In the months since President Donald Trump ordered a review of ERISA fiduciary guidelines aimed at

Processing Content

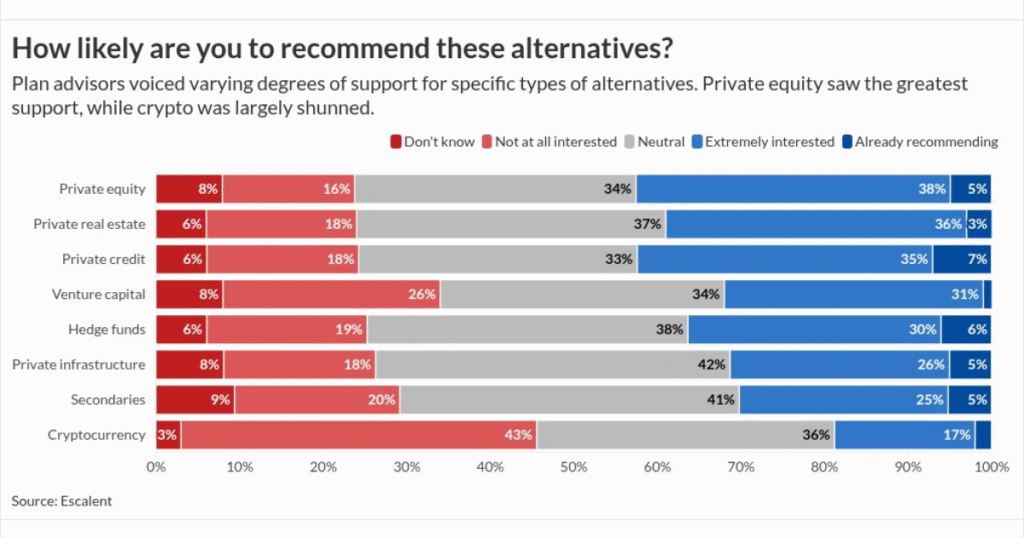

Roughly 1 in 4 defined contribution plan advisors say they are likely to recommend alternatives in workplace plan offerings, with 10% already doing so, according to a survey from market research firm Escalent.

The study, which polled more than 400 DC plan advisors in September, found that enthusiasm for alternative investments varied sharply by asset class.

Private equity,

Hedge funds and venture capital drew more moderate support, while private infrastructure and secondaries lagged, with only about a quarter of advisors expressing enthusiasm.

“We know from previous research that interest in alternative investments has been rising on the retail side,” Linda York, a senior vice president in Escalent’s Cogent Syndicated division, said in a statement. “These findings show that the same enthusiasm is starting to take hold within the DC plan space. Advisors have traditionally turned to alternatives as a diversification lever for high-net-worth and institutional clients. Now, these options are becoming more relevant for employees across all income levels.”

A crypto divide between plan advisors and participants

While advisor interest in most alternative assets generally mirrors participant demand,

Across the 400-plus advisors surveyed, just 2% are actively recommending cryptocurrency to plan sponsors, with an additional 17% voicing interest in doing so in the future.

Meanwhile, 9% of plan participants reported already investing in cryptocurrency. And 1 in 4 reported being extremely interested in cryptocurrency investments, Escalent data shows. As a whole, participant interest in crypto is about 74% higher than advisor interest.

Gregg Collier, an investment management consultant at Edgewater Family Wealth in Orlando, Florida, said that while he supports private equity and cryptocurrency investments, both should have modest allocations as part of an overall portfolio.

“There needs to be limits in both private equity and crypto — a percentage maybe, 5% for older participants and 15% for younger ones,” he said.

Other roadblocks remain for alternatives adoption

Although advisors are increasingly warming to alternative investments, some of their unique characteristics limit their adoption in workplace plans, advisors say.

When asked what might prompt them to start recommending alternatives — or increase their current recommendations to plan sponsors — DC advisors pointed to

Other factors, such as diversification, alignment with investment goals and transparency into underlying holdings, also play an important role in advisors’ evaluation of alternative investments, survey results showed.

Some of those concerns may be easier to address than others, depending on the particular asset class. Experts say the types of private investments likely to appear in 401(k)s will have greater liquidity than traditional private assets, but compared to public investments, they will generally carry

Plan sponsors, too, are approaching alternative investments cautiously, citing some of the same concerns.

Last month, the

And beyond the investment features themselves, both advisors and sponsors say participant education remains a major hurdle.

“Educating participants on lifetime income or private equity is a challenge,” one sponsor explained. “Both are complex, and participants may not fully understand what they are getting into.”

A bell that can’t be unrung

For

“To put an alternative investment into a company’s qualified plan was kind of unheard of,” Pugh said. “Now, that toe has been dipped in the water, and it’s not going to go back. … I think private [investments] are just going to eke into other once closed-off investment vehicles. We’re going to see it more and more.”

“Now, is that a good thing? Not necessarily. Because private investments are not regulated the same way as public [investments],” Pugh added. “They are a little bit of a black box as to what you’re getting into. So a lot of caution has to be exercised when looking at those investments. But next year, I think it’s just going to be more and more growth in that area.”