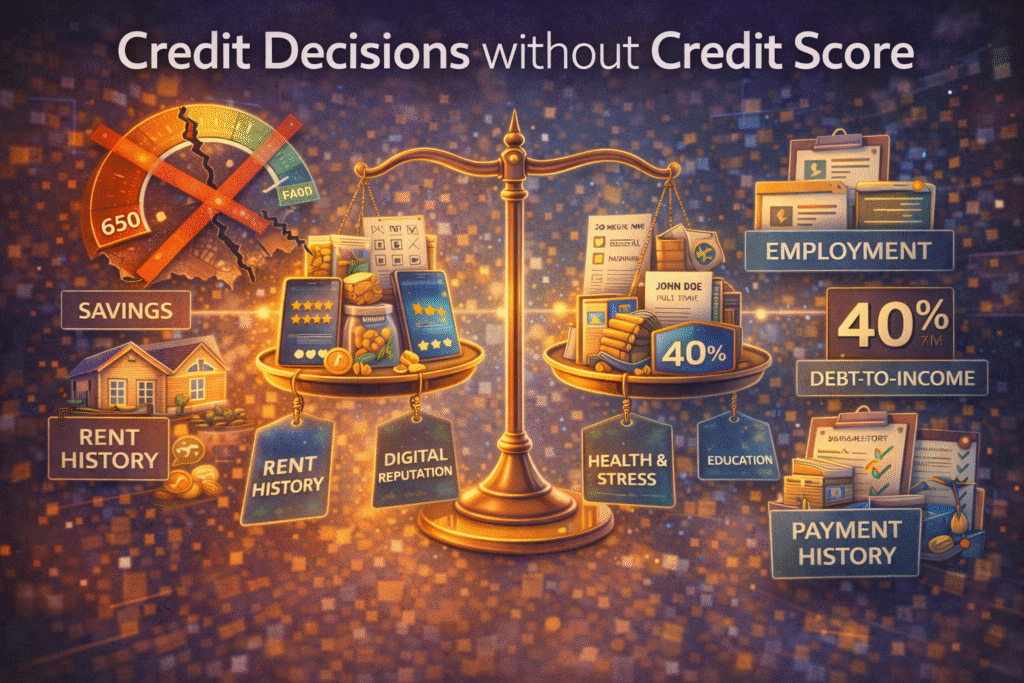

You’ve probably seen the ads: “Get approved without a credit check” or “Your credit score doesn’t matter here.” It sounds like a fresh start, especially if your score has taken some hits. But here’s what most people don’t realize—credit decisions without credit score don’t mean lenders stop evaluating you. The real question isn’t whether they’re checking your financial background, but what specific data they’re using instead.

The reality is more complex than the marketing suggests. While some lenders genuinely skip pulling your FICO or VantageScore, credit decisions without credit score rely heavily on alternative data that can reveal just as much about your financial habits—sometimes more. Bank account activity, payment patterns, employment history, and even lesser-known databases all contribute to a financial profile that determines approval and loan terms. Understanding what’s reviewed and ensuring that information is accurate can be the difference between rejection and approval with favorable terms.

Decoding the “No Credit Check” Promise: What Lenders Actually Review Instead

The phrase “no credit check loans” creates an immediate misconception that deserves clarification. Credit decisions without credit score don’t mean lenders are making blind approvals—they’re making a precise technical choice not to calculate or rely on your FICO or VantageScore. This distinction matters because most consumers assume “no score” means “no review,” when in reality credit decisions without credit score simply shift which data points are prioritized during underwriting.

Traditional credit scoring models compress your financial history into a three-digit number, but credit decisions without credit score rely on analyzing raw credit report data differently. Lenders may still pull reports from Equifax, Experian, or TransUnion, but instead of generating a score, they examine payment patterns, account types, and utilization directly. Even when a soft pull is used, credit decisions without credit score still expose collections, charge-offs, bankruptcies, and public records that influence approval outcomes.

The move toward cash-flow underwriting represents the most significant evolution in credit decisions without credit score. Instead of relying on historical credit behavior, lenders assess current financial capacity by reviewing bank account transactions through open banking platforms. Deposit consistency, balance management, and overdraft activity often carry more weight than a traditional score derived from older data.

The alternative data ecosystem supporting credit decisions without credit score extends far beyond what most borrowers expect. Employment databases verify job stability, rental payment records demonstrate recurring obligation management, and utility payment histories reveal essential bill behavior. These data points function as credit proxies, allowing credit decisions without credit score to assess risk through financial behavior rather than scoring formulas.

The technical infrastructure behind credit decisions without credit score depends heavily on identity verification before any financial analysis occurs. Lenders cross-check your name, address, Social Security number, and date of birth across multiple databases to confirm identity. Even when a credit report is accessed solely for verification purposes, credit decisions without credit score still rely on that file as a reference point—just not as a numerical scorecard.

The Hidden Gatekeepers: Credit Report Errors That Sabotage “Scoreless” Applications

Credit report disputes become even more critical in credit decisions without credit score, despite how counterintuitive that may seem. When traditional lenders reject applications based on low scores, the problem is obvious. But in credit decisions without credit score, applicants are often denied without any numerical explanation. The cause is frequently a specific inaccuracy on the credit report—an error that automated underwriting systems flag as disqualifying when no score is used as a buffer.

Identity mismatches are the most common and least understood obstacles in credit decisions without credit score. A name variation, address inconsistency, or Social Security number discrepancy can halt an application instantly. These systems prioritize identity certainty above all else, meaning credit decisions without credit score may fail even when your financial behavior is solid and repayment capacity is strong.

Zombie debt creates another major barrier in credit decisions without credit score. Collections and charge-offs that should have aged off your report often remain visible and are treated as automatic red flags regardless of age. While traditional scoring models reduce the impact of older negatives, credit decisions without credit score frequently apply binary logic—any collection equals elevated risk—without considering context or resolution.

Thin credit files magnify every mistake in credit decisions without credit score environments. When only a few accounts exist, each data point carries disproportionate weight. One misreported late payment can dominate the entire evaluation, making accuracy essential for borrowers relying on credit decisions without credit score due to limited traditional credit history.

The compounding nature of reporting errors further undermines credit decisions without credit score. Duplicate accounts inflate debt-to-income ratios, misreported balances distort utilization, and incorrect account statuses multiply perceived risk. A single creditor error can corrupt multiple underwriting variables at once, preventing alternative models from accurately assessing your true financial position in credit decisions without credit score systems.

Building Your Alternative Credit Profile: Strategic Moves Beyond Traditional Credit Building

The 90-day bank account hygiene strategy is essential for succeeding in credit decisions without credit score, because most cash flow underwriting systems analyze roughly three months of transaction data. Alternative lenders typically review 90 days of bank activity to assess financial stability. Maintaining a consistent minimum balance during this period signals that you’re not living paycheck to paycheck, while avoiding overdrafts and NSF fees demonstrates competent cash management—both critical indicators in credit decisions without credit score environments.

The behaviors that strengthen approval odds in credit decisions without credit score differ sharply from traditional credit-building advice. Instead of focusing on credit card usage, cash flow underwriting rewards stable checking balances and the absence of negative banking events. Overdrafts, frequent zero-balance periods, and erratic withdrawals are all treated as risk signals. Because algorithms can’t interpret intent, volatility in your bank account—regardless of cause—is penalized in credit decisions without credit score models.

Rent reporting represents one of the most underused tools for improving outcomes in credit decisions without credit score. Since rent is often the largest monthly obligation, documented on-time payments carry significant weight. Services like Experian Boost, RentTrack, and eCredable add rental history to credit reports, allowing alternative lenders to see consistent payment behavior even when no score is calculated. Timing matters—adding rent history before applying can materially improve approval odds in credit decisions without credit score systems.

Utility payment history plays a similar role, especially when consumers proactively enroll in reporting programs. Phone, electricity, gas, and internet payments demonstrate reliability with essential obligations. Credit-builder loans also support credit decisions without credit score by establishing verified payment history and savings behavior simultaneously, creating positive signals for both traditional and alternative underwriting models.

Income documentation preparation accelerates approvals in credit decisions without credit score, where employment stability and cash flow verification often outweigh historical credit behavior. Providing recent pay stubs, tax returns, and bank statements showing consistent deposits allows automated systems to approve applications quickly. Applicants who can verify income instantly move through underwriting faster than those requiring manual verification, gaining a decisive edge in scoreless lending environments.

The Pre-Application Audit: Identifying and Correcting Report Issues Before They Block Approvals

The multi-bureau reality of credit reporting creates complexity that catches most consumers unprepared for alternative lending applications. You’re legally entitled to free credit reports from Equifax, Experian, and TransUnion annually through AnnualCreditReport.com, but many people check only one bureau and assume the others contain identical information. This assumption proves costly because creditors don’t report to all three bureaus uniformly. A collection account might appear on Equifax but not Experian. A late payment could show on TransUnion but not Equifax. When an alternative lender pulls your Experian report but you’ve only reviewed your Equifax report, you’re operating with incomplete information about what the lender sees. The strategic approach involves obtaining all three reports simultaneously, comparing them side-by-side, and identifying discrepancies that need correction across multiple bureaus.

Specialized consumer reports operating outside the traditional credit bureau system require separate requests and often catch consumers completely off guard. ChexSystems maintains a database of banking history, tracking account closures, overdrafts, and suspected fraud that banks consult when you apply for new checking or savings accounts. If you’ve had a checking account closed due to negative balance or suspected check fraud, that information lives in ChexSystems for five years and can block approval for bank accounts needed to establish cash flow underwriting profiles. LexisNexis maintains consumer reports that aggregate public records, address history, and other data points used for identity verification and risk assessment. Clarity Services tracks alternative financial services usage, including payday loans and check cashing services. Each of these databases operates independently, requires separate requests to access your file, and can contain errors that sabotage applications without your knowledge.

The 30-60-90 day dispute timeline reflects the practical reality of how long credit bureau investigations take and why strategic sequencing matters. When you dispute an error, the Fair Credit Reporting Act requires bureaus to investigate within 30 days, but this deadline represents the maximum timeframe, not the typical resolution period. Simple disputes—a late payment that clearly belongs to someone else, a duplicate account with obvious matching details—often resolve within two weeks. Complex disputes involving mixed credit files, identity theft, or creditors that respond slowly to bureau inquiries can extend beyond 30 days and require multiple dispute rounds. If you’re planning to apply for an apartment lease in 60 days, you need to start disputing errors immediately to allow time for investigation, creditor response, and potential follow-up disputes if the initial result proves unsatisfactory.

Documentation strategies for credit report disputes determine success rates more than the actual merit of your dispute. Credit bureaus process millions of disputes monthly, and those with clear, compelling evidence receive priority attention while vague complaints without supporting documentation often result in “verified as accurate” responses that change nothing. When disputing a collection account that isn’t yours, include a copy of your identity theft report filed with the FTC, police report if applicable, and a detailed explanation of why this debt couldn’t possibly be yours. When disputing a late payment you made on time, attach copies of bank statements showing the payment cleared before the due date, confirmation numbers from the creditor’s payment system, and correspondence proving you contacted the creditor about the error. The burden of proof falls on you to demonstrate inaccuracy, not on the bureau to prove accuracy.

Professional credit repair services become necessary when errors involve systemic creditor misreporting, mixed credit files that merge your information with someone else’s, or identity theft that has spawned multiple fraudulent accounts. These complex situations require expertise in consumer protection law, established relationships with credit bureau escalation departments, and persistence through multiple dispute rounds that individual consumers find overwhelming. Mixed files, where credit bureaus merge information from two people with similar names or Social Security numbers, require specialized correction procedures that go beyond standard dispute processes. Identity theft cases involving multiple fraudulent accounts need coordinated disputes across all three bureaus plus direct creditor contact to close accounts and remove associated negative items. Recognizing when your situation exceeds the scope of DIY disputes saves months of frustration and prevents the compounding damage that occurs while errors remain uncorrected.

Maximizing Approvals and Terms: How Clean Reports Unlock Better Offers in Alternative Lending

The tiered approval structure in alternative lending systems operates on a spectrum rather than the binary approve/deny model many consumers expect. At the bottom tier, applicants with significant negative items on credit reports might receive approval but with maximum interest rates, minimum loan amounts, and restrictive terms like required cosigners or collateral. The middle tier includes applicants with clean reports but limited positive history, receiving approval with moderate rates and standard terms. The top tier—reserved for applicants with clean reports plus strong alternative data profiles—unlocks the lowest rates, highest limits, and most flexible terms. This stratification means that correcting credit report errors doesn’t just change denial to approval; it moves you up the tier system toward substantially better offers.

The compounding benefit effect of credit report corrections creates value that exceeds the obvious impact of removing a single negative item. When you successfully dispute and remove a duplicate account, your total reported debt decreases, which improves your debt-to-income ratio—a critical metric in alternative underwriting. Your credit utilization ratio improves because the same amount of available credit now supports less reported debt. Your account diversity might improve if the duplicate was distorting your mix of credit types. Your payment history strengthens because late payments associated with the duplicate account disappear. A single successful dispute thus triggers positive changes across multiple underwriting variables simultaneously, creating exponential rather than linear improvement in how alternative credit scoring systems evaluate your application.

Credit monitoring services provide the defensive infrastructure necessary to maintain clean reports after you’ve invested time correcting errors. Real-time alerts when new accounts appear on your credit report let you identify unauthorized accounts within days rather than months, enabling immediate fraud reports that minimize damage. Notifications about new inquiries reveal when creditors pull your credit, helping you spot identity theft attempts or errors where inquiries appear without your authorization. Balance update alerts show when creditors report new information, letting you catch reporting errors in the current billing cycle rather than discovering them months later when they’ve already influenced multiple credit decisions. The 30-day window immediately after an error appears represents the easiest time to dispute and correct it, before the information gets verified and reinforced through multiple reporting cycles.

Professional credit report analysis identifies patterns of creditor misreporting that individual consumers typically miss when reviewing their own reports. A creditor that consistently reports your payment due date incorrectly might make your on-time payments appear late. A debt buyer that reports the same debt under multiple collection agency names creates artificial duplicate accounts. A credit card issuer that fails to update your credit limit when you request increases makes your utilization ratio appear worse than reality. These systematic errors require different correction strategies than one-time mistakes—you need to address the root cause with the creditor’s reporting department, not just dispute individual instances with credit bureaus. Recognizing these patterns requires expertise in how credit reporting systems work and what constitutes normal versus abnormal reporting behavior across different creditor types.

The strategic advantage of ongoing credit report maintenance extends beyond alternative lending into every financial decision that involves background checks or risk assessment. Landlords reviewing rental applications see the same credit report information as alternative lenders, making clean reports essential for housing approval. Insurance companies in states that allow credit-based insurance scoring use credit report data to set premiums, meaning errors cost you money monthly through higher rates. Employers in industries that conduct credit checks as part of background screening may view negative items as disqualifying factors for positions involving financial responsibility. The investment in maintaining accurate credit reports across all bureaus and specialized consumer reporting agencies pays dividends across multiple aspects of your financial life, not just when applying for credit decisions without credit score products. Each corrected error strengthens your position in every system that uses credit report data for evaluation, creating a foundation of accurate information that supports favorable outcomes regardless of which specific underwriting model a lender employs.

The Bottom Line: Your Financial Profile Exists Whether You Check It or Not

The promise of “no credit check” lending isn’t about escaping financial scrutiny—it’s about shifting which data points determine your approval. While these lenders might skip your FICO score, they’re analyzing bank transactions, employment records, rental history, and specialized databases that reveal just as much about your financial behavior. The critical insight here is that errors in these systems hurt you more severely than in traditional lending because you can’t see a declining score as a warning signal. A single inaccuracy—a duplicate collection, an identity mismatch, or outdated banking information—can trigger automated denials without explanation, leaving you confused about what went wrong.

What started as a question about whether lenders check your financial background has revealed a more important truth: they’re always checking, just through different windows. Your financial profile exists across multiple databases whether you monitor it or not, and inaccuracies compound silently until they block opportunities you didn’t even know you were pursuing. The real question isn’t whether your credit matters in alternative lending—it’s whether you’ll take control of the information defining your financial identity before it costs you approval, better terms, or hundreds of dollars in unnecessary fees.