groceries: 40% = $400

- Dining out: 20% = $200

- Entertainment: 15% = $150

- Gas: 15% = $150

- Personal care: 5% = $50

- Miscellaneous: 5% = $50

This method automatically adjusts your spending when your income changes.

Digital and Hybrid Envelope Systems

Digital Envelope Apps

Modern technology offers envelope budgeting without physical cash:

Goodbudget (formerly EEBA):

- Virtual envelopes with spending tracking

- Syncs across multiple devices

- Free and paid versions available

Mvelopes:

- Automatically categorizes transactions

- Virtual envelope system

- Bank account integration

YNAB (You Need A Budget):

- Envelope-style budgeting with digital tools

- Excellent mobile app

- Subscription-based service

Hybrid Cash-Digital System

Combine physical cash for some categories with digital tracking for others:

Cash Categories:

- Groceries

- Dining out

- Entertainment

- Personal care

Digital Categories:

- Gas (paid with card, tracked digitally)

- Online shopping

- Subscriptions

Bank Account Envelope Method

Use multiple bank accounts as “envelopes”:

Setup:

- Open separate savings accounts for each category

- Set up automatic transfers on payday

- Use debit cards linked to specific accounts

Benefits:

- Earn interest on unused money

- No cash security concerns

- Easy online tracking

Drawbacks:

- Potential bank fees

- Less tactile spending awareness

- Requires multiple accounts

Common Challenges and Solutions

Challenge 1: Feeling Restricted

Many people initially feel confined by the envelope method’s rigid spending limits.

Solutions:

- Start with generous envelope amounts and adjust downward

- Include fun money envelopes for guilt-free spending

- Remember that restriction now leads to financial freedom later

- Focus on your long-term goals

Challenge 2: Forgetting Envelopes

Leaving envelopes at home defeats the purpose of the system.

Solutions:

- Keep envelopes in your car

- Use a small envelope wallet that fits in your purse or pocket

- Take photos of envelope contents for reference

- Create a backup plan for forgotten envelopes

Challenge 3: Safety Concerns

Carrying large amounts of cash can feel unsafe.

Solutions:

- Never carry all envelopes at once

- Use a concealed envelope wallet

- Shop during daylight hours when possible

- Consider digital alternatives for high-risk situations

Challenge 4: Inconvenience

Cash-only spending can be inconvenient in our increasingly cashless society.

Solutions:

- Use hybrid systems combining cash and digital tracking

- Keep some envelope money in checking account with strict tracking

- Use cash for major spending categories only

- Gradually transition to digital envelope systems

Challenge 5: Overspending in Categories

Running out of envelope money before month-end is common initially.

Solutions:

- Borrow from other envelopes (track these transfers)

- Use your emergency buffer envelope

- Adjust next month’s budget based on actual spending

- Find free alternatives for remaining days

Success Tips for Envelope Budgeting

Start Small

Begin with 3-4 envelopes for your biggest problem spending areas rather than trying to envelope-budget everything at once.

Track Everything

Keep receipts and note spending patterns to improve your budget over time.

Tracking Methods:

- Small notebook in each envelope

- Smartphone app or note-taking app

- Spreadsheet or budgeting software

- Photos of receipts

Adjust Regularly

Your first envelope budget won’t be perfect. Adjust amounts based on actual spending patterns and changing needs.

Plan for Irregular Expenses

Create envelopes for predictable but irregular expenses like car maintenance, gifts, and seasonal purchases.

Make It Visual

Use clear envelopes or write balances on the outside to see your money at a glance.

Include Your Family

If you’re married or have older children, involve them in the envelope system to ensure everyone follows the plan.

Real-World Envelope Budgeting Examples

Example 1: Sarah – Single Professional

Monthly Income: $3,800 Fixed Expenses: $2,200 Savings: $800 Available for Envelopes: $800

Envelope Allocation:

- Groceries: $300

- Dining out: $200

- Entertainment: $100

- Gas: $100

- Personal care: $50

- Clothing: $30

- Miscellaneous: $20

Monthly Results:

- Reduced grocery spending by 25%

- Eliminated impulse dining out

- Stayed within all envelope limits

- Built emergency fund faster

Example 2: The Johnson Family

Monthly Income: $6,500 Fixed Expenses: $4,200 Savings: $1,000 Available for Envelopes: $1,300

Envelope Allocation:

- Groceries: $600

- Dining out: $250

- Entertainment/Kids: $200

- Gas: $150

- Personal care: $50

- Clothing: $30

- Miscellaneous: $20

Family Rules:

- Mom manages grocery and household envelopes

- Dad handles gas and entertainment envelopes

- Children earn spending money through chores

- Family meetings to discuss envelope performance

Transitioning from Envelope Budgeting

When to Consider Changes

Signs you might need to adapt:

- Consistent overspending in multiple categories

- Major life changes (income increase, new job, marriage)

- Comfort with spending discipline

- Desire for more sophisticated tracking

Evolution Options

Hybrid Systems:

- Keep cash for problem categories

- Use digital tracking for others

- Maintain envelope mindset with debit cards

Zero-Based Budgeting:

- Apply envelope principles to comprehensive budgeting

- Assign every dollar a specific job

- Maintain spending discipline with digital tools

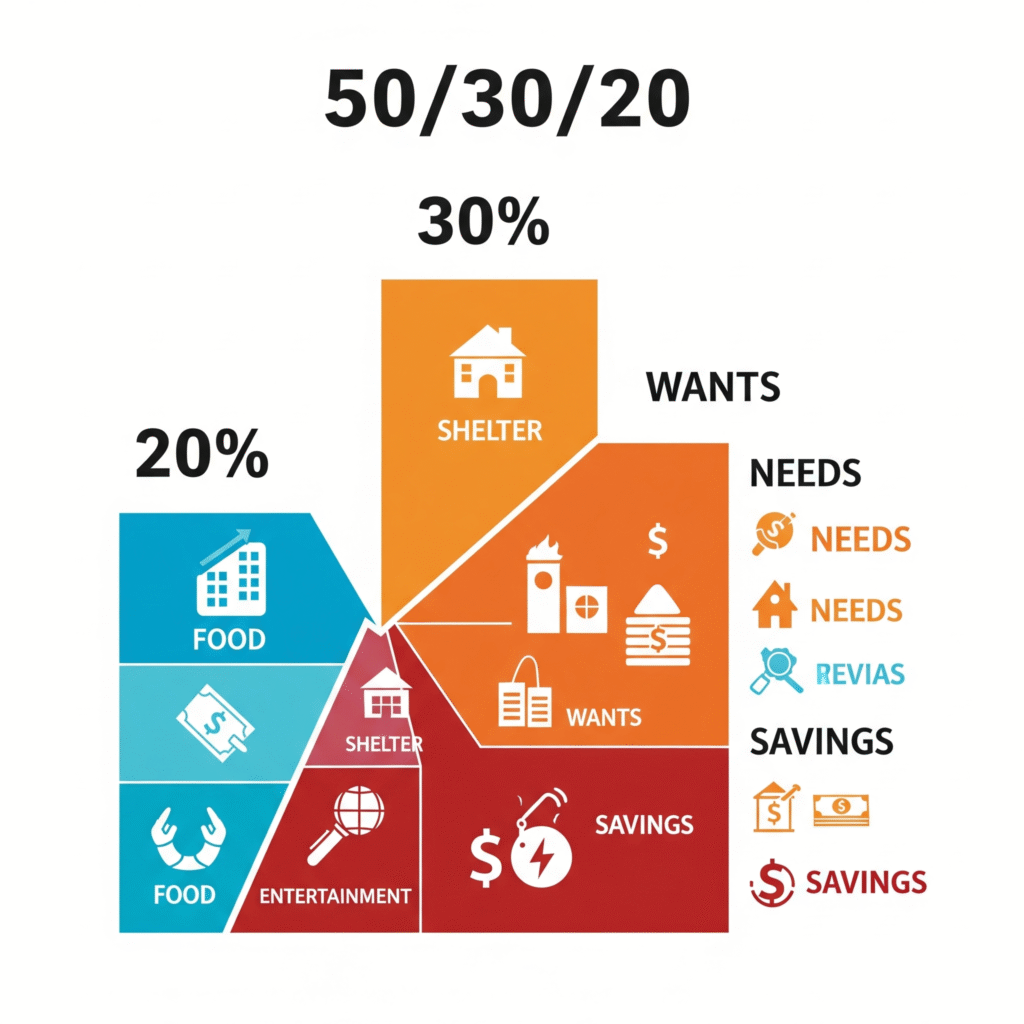

Percentage-Based Budgeting:

- Use lessons learned to implement 50/30/20 rule

- Maintain spending awareness from envelope training

- Scale up financial planning

Long-Term Benefits of Envelope Budgeting

Financial Discipline Development

The envelope method teaches fundamental financial skills:

- Conscious spending decisions

- Delayed gratification

- Priority-based spending

- Resource management

Debt Reduction

By preventing overspending, envelope budgeting helps people:

- Stop accumulating new debt

- Free up money for debt payments

- Break the credit card cycle

- Build positive financial momentum

Emergency Fund Building

Money not spent from envelopes can be redirected to:

- Emergency fund contributions

- Additional savings goals

- Debt elimination

- Investment opportunities

Improved Financial Communication

For couples, envelope budgeting improves:

- Financial transparency

- Spending accountability

- Goal alignment

- Conflict reduction

Conclusion

The envelope budgeting method is a powerful tool for anyone struggling with overspending or looking to gain better control over their finances. Its simplicity and effectiveness have helped millions of people break free from debt, build savings, and develop healthy financial habits.

While the envelope method may seem old-fashioned in our digital age, its core principles remain as relevant as ever. The tactile nature of cash creates a psychological barrier to overspending that digital transactions simply cannot match. Whether you use physical envelopes, digital apps, or a hybrid approach, the envelope method’s emphasis on predetermined spending limits and conscious money management will serve you well.

Remember that the envelope method is not about deprivation—it’s about intention. By allocating your money purposefully and spending within predetermined limits, you’re taking control of your financial future and working toward your most important goals.

Start your envelope budgeting journey today with just a few categories. As you experience the peace of mind that comes from knowing exactly where your money goes and the satisfaction of staying within your limits, you’ll understand why this time-tested method continues to help people achieve financial success.

The envelope method isn’t just a budgeting technique—it’s a pathway to financial freedom, one envelope at a time.