The 50/30/20 rule has become one of the most popular budgeting methods for good reason: it’s simple, flexible, and effective for people at any income level. Created by Harvard bankruptcy expert Elizabeth Warren, this budgeting framework provides a straightforward way to allocate your after-tax income across three essential categories without the complexity of traditional budgeting methods.

If you’ve struggled with complicated budgeting systems or felt overwhelmed by tracking every expense, the 50/30/20 rule might be exactly what you need. This comprehensive guide will teach you everything about implementing this powerful budgeting strategy, from basic calculations to advanced optimization techniques.

What is the 50/30/20 Rule?

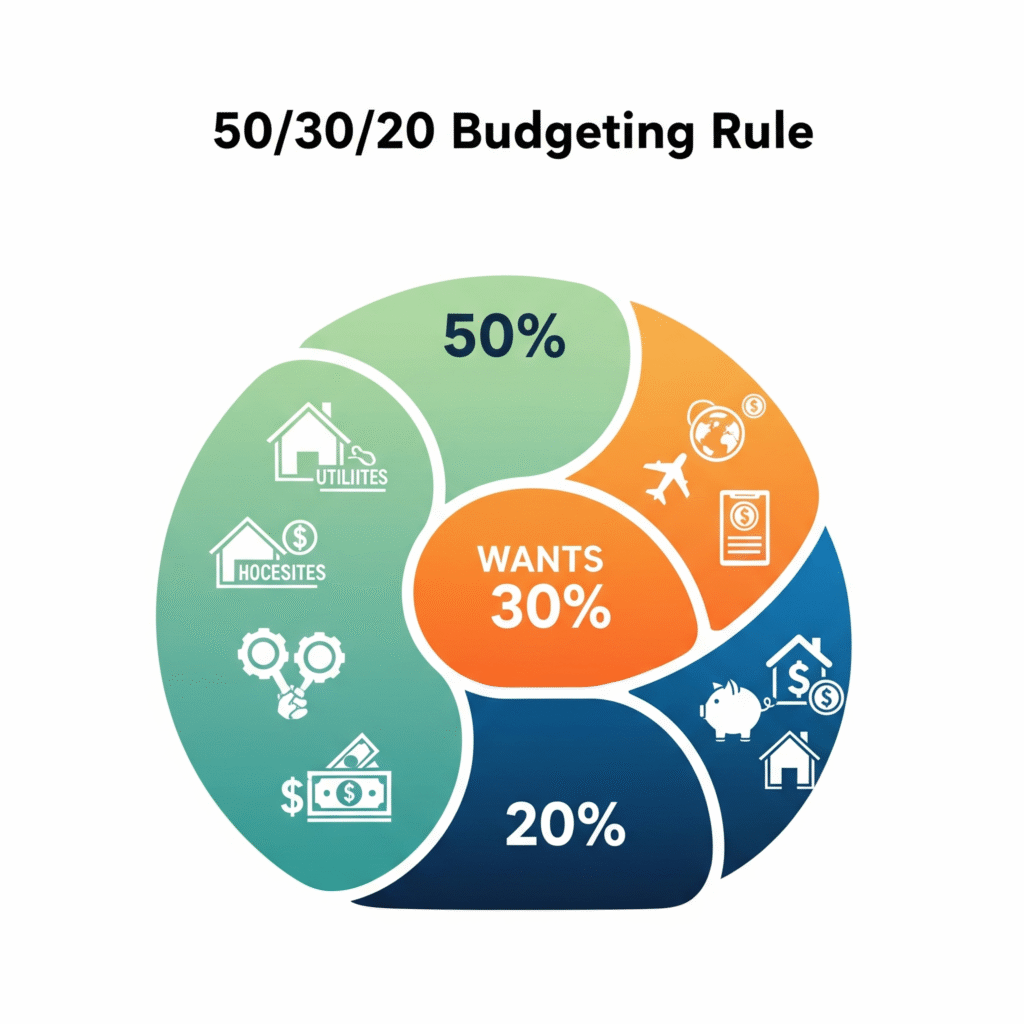

The 50/30/20 rule is a simple budgeting framework that divides your after-tax income into three main categories:

- 50% for Needs: Essential expenses you cannot avoid

- 30% for Wants: Discretionary spending that enhances your lifestyle

- 20% for Savings and Debt Repayment: Building your financial future

This allocation provides a balanced approach to money management that ensures you cover your essentials, enjoy your life, and secure your financial future simultaneously.

Why This Rule Works

The beauty of the 50/30/20 rule lies in its simplicity and psychological appeal. Unlike complex budgeting systems that require tracking dozens of categories, this method gives you clear guidelines while maintaining flexibility within each category. Research in behavioral economics shows that people are more likely to stick with simple systems, making this rule particularly effective for long-term success.

Breaking Down the 50/30/20 Categories

The 50% – Your Needs

The needs category covers expenses that are absolutely essential for your survival and basic functioning in society. These are non-negotiable expenses that you must pay regardless of your financial situation.

Housing Costs:

- Rent or mortgage payments

- Property taxes

- Homeowners or renters insurance

- Basic utilities (electricity, gas, water, trash)

- Essential home maintenance

Transportation:

- Car payments

- Auto insurance

- Gas for commuting

- Public transportation costs

- Basic car maintenance and repairs

Food:

- Groceries for home cooking

- Essential household supplies

Healthcare:

- Health insurance premiums

- Essential medical expenses

- Prescription medications

Other Essential Expenses:

- Minimum debt payments (credit cards, loans)

- Phone service (basic plan)

- Internet (if required for work)

- Childcare costs

- Basic clothing needs

The 30% – Your Wants

The wants category covers everything that enhances your quality of life but isn’t absolutely necessary for survival. This is where you have the most flexibility and can adjust spending based on your priorities and values.

Entertainment and Social Life:

- Dining out and takeout

- Movies, concerts, and events

- Streaming services and subscriptions

- Hobbies and recreational activities

- Social outings with friends

Lifestyle Enhancements:

- Shopping for non-essential items

- Upgraded phone or internet plans

- Gym memberships and fitness classes

- Beauty treatments and spa services

- Home décor and non-essential furniture

Travel and Experiences:

- Vacations and weekend trips

- Adventure activities and experiences

- Travel-related expenses

Upgraded Necessities:

- Organic or premium groceries

- Designer clothing

- Luxury car features

- Premium housing amenities

The 20% – Savings and Debt Repayment

This category is crucial for building long-term financial security and should be treated as non-negotiable as your needs category.

Emergency Fund:

- Building initial $1,000 emergency fund

- Growing to 3-6 months of expenses

- Maintaining and replenishing when used

Debt Repayment:

- Extra payments on high-interest debt

- Accelerated student loan payments

- Additional mortgage payments

Retirement Savings:

- 401(k) contributions beyond employer match

- IRA contributions

- Other retirement accounts

Short-term Savings Goals:

- Vacation fund

- Home down payment

- Car replacement fund

- Major purchase savings

Long-term Investments:

- Taxable investment accounts

- Real estate investments

- Education savings (529 plans)

How to Calculate Your 50/30/20 Budget

Step 1: Determine Your After-Tax Income

Start with your monthly take-home pay after taxes and deductions. This includes:

- Regular salary or wages (after taxes)

- Freelance or side hustle income (after taxes)

- Investment income

- Any other regular income sources

Example calculation:

- Monthly gross income: $6,000

- Taxes and deductions: $1,500

- After-tax income: $4,500

Step 2: Calculate Each Category

Using our example of $4,500 monthly after-tax income:

Needs (50%): $4,500 × 0.50 = $2,250 Wants (30%): $4,500 × 0.30 = $1,350 Savings/Debt (20%): $4,500 × 0.20 = $900

Step 3: List Your Current Expenses

Before implementing the 50/30/20 rule, track your current spending for at least one month to understand where your money currently goes. Categorize each expense into needs, wants, or savings/debt repayment.

Step 4: Make Adjustments

Compare your current spending to the 50/30/20 targets. You’ll likely need to make adjustments in one or more categories.

Real-World Examples of the 50/30/20 Rule

Example 1: Sarah – $3,000 Monthly Income

After-tax income: $3,000/month

50% Needs ($1,500):

- Rent: $900

- Utilities: $150

- Groceries: $250

- Car payment: $200

- Total: $1,500

30% Wants ($900):

- Dining out: $300

- Entertainment: $200

- Shopping: $250

- Streaming services: $50

- Gym membership: $100

- Total: $900

20% Savings/Debt ($600):

- Emergency fund: $200

- Retirement (401k): $250

- Credit card payment: $150

- Total: $600

Example 2: Mike – $5,500 Monthly Income

After-tax income: $5,500/month

50% Needs ($2,750):

- Mortgage: $1,600

- Utilities: $200

- Groceries: $400

- Car payment: $350

- Insurance: $200

- Total: $2,750

30% Wants ($1,650):

- Dining out: $500

- Travel fund: $400

- Entertainment: $300

- Shopping: $300

- Hobbies: $150

- Total: $1,650

20% Savings/Debt ($1,100):

- Emergency fund: $300

- Retirement: $500

- Extra mortgage payment: $300

- Total: $1,100

Common Challenges and Solutions

Challenge 1: Needs Exceed 50%

This is common in high-cost-of-living areas or for people with lower incomes.

Solutions:

- Reduce housing costs: Consider roommates, downsizing, or relocating

- Lower transportation costs: Use public transit, carpool, or consider a less expensive vehicle

- Audit your needs: Ensure everything in this category is truly essential

- Increase income: Look for side hustles or career advancement opportunities

Challenge 2: Difficulty Distinguishing Needs vs. Wants

The line between needs and wants can be blurry and personal.

Solutions:

- Use the necessity test: Can you survive without this expense for 30 days?

- Consider alternatives: If there’s a cheaper option that meets your basic need, the upgrade is a want

- Be honest with yourself: It’s okay to have wants, but categorize them correctly

Challenge 3: Not Saving the Full 20%

Many people struggle to save 20% of their income, especially when starting out.

Solutions:

- Start smaller: Begin with 10% or 15% and gradually increase

- Automate savings: Set up automatic transfers to make saving effortless

- Use windfalls: Direct tax refunds, bonuses, or gifts to savings

- Reduce wants temporarily: Temporarily allocate more to savings by cutting discretionary spending

Advanced Strategies for Optimizing Your 50/30/20 Budget

Strategy 1: The Graduated Approach

If you can’t immediately hit the 20% savings target, use a graduated approach:

Month 1-3: 50% needs, 40% wants, 10% savings Month 4-6: 50% needs, 35% wants, 15% savings Month 7+: 50% needs, 30% wants, 20% savings

Strategy 2: Seasonal Adjustments

Adjust your percentages based on seasonal needs:

Holiday Season: Temporarily increase wants percentage for gifts and celebrations Tax Season: Allocate tax refunds to boost your savings percentage Summer: Adjust for vacation and travel expenses

Strategy 3: The 50/30/20 Plus Method

For higher earners or those with specific goals:

50% Needs (keep essential spending controlled) 25% Wants (maintain lifestyle but be more conscious) 25% Savings/Debt (accelerate financial goals)

Strategy 4: Debt-First Modification

If you have high-interest debt, temporarily modify the rule:

50% Needs 20% Wants (reduce discretionary spending) 30% Savings/Debt (focus heavily on debt elimination)

Using Technology to Implement the 50/30/20 Rule

Budgeting Apps

Modern budgeting apps can automatically categorize expenses and track your 50/30/20 allocation:

- Mint: Free app that connects to your accounts and categorizes spending

- YNAB (You Need A Budget): Focuses on intentional spending and budgeting

- Personal Capital: Great for tracking investments and net worth

- PocketGuard: Helps prevent overspending in each category

Automation Strategies

Automatic Transfers:

- Set up automatic transfers to savings on payday

- Use separate accounts for each category

- Automate bill payments to streamline your needs category

Account Structure:

- Checking Account: For needs (50%)

- Fun Account: For wants (30%)

- Savings Account: For emergency fund and short-term goals

- Investment Account: For long-term wealth building

Adapting the 50/30/20 Rule to Different Life Stages

Young Professionals (20s-30s)

Focus Areas:

- Building emergency fund

- Starting retirement savings early

- Potentially higher wants percentage for experiences and networking

Modifications:

- Consider 50/35/15 initially while building career

- Prioritize high-yield savings accounts

- Focus on experiences over material possessions

Mid-Career (30s-40s)

Focus Areas:

- Maximizing retirement contributions

- Saving for children’s education

- Building substantial emergency fund

Modifications:

- May need to adjust for childcare costs in needs category

- Consider 529 education savings plans

- Focus on tax-advantaged retirement accounts

Pre-Retirement (50s-60s)

Focus Areas:

- Maximizing retirement savings

- Paying off mortgage

- Reducing unnecessary expenses

Modifications:

- Consider 45/25/30 to accelerate retirement savings

- Take advantage of catch-up contributions

- Focus on debt elimination

Common Mistakes to Avoid

Mistake 1: Not Tracking Actual Spending

Creating a 50/30/20 budget is only the first step. You must track your actual spending to ensure you’re staying within each category.

Mistake 2: Being Too Rigid

The 50/30/20 rule is a guideline, not a strict law. Some months you might need to adjust based on circumstances.

Mistake 3: Ignoring Irregular Expenses

Car repairs, medical bills, and other irregular expenses can derail your budget if not planned for.

Mistake 4: Not Adjusting for Income Changes

Your budget should evolve with your income. A raise means more money for all categories, not just wants.

Maximizing the Benefits of the 50/30/20 Rule

Build Emergency Fund First

Before focusing on other savings goals, ensure you have at least $1,000 in your emergency fund. This prevents you from going into debt for unexpected expenses.

Prioritize High-Interest Debt

If you have credit card debt or other high-interest loans, prioritize these in your 20% category before focusing on long-term investments.

Automate Your Success

Set up automatic systems for all three categories:

- Automatic bill pay for needs

- Automatic transfers to savings

- Automatic investment contributions

Review and Adjust Monthly

Schedule a monthly budget review to:

- Compare actual spending to your 50/30/20 targets

- Adjust categories based on changing circumstances

- Celebrate successes and learn from overspending

The Long-Term Impact of the 50/30/20 Rule

Wealth Building Potential

Consistently saving 20% of your income can lead to significant wealth accumulation over time. Using our earlier example of $4,500 monthly income:

- Monthly savings: $900

- Annual savings: $10,800

- 10-year total (with 7% returns): approximately $148,000

- 20-year total (with 7% returns): approximately $443,000

Financial Security Benefits

Following the 50/30/20 rule provides:

- Emergency preparedness: Regular savings build financial cushions

- Debt freedom: Systematic debt repayment eliminates financial stress

- Retirement readiness: Consistent retirement contributions compound over time

- Lifestyle maintenance: Balanced approach prevents extreme restrictions

Conclusion

The 50/30/20 rule offers a practical, sustainable approach to budgeting that can work for people at any income level. Its simplicity makes it easy to understand and implement, while its flexibility allows for personal customization based on your unique circumstances and goals.

Remember that budgeting is a skill that improves with practice. Your first month using the 50/30/20 rule might not be perfect, and that’s completely normal. The key is to start, track your progress, and make adjustments as needed.

The most important aspect of any budgeting system is consistency. By committing to the 50/30/20 framework and making it a habit, you’ll develop the financial discipline needed to achieve your long-term goals while still enjoying life today.

Start implementing the 50/30/20 rule today, and take the first step toward a more balanced, secure financial future. Your future self will thank you for the financial foundation you’re building now.