Financial planning has evolved dramatically in the digital age, with sophisticated software solutions now available to help individuals and families manage their finances more effectively. Whether you’re just starting your financial journey or looking to optimize your existing financial strategy, choosing the right financial planning software can make a significant difference in achieving your goals.

This comprehensive guide explores the landscape of financial planning software, comparing free and paid options to help you make an informed decision that best fits your needs and budget.

Understanding Financial Planning Software

Financial planning software encompasses digital tools designed to help users manage various aspects of their financial lives, including budgeting, expense tracking, investment planning, retirement planning, debt management, and tax preparation. These platforms have transformed personal finance management from manual spreadsheets and paper-based systems to automated, intelligent solutions that provide real-time insights and recommendations.

Modern financial planning software typically integrates with bank accounts, credit cards, investment accounts, and other financial institutions to provide a comprehensive view of your financial situation. Advanced platforms offer features like goal setting, scenario planning, risk assessment, and detailed reporting to help users make informed financial decisions.

The rise of fintech has democratized access to sophisticated financial planning tools that were once available only to high-net-worth individuals through expensive financial advisors. Today, both free and paid options offer varying levels of functionality to meet different user needs and preferences.

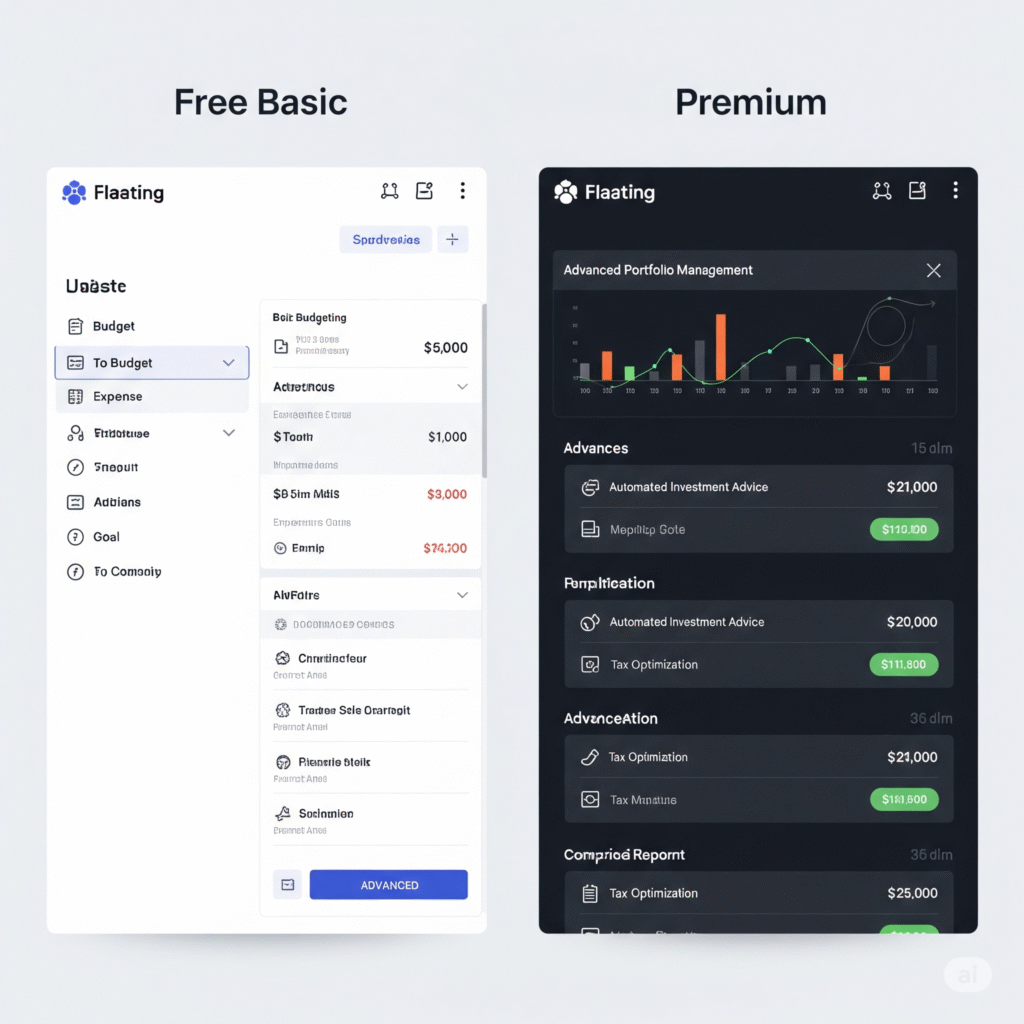

The Free Financial Planning Software Landscape

Free financial planning software has gained significant popularity as more companies recognize the value of offering basic financial tools to attract users to their broader ecosystem of services. These platforms typically generate revenue through advertising, premium upgrades, affiliate partnerships, or by promoting related financial products and services.

Popular Free Options

Several reputable companies offer free financial planning software with robust feature sets. Mint, owned by Intuit, provides comprehensive budgeting and expense tracking capabilities with bank account integration. Personal Capital offers free portfolio management and investment tracking tools alongside basic budgeting features. YNAB (You Need A Budget) provides a free trial period, while Credit Karma offers free credit monitoring alongside basic budgeting tools.

Many banks and credit unions also provide free financial planning tools for their customers, often integrated directly into their online banking platforms. These tools typically focus on account management, spending analysis, and basic budgeting functionality.

Advantages of Free Financial Planning Software

The most obvious advantage of free financial planning software is cost accessibility. Users can access sophisticated financial tools without any upfront investment, making these platforms ideal for individuals just starting their financial journey or those with limited budgets. This accessibility allows users to experiment with different approaches to financial planning without financial commitment.

Free software often provides essential features that meet the basic needs of many users. These typically include expense tracking, budget creation, bill reminders, and basic reporting functionality. For individuals with straightforward financial situations, these features may be entirely sufficient for effective financial management.

Free platforms also serve as excellent educational tools, helping users understand fundamental financial concepts and develop good financial habits. Many free options include educational resources, tutorials, and tips to help users improve their financial literacy and make better financial decisions.

The low barrier to entry means users can quickly get started with financial planning without lengthy decision-making processes or budget approvals. This immediate accessibility can be crucial for building momentum in financial planning efforts.

Limitations of Free Software

Despite their benefits, free financial planning software options typically come with several limitations that may impact their effectiveness for certain users. Feature restrictions are common, with free versions often providing only basic functionality while reserving advanced features for paid upgrades.

Data storage and historical tracking may be limited in free versions, potentially restricting users’ ability to analyze long-term financial trends or maintain comprehensive financial records. Some free platforms may also limit the number of accounts that can be connected or the frequency of data synchronization.

Customer support for free software is typically limited, with users often relying on community forums, knowledge bases, or basic email support rather than dedicated customer service representatives. This can be frustrating when users encounter technical issues or need assistance with complex financial planning questions.

Free software may also include advertisements or promotional content that can be distracting or potentially bias users toward specific financial products or services. Additionally, some free platforms may have less robust security measures compared to paid alternatives, though this varies significantly between providers.

The Paid Financial Planning Software Market

Paid financial planning software typically offers more comprehensive features, better customer support, and advanced functionality designed for users with more complex financial needs. These platforms generate revenue directly from subscriptions, allowing them to focus on user experience and feature development rather than advertising or product promotion.

Categories of Paid Software

Paid financial planning software ranges from affordable personal finance tools to enterprise-level solutions designed for financial professionals. Personal finance software like Quicken, YNAB Pro, and Tiller offer comprehensive budgeting, investment tracking, and financial planning capabilities for individual users and families.

Professional-grade software such as MoneyGuidePro, eMoney, and NaviPlan targets financial advisors and planning professionals, offering sophisticated modeling capabilities, client management features, and comprehensive reporting tools. These platforms typically require significant training and may be overkill for individual users.

Mid-tier options like Personal Capital’s premium services, Mint Premium, and various robo-advisor platforms with planning components offer enhanced features and support while remaining accessible to individual users.

Advantages of Paid Software

Paid financial planning software typically provides more comprehensive and advanced features compared to free alternatives. These may include sophisticated investment analysis tools, retirement planning calculators, tax optimization strategies, estate planning features, and detailed scenario modeling capabilities.

Customer support is generally superior in paid software, with dedicated support teams, comprehensive documentation, and often phone or chat support options. This enhanced support can be invaluable when dealing with complex financial planning questions or technical issues.

Data security and privacy protections are often more robust in paid software, with companies investing heavily in cybersecurity measures to protect sensitive financial information. Many paid platforms also offer enhanced data backup and recovery options.

Paid software frequently provides more detailed reporting and analytics capabilities, allowing users to gain deeper insights into their financial situation and track progress toward their goals more effectively. Advanced features like cash flow projections, Monte Carlo simulations, and tax-loss harvesting may only be available in paid versions.

Integration capabilities are often more extensive in paid software, with the ability to connect more accounts, access more financial institutions, and integrate with other financial tools and platforms.

Disadvantages of Paid Software

The most significant disadvantage of paid financial planning software is cost. Monthly or annual subscription fees can add up over time, potentially making these tools expensive for users with limited budgets or simple financial needs. Some professional-grade software can cost hundreds or thousands of dollars annually.

Paid software may also have a steeper learning curve, with more complex interfaces and advanced features that can be overwhelming for beginners. Users may need to invest significant time in learning how to effectively use all available features.

The subscription model means users must continue paying to maintain access to their financial data and planning tools. This ongoing cost commitment may not be suitable for all users, particularly those who prefer one-time purchases or free alternatives.

Some paid platforms may offer more features than necessary for individual users, leading to paying for functionality that goes unused. This can make paid software less cost-effective for users with basic financial planning needs.

Key Features to Consider

When evaluating financial planning software, several key features should be considered regardless of whether you choose free or paid options. Account aggregation capabilities allow software to connect with various financial institutions to provide a comprehensive view of your financial situation. Look for platforms that support a wide range of banks, credit unions, investment accounts, and other financial institutions.

Budgeting and expense tracking features are fundamental to most financial planning software. Evaluate how easily you can create budgets, categorize expenses, and track spending against your financial goals. Some platforms offer automatic categorization and spending alerts to help maintain budget discipline.

Investment tracking and analysis capabilities are important for users with investment portfolios. Look for features like performance tracking, asset allocation analysis, fee analysis, and investment research tools. Some platforms also offer portfolio rebalancing suggestions and tax-loss harvesting opportunities.

Goal setting and progress tracking features help users define financial objectives and monitor their progress over time. This might include retirement planning calculators, debt payoff trackers, and savings goal monitoring.

Reporting and analytics capabilities vary significantly between platforms. Consider what types of reports and insights are most valuable for your financial planning needs, such as net worth tracking, cash flow analysis, or tax preparation support.

Security and Privacy Considerations

Regardless of whether you choose free or paid financial planning software, security and privacy should be top priorities. Financial data is highly sensitive, and any platform you choose should implement robust security measures to protect your information.

Look for platforms that use bank-level security protocols, including 256-bit encryption, multi-factor authentication, and secure data transmission. Verify that the software provider is transparent about their security practices and regularly updates their security measures.

Privacy policies should clearly explain how your data is used, stored, and potentially shared. Free platforms may monetize user data through advertising or partnerships, while paid platforms typically have stricter privacy protections due to their subscription-based revenue model.

Consider whether the platform stores your financial account passwords or uses read-only access through secure APIs. Read-only access is generally more secure as it prevents the software from making transactions on your behalf.

Making the Right Choice for Your Needs

The decision between free and paid financial planning software depends on several factors specific to your situation. Consider the complexity of your financial situation, your comfort level with technology, your budget for financial tools, and your long-term financial planning goals.

If you’re just starting with financial planning or have a relatively simple financial situation, free software may provide all the functionality you need. These platforms are excellent for building financial awareness, establishing budgeting habits, and learning basic financial planning concepts.

For users with more complex financial needs, multiple investment accounts, business finances, or specific planning goals like retirement or estate planning, paid software may provide the advanced features and support necessary for effective financial management.

Consider starting with free options to understand your preferences and needs before potentially upgrading to paid software. Many users find that their needs evolve over time, and what works initially may not be sufficient as their financial situation becomes more complex.

Integration and Compatibility

Modern financial planning software increasingly emphasizes integration with other financial tools and platforms. Consider how well potential software options integrate with your existing financial ecosystem, including bank accounts, credit cards, investment platforms, and tax preparation software.

Some platforms offer APIs or direct integrations with popular financial institutions, while others may require manual data entry or file uploads. Automated integration typically provides more accurate and up-to-date information but may have security implications that should be carefully evaluated.

Mobile compatibility is increasingly important as users expect to access their financial information from smartphones and tablets. Evaluate the quality and functionality of mobile apps for any software you’re considering.

Future Trends and Considerations

The financial planning software industry continues to evolve rapidly, with artificial intelligence, machine learning, and automation increasingly integrated into these platforms. These technologies can provide more personalized recommendations, automated investment management, and predictive analytics to help users make better financial decisions.

Robo-advisors represent a growing segment that combines automated investment management with financial planning tools. These platforms often offer a middle ground between free basic tools and expensive human financial advisors.

Open banking initiatives and improved API standards are making it easier for financial planning software to integrate with a broader range of financial institutions and services. This trend should continue to improve the comprehensiveness and accuracy of financial planning tools.

Conclusion

The choice between free and paid financial planning software ultimately depends on your individual needs, financial complexity, and budget. Free options provide excellent value for users with basic needs and can serve as stepping stones to more advanced financial planning practices. These platforms offer accessibility and fundamental features that can significantly improve financial awareness and management.

Paid software typically provides more comprehensive features, better support, and advanced capabilities suitable for users with complex financial situations or specific planning goals. The additional cost may be justified by the enhanced functionality, security, and support these platforms provide.

Many users find success with a hybrid approach, using free software for basic budgeting and expense tracking while supplementing with paid tools for specific needs like investment analysis or retirement planning. The key is to choose tools that align with your financial goals and that you’ll actually use consistently.

As the financial planning software market continues to evolve, both free and paid options are likely to become more sophisticated and user-friendly. Staying informed about new developments and regularly evaluating your software needs can help ensure you’re using the most effective tools for your financial planning journey.

Remember that financial planning software is just a tool – the most important factors in achieving financial success are consistent use, good financial habits, and making informed decisions based on the insights these platforms provide. Whether you choose free or paid software, the key is finding a platform that motivates you to stay engaged with your financial planning and helps you work toward your financial goals.

Always ensure that any financial planning software you choose is reputable, secure, and aligned with your specific financial planning needs and goals.